Press release

Global Private Equity Market Analysis and Forecast, 2019-2028 - In-depth Market Report by RationalStat

The report titled "Private Equity Market" assesses the global market based on deal size, fund type, sector, and region. A comprehensive report provides a detailed historical and future market size with trend analysis. The market share analysis, production, competitive landscape, development plans, expansion opportunities, and competition analysis for the target companies evaluated in the global private equity market study are highlighted in the report.Market Overview and Dynamics: Surge of liquidity and the increasing need for diversification of funds to fuel market growth in the residential sector

The Global private equity market is expected to grow at a CAGR of 10.2% during the forecast period of 2022-2028. As per the analysis, the global buyout value reached US$ 1,120 million in 2021.

The availability of a huge volume of capital in the market and the growing need for diversification of that capital are the key reasons contributing to the growth of the private equity market. In addition to that, the correlation of private equity compared with other investment classes is low, which makes it a preferable choice for ultra-high net worth individuals (UHNIs) and high net individuals (HNIs).

The emerging trend of start-up culture is estimated to increase the number of private equity deals. Furthermore, as investing in private equity firms is not taken up by the general public, it does not have many rules and regulations. This acts as a contributing factor in the growth of private equity deals as the investors have more control and freedom over their funds without the interference of the government.

Segmental Analysis

• On the basis of fund type, the buyout segment is expected to dominate the market. This growth is backed by the burst of liquidity, ensuring enough debt to fund buyouts of private equity firms.

• Based on sector, the technology and healthcare sector are expected to dominate the market as they promise long-term growth and projected earnings and margins.

• Based on the region, North America is expected to dominate the market due to increasing P2P activities in the region.

Competition Analysis: Emergence of SPACs ¬¬ to boost the demand for Private Equity

The global private equity market experiences intense competition due to the presence of numerous established companies in the market. SPACs have a short lock-in period (usually 18 to 24 months) as compared to PE portfolio companies (5-6 years) and are capable of earning sizeable returns that to more quickly than a private equity fund. Not only this, registration formalities can be done on a shorter timeline than a traditional IPO process. All these attributes of SPACs make them preferable to UHNIs and HNIs, fueling the growth of the private equity market.

Moreover, the future of SPACs is likely to involve private equity firms in simultaneously sponsoring many SPACs by utilizing their financial resources, networks, deal-making expertise, and industry experience. This will further contribute to the rapid expansion of SPACs as a preferred investment vehicle in the forthcoming years. Lastly, some of the forces like the lingering pandemic and geopolitical turmoil also are driving PE deal making imperatives.

The observed industry trend in the global private equity market is product innovations, launches, and alliances. During the estimated period of 2022-2028, a significant amount of market consolidation is anticipated.

• In September 2022, Nonantum Capital Partners, a middle-market private equity firm, today announced the acquisition of LJP Waste Solutions ("LJP") from Aperion Management. LJP is a leading regional provider of non-hazardous solid waste and recycling services that specializes in zero landfill and waste-to-energy solutions.

• In August 2022, Indian firm Trilegal acted as the sole advisor to global consumer internet group and technology investor Prosus Ventures, and PayU India for the acquisition of IndiaIdeas.com Limited (BillDesk). It is the largest-ever acquisition in the digital payments space in India, and the deal is valued at US$ 4.7 billion.

Some of the leading players involved in the production and marketing of the Global private equity market include Advent International, Apollo Global Management, The Blackstone Group Inc, The Carlyle Group Inc, CVC Capital Partners, KKR & Co. Inc, Thoma Bravo, EQT AB, Vista Equity Partners, TPG Capital, Bain Capital, Warburg Pincus LLC, and Neuberger Berman Group LLC among others.

RationalStat has segmented the Global Private Equity market on the basis of deal size, fund type, sector, and region.

• By Deal Size

o Less than US$ 0.1 Bn

o US$ 0.1 - US$ 1 Bn

o US$ 1 - US$ 2.5 Bn

o US$ 2.5 - US$ 5 Bn

o US$ 5 - US$ 10 Bn

o More than US$ 10 Bn

• By Fund Type

o Buyout

o Venture Capital (VCs)

o Real Estate

o Infrastructure

o Other (Distressed PE, Direct Lending, etc.)

• By Sector

o Technology (Software)

o Healthcare

o Real Estate and Services

o Financial Services

o Industrials

o Consumer & Retail

o Energy & Power

o Media & Entertainment

o Telecom

o Others (Transportation etc.)

