Press release

Global Sales Tax Software Market Overview, Regional Analysis, Market Share and Competitive Analysis

During the truncated forecast period, Sales Tax Software Market report is based on product type, application, and end-user. The in-depth study also provides a broad interpretation of the Sales Tax Software Market based on systematic market analysis using a variety of reliable sources and comprehensive data points. The report provides a market forecast that takes into account size, volume, revenue, production techniques, sales consumption, compound annual growth rate (CAGR), supply, price, gross margin and many other important factors. An in-depth review of the results of the impact of the COVID-19 pandemic on businesses is also included in the report. Further, the report examines the global market by segmenting it into various districts, suitable distribution channels, revenue generated, and generalized market space.Some of the major players in the global Sales Tax Software Market are: APEX Analytix, Avalara, CCH Incorporated, eDocSolutions, eGov Systems, Exactor, LegalRaasta.com, LumaTax Inc., Ryan, Sage Intacct Inc., Sales Tax DataLINK, Sovos Compliance, Thomson Reuters, Vertex Inc., Xero, Zoho Corporation

Get Best Sample Report From Here Also For Free @ https://www.zionmarketresearch.com/sample/sales-tax-software-market

Following is the basic segmentation of the Sales Tax Software Market:

Manufacturer Compliance | Technological Advances | Key Market Trends | Growth forecasts | Market share | Production and sales figures | Diversified regions

1. Manufacturer Compliance:

The following points are covered in the Sales Tax Software Market report along with given key factors and many more:

National, federal and international laws and regulations regarding operations must be observed. This type of regulation is established and enforced by governments and industry associations.

Corporate compliance requires businesses to ensure that they operate within the bounds of the law while adhering to their own corporate policies and regulations.

Your manufacturing business should focus on the following aspects:

Anti-corruption, labor law and data protection export restrictions a competitive environment, security, environment and welfare it has to do with safety and security, product safety

2. Technological advances:

New technologies are on the rise. Advances in information technology, including artificial intelligence, pave the way for further technological evolution. Robotics is advancing.

3. Key Market Trends:

Key market trends included in the Sales Tax Software Market report. This concept originated in finance but is used today in various industries. Whether your company's operations are focused on B2B services, retail, energy, technology, healthcare, or many other industries, finance professionals have three basic ways to understand a market trend.

Short-term, medium-term and long-term trends

4. Growth forecasts:

The current Sales Tax Software Market CAGR is covered in the report. Statistical models that combine several key variables, or indicators, in an attempt to forecast a future GDP growth rate, are commonly used in economic forecasting.

Download Full Research Report with Table of Contents @ https://www.zionmarketresearch.com/report/sales-tax-software-market

5. Market share:

The global Sales Tax Software Market market share plays an important role which refers to the percentage of product sales made by a company in units, dollars, or any other significant measure from all product sales. This is usually defined by a geographic area, such as all sales in a particular country or all sales during a specific time period.

6. Production and sales figures:

Sales Tax Software Market market production is based on demand and trend as per user requirements. Turnover includes sales information or figures, facts, statistics

7. Diversified Regions:

The competitive landscape of the Sales Tax Software Market market study encompasses a broader analysis of the regions included in the given list, which are expected to capture the essence of the market at its broadest category.

The European continent (Germany, United Kingdom, France, Italy, Russia and Turkey, etc.)

The upper part of North America (United States, Canada and Mexico) The southern region of South America (Argentina, Brazil, Colombia, etc.)

Middle East and Africa region (Saudi Arabia, United Arab Emirates, Nigeria, Egypt and South Africa)

Asia-Pacific ( Japan, China, Korea, India, Thailand, Australia, Indonesia, Philippines, Malaysia and Vietnam)

Segmentation based on product types: Tax management for consumer use, automatic tax declarations, exemption certificate management and others

Segmentation based on user applications: Individuals and commercial enterprises

Apart from the market growth points, the study also targets the risks associated with the Sales Tax Software Market industry in a detailed manner. The report majorly focuses on the market categories which are intended to distribute the Sales Tax Software Market industry analytically which will further help you to get a better overview of the market.

Here is an overview of the different factual statements covered by the study:

► The study includes a section that breaks down strategic developments for the major players in existing and upcoming R&D, new product launches, collaborations, regional expansion, and mergers & acquisitions.

