Press release

Rising Demand Expects The Automobile Insurance To Reach US$ 1,616.2 billion By 2032

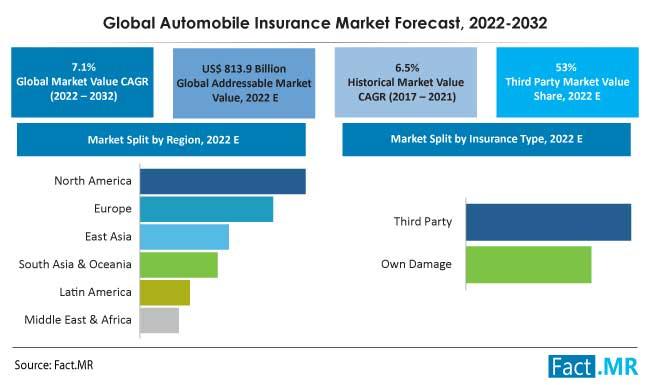

The global automobile insurance market is valued at $817 billion in 2022 and is expected to grow rapidly at a CAGR of 7.1% to reach $1,616.2 billion by the end of 2032.In 2022, automobile insurance premiums will account for nearly 15% of total insurance premiums paid worldwide. Over the next ten years, auto insurance premium share in total insurance is expected to exceed 20%, indicating strong traction for the segment.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.factmr.com/connectus/sample?flag=S&rep_id=7849

Through the new research report, analysts focus on offering a panoramic view of the Automobile Insurance market at regional, country, and global levels. The report gives significant data and analysis on different major factors such as challenges, drivers, growth avenues, threats, and restraints of the market for Automobile Insurance throughout 2022-2032.

𝐓𝐨𝐩 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐂𝐨𝐯𝐞𝐫𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

• Allstate Insurance Company

• American Automobile Association

• American Family

• Erie Insurance

• Farmers Insurance

• Geico

• Liberty Mutual Insurance

• MS&AD Insurance Group Holdings, Inc.

• Nationwide Mutual Insurance Company

• Progressive Casualty Insurance Company

• Sompo Holdings Inc.

• State Farm Mutual Automobile Insurance Company

• The Travelers Companies, Inc.

• Tokio Marine Holdings, Inc.

• USAA

NOTE: The report has been assessed in accordance with the COVID-19 Pandemic and its impact on the Non-Alcoholic Wine market.

𝐆𝐞𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐨𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬: https://www.factmr.com/connectus/sample?flag=RC&rep_id=7849

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐀𝐮𝐭𝐨𝐦𝐨𝐛𝐢𝐥𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐒𝐮𝐫𝐯𝐞𝐲

𝐁𝐲 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐓𝐲𝐩𝐞𝐬 :

• Own Damage

• Third Party

𝐁𝐲 𝐕𝐞𝐡𝐢𝐜𝐥𝐞 𝐓𝐲𝐩𝐞 :

• Commercial Vehicles

• Private Vehicles

𝐁𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥 :

• Individual Agents

• Brokers

• Banks

• Direct

• Others (Not Covered Elsewhere)

𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧 :

• North America

• Latin America

• Europe

• East Asia

• South Asia & Oceania

• Middle East & Africa

𝐓𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐜𝐨𝐯𝐞𝐫𝐬 𝐤𝐞𝐲 𝐫𝐞𝐠𝐢𝐨𝐧𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐀𝐮𝐭𝐨𝐦𝐨𝐛𝐢𝐥𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

North America: U.S., Canada, Mexico

South America: Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, Costa Rica

Europe: U.K., Germany, Italy, France, Netherlands, Belgium, Spain, Denmark

APAC: China, Japan, Australia, South Korea, India, Taiwan, Malaysia, Hong Kong

The Middle East and Africa: Israel, South Africa, Saudi Arabia

𝐒𝐜𝐨𝐩𝐞 𝐨𝐟 𝐀𝐮𝐭𝐨𝐦𝐨𝐛𝐢𝐥𝐞 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭:-This research report contains information curated by professionals to estimate the nearest to accurate dynamics of the Automobile Insurance market. The research study extensively covers various aspects and segments that the Automobile Insurance market spans. There is also a detailed forecast for the Automobile Insurance market present in the following document. The report can be utilized to realize true growth potential and generate good business and improve the revenue generation capacity of the organizations in the Automobile Insurance market.

