Press release

Employee Retention Tax Credit

Did you know that you may be eligible for a return of $26,000 per employee through the Employee Retention Credit if your company had to make modifications during COVID owing to supply chain challenges, capacity issues, project delays, or other pandemic-related effects.To find out more, arrange a free consultation with our team of ERC professionals.

We'll go over your eligibility and file your ERC credit with the IRS.

schedule a free consultation with one of our experts!

Schedule a Free Consultation :

https://calendly.com/nskt-global-us-office/45mins_discoverycall?month=2022-12

Source URL : https://www.nsktglobal.com/employee-retention-tax-credit-

Contact Us:

Charlotte City Center 25 North Tryon Street Suite 1600, Charlotte, North Carolina, 28202

About NSKT Global Services:

NSKT Global, is a Global consulting firm with a team of certified public accountants, certified fraud examiners (CFE), certified Sarbanes Oxley experts (CSOE), Business Advisers, Internal Auditors, Data Scientist and IT experts. We extend all kinds of help to our clients and assist them at all possible junctures of their business. We love to work collaboratively with like-minded people who challenge the process and make a difference.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Employee Retention Tax Credit here

News-ID: 2856488 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

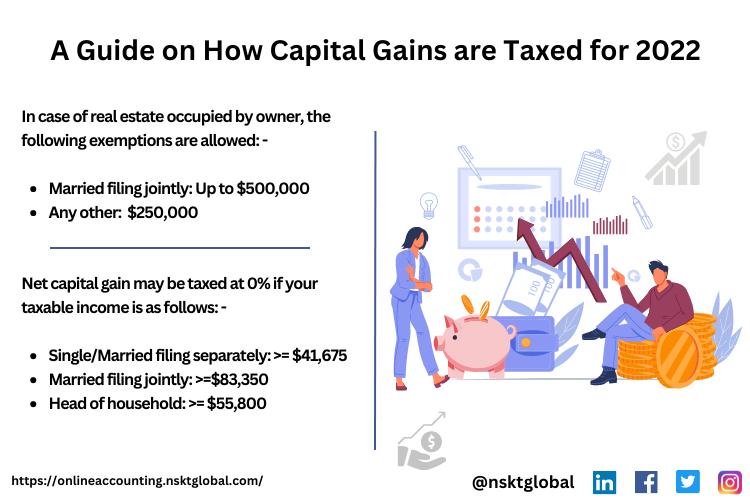

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

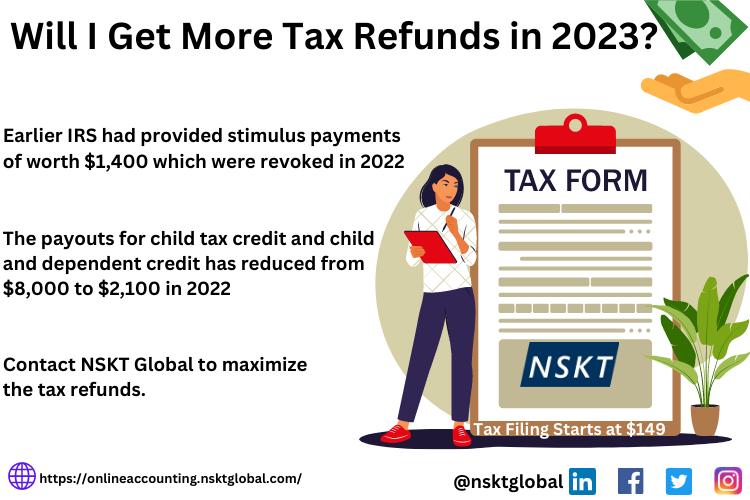

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for ERC

ERC Restaurant Consulting Unveils New Website to Empower Restaurant Success

Enterprise Restaurant Consulting in Canada drives restaurant growth and franchise success with expert strategies, proven solutions, and sustainable results.

Toronto, ON - September 17, 2025 - ERC Restaurant Consulting, Canada's go-to firm for restaurant growth and franchise success, is thrilled to announce the launch of its brand-new website, Enterprise Restaurant Consulting [https://erestaurantconsulting.ca/].

With a fresh, user-friendly design, the site showcases ERC's 35+ years of expertise in helping QSRs and full-service restaurants scale…

Could the ERC be the Destruction of Small Businesses?

The Employee Retention Credit (ERC) was established as a lifeline for businesses struggling during the COVID-19 pandemic. Initially designed to provide financial relief and incentivize businesses to retain employees, the ERC aimed to bolster the economy by preventing mass layoffs.

However, what started as a beacon of hope for many small businesses may now become a source of financial peril.

The Employee Retention Credit, introduced as part of the Coronavirus Aid,…

ERC Tax Refund News - IRS Clarifies New Employee Retention Credit (ERC) Payroll …

Houston, Texas -- The IRS has issued Employee Retention Credit (ERC) payroll tax refund filing instructions that clarifies and extends the previous filing deadlines. The clarification of the IRS three-year period of limitations for amended 941X filings for ERC payroll tax refund claims is April 15 of the year following the original 941 filing. Therefore, the newly clarified deadline for any new 2020 CARES Act Payroll Tax Refund claim is…

Employee Retention Credit 2023 - Is The ERC Tax funds Free Money? Eligibility.

The employee retention tax credit is a tax refunds that the USA government give to businesses to help them recover from the restrictions during the covid19 pandemic. Businesses that were hit by the pandemic in different ways; their employees could not come to work, they were restricted to travel, their shipping of goods took more time than expected, they experienced a revenue decreased quarterly these businesses are entitled to an…

Welcome the massive ecosystem built on ERC - 20

A holistic approach has been undertaken by BRADS to empower the ever-growing digital community of virtual assets. An allowance for being a part of what is trending, and engagement with the massive ecosystem that is built on the ERC-20 standard. BRADSCoin (BDC) is implementing the most efficient choice of digital encryption. To bring further clarifications to your plate, BRADSCoin is a utility token, powered by BRADS International Pvt. Ltd. To…

KABN (Gibraltar) PLC to Launch ERC 1400 Equity Token Offering

Crowdfunding Offering supported by UK Based Tokenise and KABN Equity Token created using Polymath Token Studio

December 9, 2019 – Gibraltar – KABN (Gibraltar) PLC (“KABN” or the “Company”) is pleased to announce that it has created its KABN Equity Token using the Polymath Token Studio and will make its Equity Token available for sale through a public Equity Crowdfunding sale via UK based Tokenise, which is fully compliant with the…