Press release

Payment As A Service Market Glorious Opportunities, Business Growth, Size, And Statistics Forecasts Up To 2031

The Payment As A Service market is projected to develop from US$ 7.5 Bn to US$ 22 Bn by 2031, at a normal CAGR of 35.7% during the conjecture time frame 2021-2031. Installment as-a-Administration is alluded as PaaS. It is a stage, wherein outsider organizations assist undertakings with tolerating electronic installments by various installments technique.Visa, check card, bank move and continuous bank move in view of web based banking are the different installments technique acknowledged by endeavors. SaaS model is involved by installment as a Help (PaaS) to smooth out the installment for the client.

As advanced installments are expanding step by step, exchanges are finished through e-wallet, sites, and different applications. The stage is trusted by purchasers and merchants as the installment specialist organizations are offering sans risk and secure installment technique. There is an ascent in web based business, which is further driving the development of PaaS universally.

Get a Sample Copy of Report @ https://www.persistencemarketresearch.com/samples/32609

What is Driving Demand for Payment as a Service Market?

There is an increase in penetration of smartphones, which is proliferating the growth of the sale of goods and services online. Online shopping mobile applications are providing an easy and convenient shopping experience to customers. The rise in demand for easy and convenient shopping experience is shifting towards digital and cashless payments.

The surge in e-commerce business is further driving the growth of payment-as-a-service (PaaS) globally. There is a radical shift from an on premise model to a cloud-based service model, this is one of the major factor driving the growth of PaaS solutions.

For an instance in October 2018, Klarna, Swedish payments startup was funded 20$ million by a fashion retailor company H & M to build an omnichannel payments service. The deal took a place for mobile and online payments, better delivery and return process, and more flexible payment options.

Shoppers are looking for an easy and safe payment method for their purchases, it is giving an opportunity to retailer to adopt innovative technologies. Cloud computing, big data analytics, social networks and digital stores are the latest technologies, used by retail enterprise to increase their presence in the market.

What are the Key Trends for Payment as a Service Market?

There are several initiatives taken by governments of different countries for promoting payment solutions based on secure and real-time transactions. Quick, secure payment methods and optimized customer experience are the major factors driving the growth of payment-as-a-service globally.

There is a massive growth in the e-commerce industry, due to which retailers are rapidly moving towards digital payments technology. This will bring more convenient experiences to retailer customers. Recently, Walmart, a largest company in the world, announced that they will enable their customers to pay for goods in-store. A payment provider's service will be integrate by Walmart, through which customers can withdraw and load money using the PayPal mobile app.

Banks are also identifying that the increase in adoption of payment-as-a-service (PaaS) solutions will create many opportunities for them to provide a trustworthy option for their customers. Banks are investing a good amount of money in new generation of technologies to extend services quickly and update their payments product portfolio.

Banks are working with PaaS players to provide exclusive services, such as payments clearing, card issuing, disbursements, cross-border payments, and e-commerce gateways for their customers. Such trend will help the PaaS market to grow in the forecast period.

Ask for Customization @ https://www.persistencemarketresearch.com/request-customization/32609

North America Demand Outlook for Payment as a Service Market

North America region has majority of the key vendors of PaaS solutions and services. This is one of the major factor driving the growth of PaaS solutions in the region. There is an increase in adoption of mobile wallets in the region, which is further augmenting the growth of PaaS.

Industries such as retail and bank are continuously adopting PaaS services for secure and real-time transactions. Due to fast internet speed in the region, e-commerce sales are increasing, which is also one of the factor, driving the growth of PaaS solutions in North America.

Who are the Key Payment as a Service Market Vendors?

Some of the leading vendors of payment as a service include

TSYS

First Data

Verifone

Paysafe

Aurus

Pineapple Payments

Ingenico

Agilysys

First American Payment Systems

Alpha Fintech

allpago

FIS

Helcim

Intelligent Payments Valitor

PPRO

PayStand

Others.

These companies are increasing their market share through strengthening customer relationships, innovation, smart hiring practices, and acquiring competitors.

Buy Report Now @ https://www.persistencemarketresearch.com/checkout/32609

Key Segments

By Component

Payment as a Service Platform

Services

Professional Services

Managed Services

By Enterprise Size

Small and Mid-sized Enterprises (SMEs)

Large Enterprises

By End-use Industry

Retail

Hospitality

Media & Entertainment

Healthcare

BFSI

Others

By Region

North America

US

Canada

Latin America

Brazil

Mexico

Rest of Latin America

Europe

UK

France

Germany

Italy

Spain

BENELUX

Russia

Rest of Europe

East Asia

China

Japan

South Korea

South Asia & Pacific

India

Thailand

Indonesia

Malaysia

Australia & New Zealand

Rest of South Asia & Pacific

Middle East & Africa

GCC Countries

Turkey

South Africa

Rest of Middle East and Africa

Contact Us:

Persistence Market Research

Address - 305 Broadway, 7th Floor, New York City, NY 10007 United States

U.S. Ph. - +1-646-568-7751

USA-Canada Toll-free - +1 800-961-0353

Sales - sales@persistencemarketresearch.com

Website - https://www.persistencemarketresearch.com

Persistence Market Research is here to provide companies a one-stop solution with regards to bettering customer experience. It does engage in gathering appropriate feedback after getting through personalized customer interactions for adding value to customers' experience by acting as the "missing" link between "customer relationships" and "business outcomes'. The best possible returns are assured therein.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment As A Service Market Glorious Opportunities, Business Growth, Size, And Statistics Forecasts Up To 2031 here

News-ID: 2817662 • Views: …

More Releases from Persistence Market Research

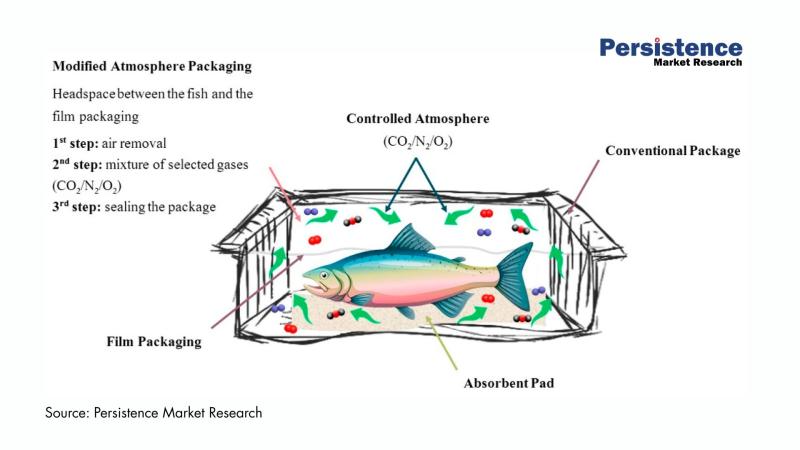

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…