► The research focuses on important market characteristics such as revenue, product cost, capacity and utilization rates, import/export rates, supply/demand figures, market share and CAGR.

► The study is a collection of analyzed data and various barrels of space obtained through a combination of analytical tools and an internal research process.

► The Sales Tax Software Market can be divided into four regions according to the regional breakdown: North American Markets, European Markets, Asian Markets and Rest of the World.

In this report, the key questions answered:

► How has the adoption of Sales Tax Software Market impacted COVID-19?

► What are the Sales Tax Software Market key market regulations in key areas?

► Which technologies are having the most impact on the expected Global Sales Tax Software Market?

► Which are the major global players currently dominating the Sales Tax Software Market?

► How do AI users perceive technology in operating theatres?

► What are the main business models followed by the main market players?

► What are the key factors that will influence the growth of Sales Tax Software Market globally?

► How are leading players in the Global Sales Tax Software Market environment integrating key strategies?

► What is the current revenue contribution of different product types in the Global Sales Tax Software Market and what are the anticipated changes?

For more information and discounts, feel free to contact us and inquire for the career as well as customization on report 24x7 @ https://www.zionmarketresearch.com/inquiry/sales-tax-software-market

Read more posts:

https://twitter.com/The_R1tss/status/1613413662898946048

https://twitter.com/The_R1tss/status/1613414047856365572

https://twitter.com/The_R1tss/status/1613414577450143745

https://twitter.com/The_R1tss/status/1613415008444256261

https://twitter.com/The_R1tss/status/1613415428805775361

Who we are?

Zion Market Research is an obligated company. We create futuristic, forward-thinking and informative reports ranging from industry reports, company reports to country reports. We provide our clients with not only market statistics unveiled by recognized private publishers and public organizations, but also trending and latest industry reports as well as profiles of preeminent and niche companies. Our market research reports database includes a wide variety of reports from cardinal industries. Our database is constantly updated to satisfy our customers with fast and direct online access to our database. Keeping the customer's needs in mind, we have included expert information on global industries, products and market trends in this database. Last but not least, we make it our duty to ensure the success of the clients linked to us. After all, if you succeed, a little light shines on us.Email: sales@zionmarketresearch.com

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Blog : https://zmrblog.com/

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Sales Tax Software Market Overview, Regional Analysis, Market Share and Competitive Analysis here

News-ID: 2880411 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

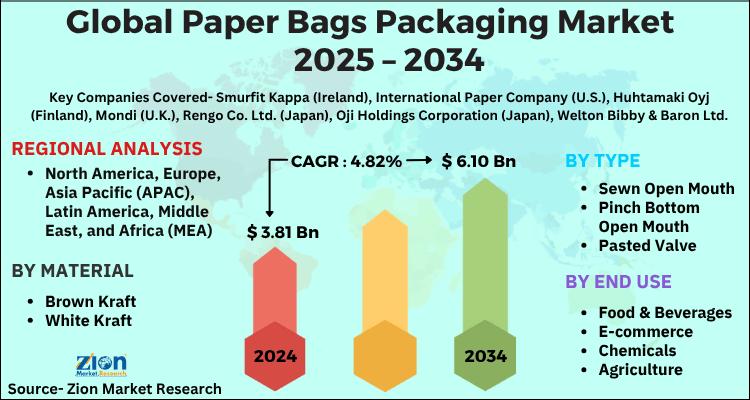

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

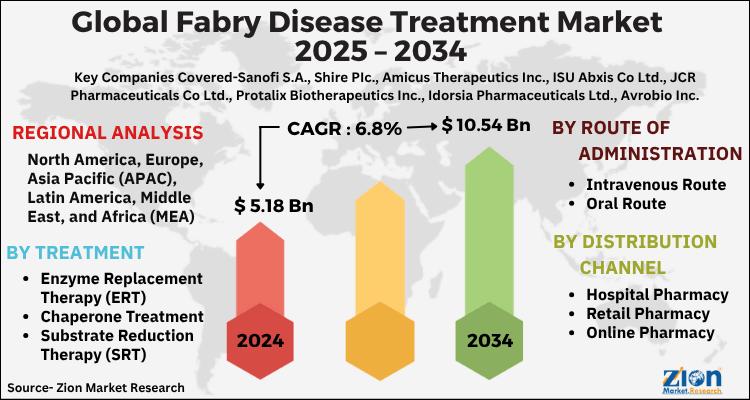

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…