𝐅𝐮𝐥𝐥 𝐀𝐜𝐜𝐞𝐬𝐬 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐢𝐬 𝐀𝐯𝐚𝐢𝐥𝐚𝐛𝐥𝐞 𝐚𝐭: https://www.factmr.com/checkout/7849

𝐒𝐨𝐦𝐞 𝐊𝐞𝐲 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐬𝐰𝐞𝐫𝐞𝐝 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐫

• What are the developments and innovations in the Automobile Insurance market?

• What are the threats and risks in the Automobile Insurance market?

• What strategies are most effective in the Automobile Insurance market?

• Who are the prominent players in the Automobile Insurance market?

• What segment of the Automobile Insurance market has the maximum revenue generation potential?

𝐖𝐡𝐲 𝐮𝐬:

• We facilitate the client with detailed reports on the Automobile Insurance market.

• We give you the best after deals administrations in the business.

• This intelligence study offers you a one-stop solution for all things related to the Automobile Insurance market.

• We also provide custom reports as per the client's requirements.

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐟 𝐅𝐚𝐜𝐭.𝐌𝐑: https://www.globenewswire.com/en/news-release/2022/08/23/2502589/0/en/Burgeoning-Demand-for-Chemical-Free-Herbal-Products-to-Open-Plethora-of-Opportunities-for-Sugar-Free-Toothpaste-Manufacturers-States-Fact-MR.html

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. We have offices in US and Dublin, whereas our global headquarter is in Dubai. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Reach out to us with your goals, and we'll be an able research partner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Demand Expects The Automobile Insurance To Reach US$ 1,616.2 billion By 2032 here

News-ID: 2885436 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

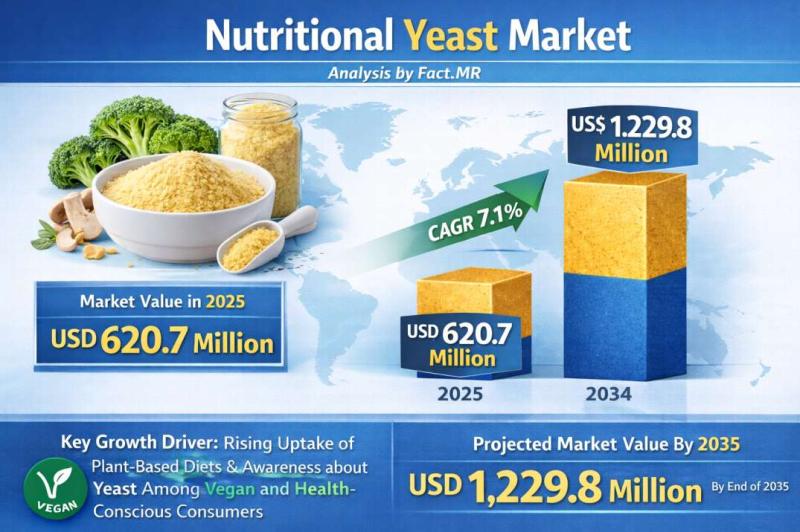

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

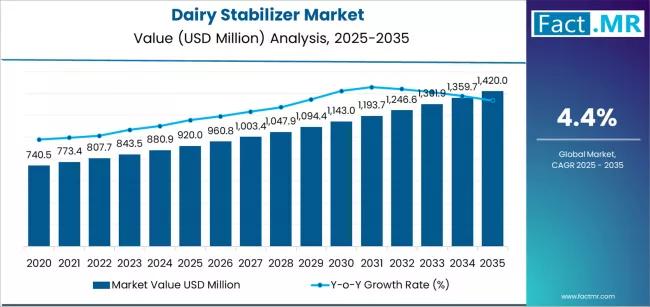

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…