Press release

Insurance Fraud Detection Market to Grow at a CAGR of 25.16% in the Forecast Period 2027

The latest research study "Insurance Fraud Detection Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027" Offers a comprehensive analysis of the industry, which comprises insights on the insurance fraud detection market size. The global insurance fraud detection market is expected to exhibit a CAGR of 25.16% during 2022-2027.Insurance fraud detection refers to systems and services used to analyze and track data to identify irregularities and offer real-time monitoring for preventing fraud related to money or property insurance. This is done through numerous software-based solutions to analyze historical patterns and incidents in order to analyze historic incidents and patterns to predict future happenings. It detects suspicious activities performed by an insurance adjuster, provider, agent, or consumer for unlawful gains during the selling, buying, or underwriting insurance. Insurance fraud detection is also used by organizations for governance, authentication, fraud analytics, risk, and compliance to safeguard databases and identify vulnerabilities and anomalies.

Report Metric

Historical: 2016-2021

Base Year: 2020

Forecast Year: 2022-2027

As the novel coronavirus (COVID-19) crisis takes over the world, we are continuously tracking the changes in the markets, as well as the industry behaviours of the consumers globally and our estimates about the latest market trends and forecasts are being done after considering the impact of this pandemic.

Request a Free Sample Report: https://www.imarcgroup.com/insurance-fraud-detection-market/requestsample

Insurance Fraud Detection Market Trends:

One of the primary factors driving the market is the rising number of insurance frauds, including abductions, fake medical records and inaccurate claims. Additionally, the increasing adoption of online applications and mobile banking services is catalyzing market growth. Other than this, the increasing utilization of advanced analytics and technology are propelling the market growth.

Besides this, the extensive application of artificial intelligence (AI) and the Internet of Things (IoT)- enabled fraud detection solutions for running self-learning models, automated business rules, image screening, text mining, network analysis, device identification, and predictive analytics is also escalating the product adoption rate. Other growth-inducing factors include significant advancements in the cyber security infrastructure and the digitalization of the insurance sector.

Ask the Analyst for Customization and Explore Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=4466&flag=C

Insurance Fraud Detection Market 2022-2027 Analysis and Segmentation:

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

ACI Worldwide Inc, BAE Systems plc, Equifax Inc., Experian plc, Fair Isaac Corporation, Fiserv Inc., FRISS, International Business Machines Corporation, Lexisnexis Risk Solutions Inc. (RELX Group plc), SAP SE, SAS Institute Inc. and Software AG.

The report has segmented the market on the basis on type, deployment, application and vertical.

Breakup by Component:

Solution

Services

Breakup by Deployment Model:

Cloud-based

On-premises

Breakup by Organization Size:

Small and Medium-sized Enterprises

Large Enterprises

Breakup by Application:

Claims Fraud

Identity Theft

Payment and Billing Fraud

Money Laundering

Breakup by End User:

Insurance Companies

Agents and Brokers

Insurance Intermediaries

Others

Breakup by Region:

North America: (United States, Canada)

Asia Pacific: (China, Japan,India, South Korea, Australia, Indonesia, Others)

Europe: (Germany, France,United Kingdom, Italy, Spain, Russia, Others)

Latin America: (Brazil, Mexico, Others)

Middle East and Africa

Key highlights of the report:

Market Performance (2016-2021)

Market Outlook (2022- 2027)

Porter's Five Forces Analysis

Market Drivers and Success Factors

SWOT Analysis

Value Chain

Comprehensive Mapping of the Competitive Landscape

If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Related Report by IMARC Group:

Digital Media Adaptor Market: https://www.imarcgroup.com/digital-media-adaptor-market

Conditional Access System Market: https://www.imarcgroup.com/conditional-access-system-market

Containerized Data Center Market: https://www.imarcgroup.com/containerized-data-center-market

Ota Transmission Platform Market: https://www.imarcgroup.com/ota-transmission-platform-market

Clickstream Analytics Market: https://www.imarcgroup.com/clickstream-analytics-market

Contact Us:

IMARC Group

30 N Gould St Ste R

Sheridan, WY 82801 USA - Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Fraud Detection Market to Grow at a CAGR of 25.16% in the Forecast Period 2027 here