• By Region

o Global

o Latin America

o Western Europe

o Eastern Europe

o Asia Pacific

o Middle East & Africa

For more information about this report https://store.rationalstat.com/store/global-private-equity-market/

RationalStat LLC

Kimberly Shaw, Content and Press Manager

sales@rationalstat.com

Phone: +1 302 803 5429

RationalStat is an end-to-end US-based market intelligence and consulting company that provides comprehensive market research reports along with customized strategy and consulting studies. The company has sales offices in India, Mexico, and the US to support global and diversified businesses. The company has over 80 consultants and industry experts, developing more than 850 market research and industry reports for its report store annually.

RationalStat has strategic partnerships with leading data analytics and consumer research companies to cater to the client's needs. Additional services offered by the company include consumer research, country reports, risk reports, valuations and advisory, financial research, due diligence, procurement and supply chain research, data analytics, and analytical dashboards.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Private Equity Market Analysis and Forecast, 2019-2028 - In-depth Market Report by RationalStat here

News-ID: 2833981 • Views: …

More Releases from RationalStat LLC

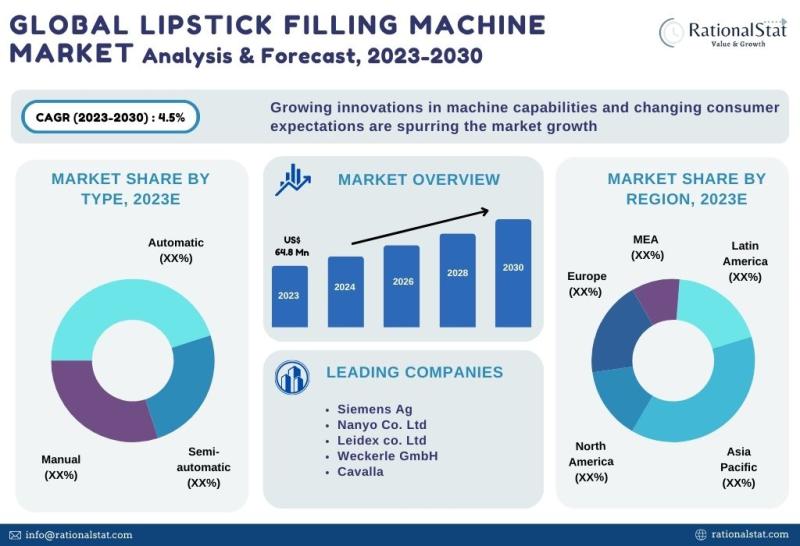

Latest Market Study | Global Lipstick Filling Machine Market Size, Share, & Fore …

The global lipstick filling machine market is expected to reach US$ 88.2 million by 2030, with an annual growth rate of more than 4.5%.

According to RationalStat's recent industry analysis, the Global Lipstick Filling Machine Market value is estimated at US$ 64.8 million in 2023 and is expected to rise at a strong CAGR of over 4.5% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

A lipstick…

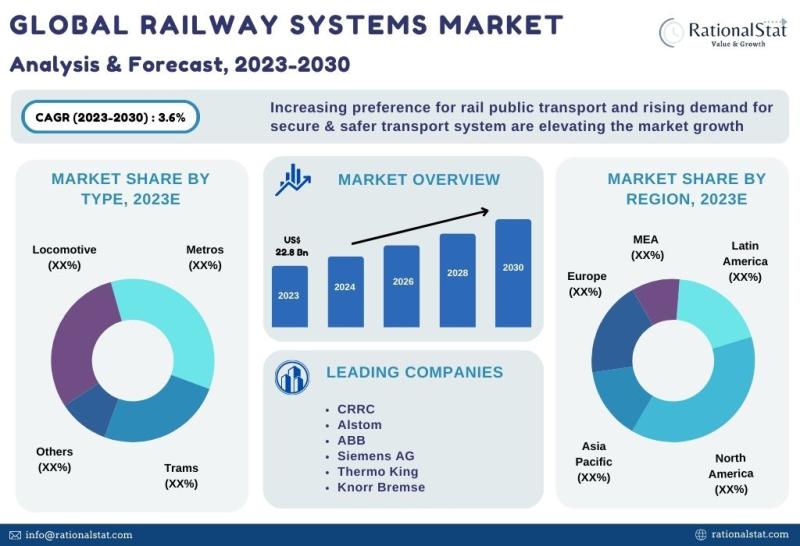

Published Market Report | Global Railway Systems Market Size, Share, & Forecast …

The global railway systems market is expected to reach US$ 29.2 billion by 2030, with an annual growth rate of more than 3.6%.

