Press release

With 18.5%% CAGR, Asia Pacific Microinsurance Market Size US$ 7.0 Billion by 2027

IMARC Group's latest report, titled "Asia Pacific Microinsurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027", the Asia Pacific microinsurance market size reached US$ 2.7 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 7.0 Billion by 2027, exhibiting a growth rate (CAGR) of 18.5% during 2022-2027.Microinsurance is a microfinance division that provides insurance plans to the underserved and low-income sections of society. It aids in providing insurance and other products and services at low premiums that are utilized for risk protection and relief against distress, misfortune, and other contingent events. Microinsurance offers tailor-made plans that meet the customer's needs and covers property risks against crops, cattle and fires. It merges various small financial units that are formed into one massive structure to prevent unexpected losses and exorbitant interest rates. Nowadays, microinsurance products are delivered via various institutional channels such as licensed insurers, healthcare providers, microfinance institutions, community-based organizations, and non-governmental organizations.

Request Free Sample Report (Exclusive Offer on this report): https://www.imarcgroup.com/asia-pacific-microinsurance-market/requestsample

Asia Pacific Microinsurance Market Growth:

The Asia Pacific represents one of the largest markets for microinsurance, primarily driven by the increasing demand for microinsurance products and services in developing countries such as India and China. This is due to the small installments of premium amounts for people from a poor financial background. Besides this, the growing interest of various stakeholders, such as NGOs, financial institutions and donors, in adding microfinance as an adaptation measure represents another factor propelling the market growth. Moreover, microinsurance offers a promising alternative for poor women to manage risk and use their assets more productively.

Ask Analyst for Instant Discount and Download Full Report with TOC & List of Figure: https://www.imarcgroup.com/asia-pacific-microinsurance-market

Key Market Segmentation:

Breakup by Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Breakup by Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Breakup by Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

Breakup by Country:

• China

• Japan

• India

• South Korea

• Australia

• Indonesia

• Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players

Key Highlights of the Report:

• Market Performance (2016-2021)

• Market Outlook (2022-2027)

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Contact Us:

IMARC Group

30 N Gould St, Ste R

Sheridan, WY (Wyoming) 82801 USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800 Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release With 18.5%% CAGR, Asia Pacific Microinsurance Market Size US$ 7.0 Billion by 2027 here

News-ID: 2863275 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

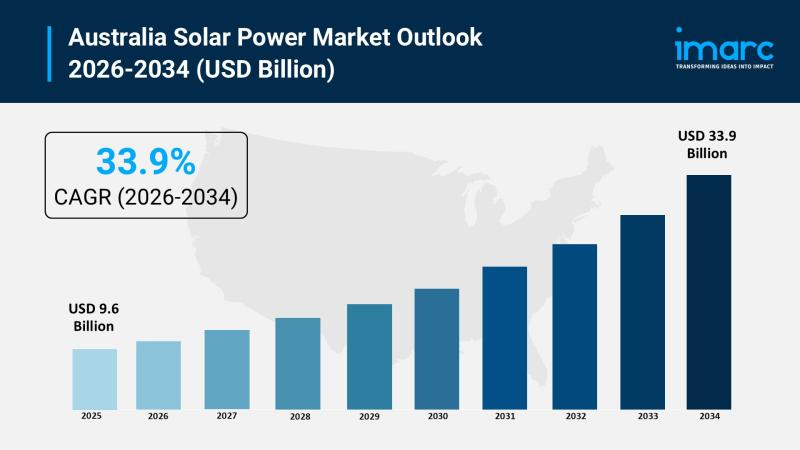

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

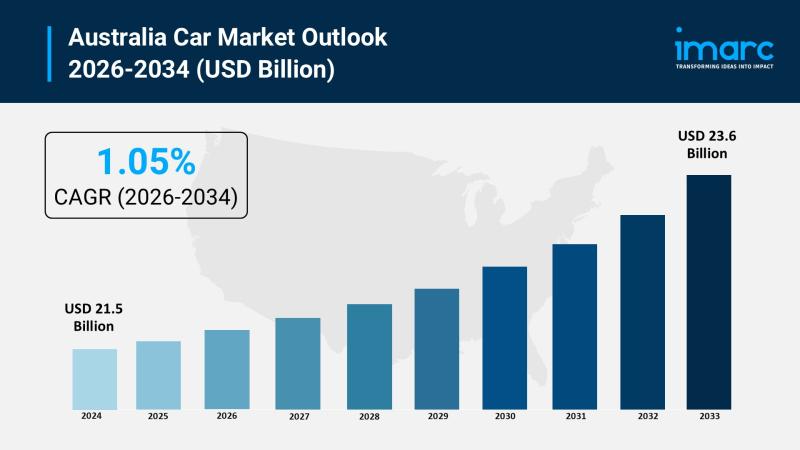

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

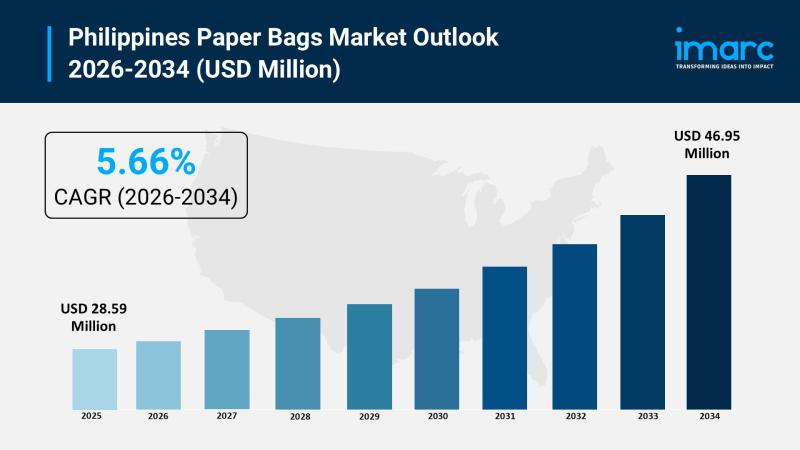

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…