News-ID: 2837637 • Views: …

More Releases from IMARC Group

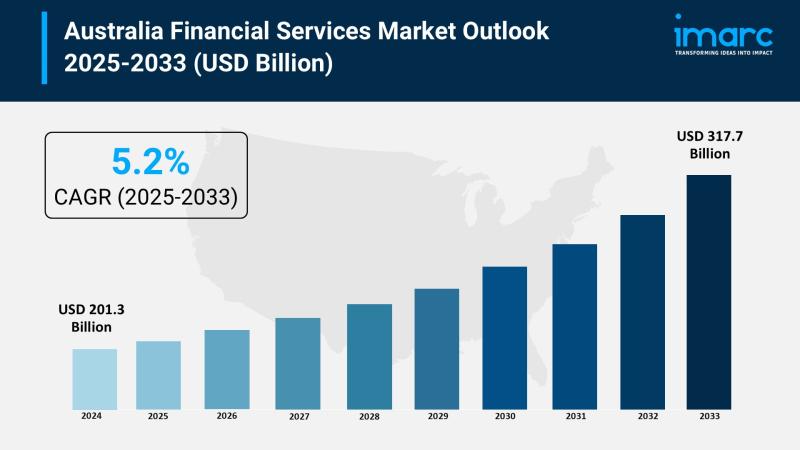

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

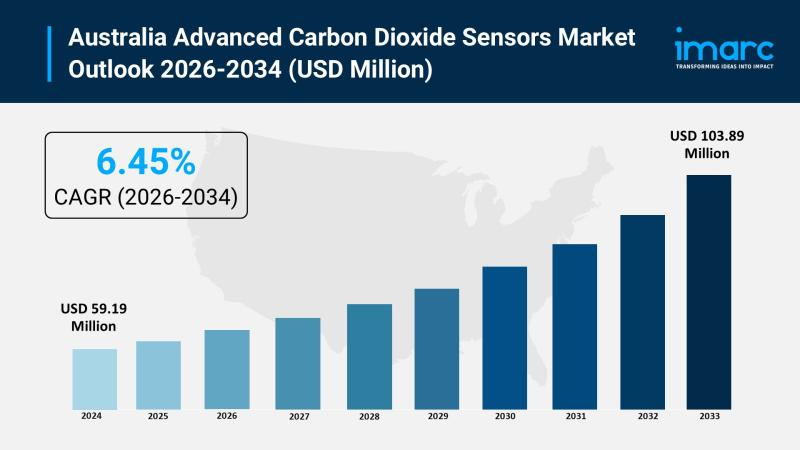

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

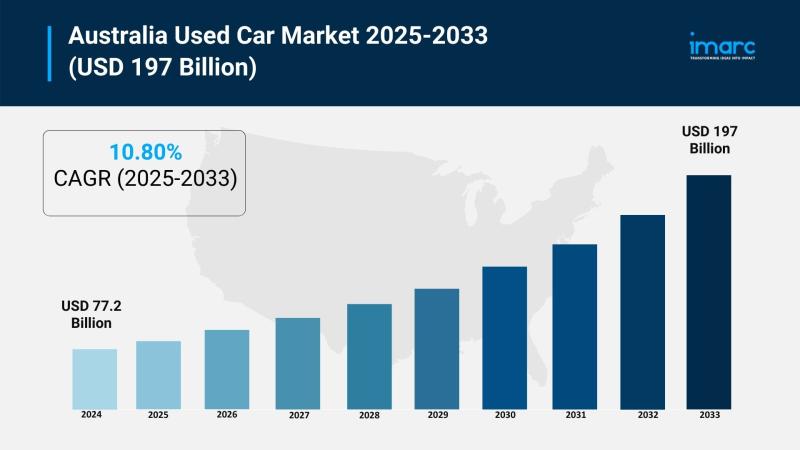

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

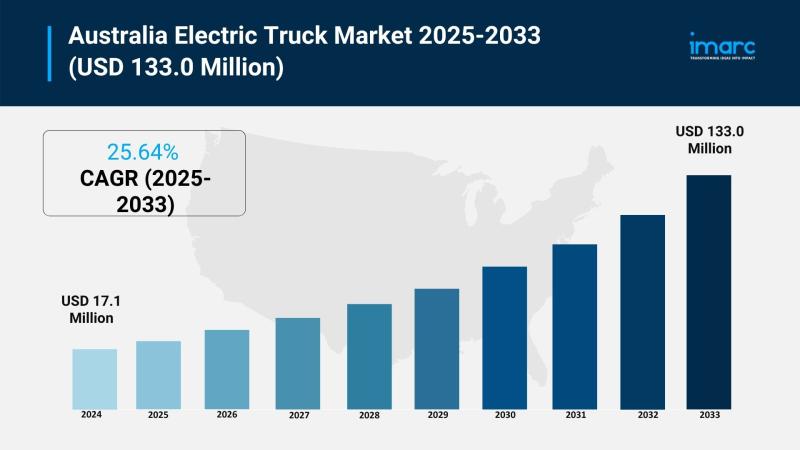

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…