According to RationalStat's recent industry analysis, the Global Railway Systems Market value is estimated at US$ 22.8 billion in 2023 and is expected to rise at a strong CAGR of over 3.6% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Railway systems, also known…

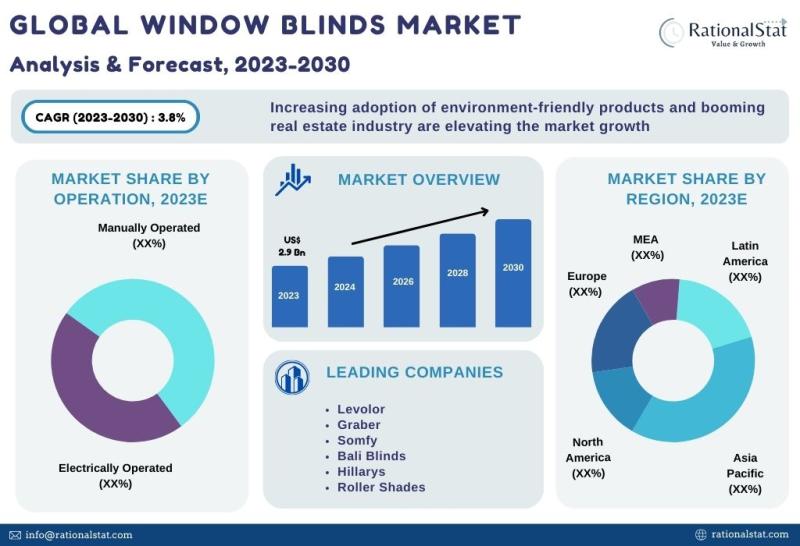

Published Market Report | Global Window Blinds Market Size, Share, & Forecast 20 …

The global window blinds market is expected to reach US$ 3.7 billion by 2030, with an annual growth rate of more than 3.8%.

According to RationalStat's most recent industry analysis, the Global Window Blinds Market value is estimated at US$ 2.9 billion in 2023 and is expected to rise at a strong CAGR of over 3.8% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Window blinds are…

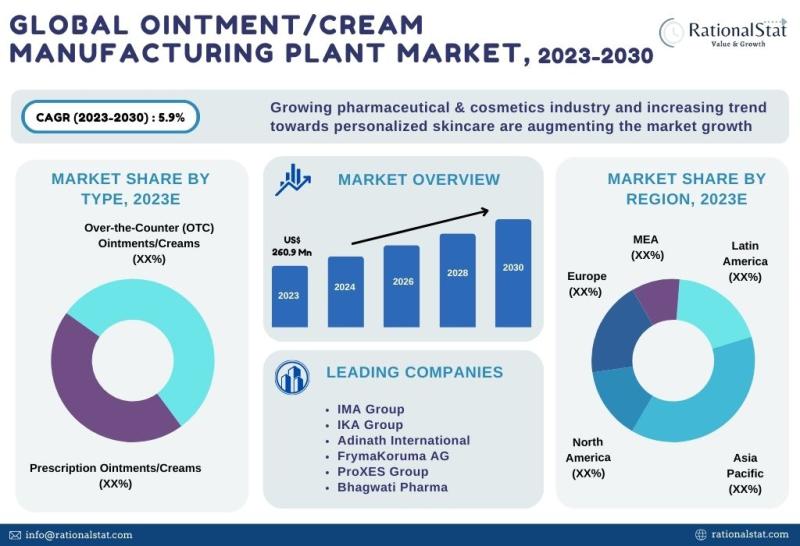

Ointment and Cream Manufacturing Plant Market Report 2023 | Ointment and Cream M …

The global ointment and cream manufacturing plant market is expected to approach US$ 388.7 million by 2030, with an annual growth rate of more than 5.9%

Global Ointment and Cream Manufacturing Plant Market is valued at US$ 260.9 million in 2023 and is expected to grow at a significant CAGR of over 5.9% over the forecast period of 2023-2030, according to the published market report by RationalStat

Market Definition, Market…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…