Press release

Payment as a Service (PaaS) Market Size Worth USD 28.99 Billion By 2028| Payment as a Service Industry Expected CAGR 15.9% From 2022 To 2028.

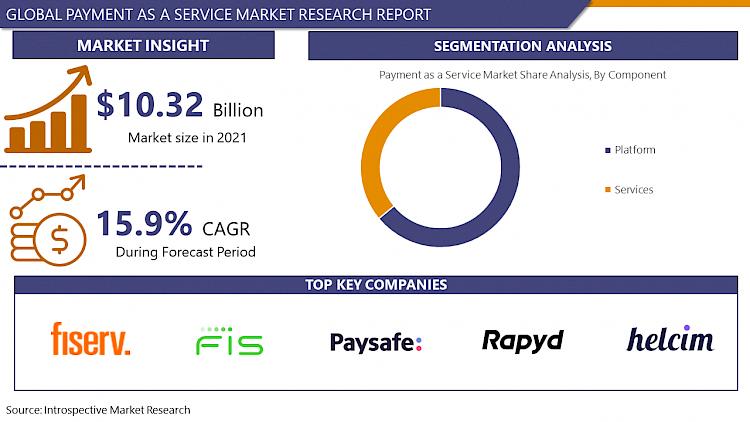

Market Overview:Global Payment as a Service (PaaS) Market Size Was Valued At USD 10.32 Billion In 2021, And Is Projected To Reach USD 28.99 Billion By 2028, Growing At A CAGR Of 15.9% From 2022 To 2028.

Various payment methods, including credit card, direct debit, bank transfer, and real-time bank transfer, are accepted online by a payment service provider. The software as a service concept is commonly utilized by the payment service provider. A provider of payment as a service connects to numerous banks, credit cards, and payment networks. Due to the confluence of mobile devices, data, and the cloud, fast-growing MNCs with digital platforms have recently emerged at an unprecedented rate. In order to develop an omnichannel payments service across H&M's physical and online sites, the Swedish payments company Klarna received $20 million in funding from the clothing retailer H&M in October 2018. The agreement includes "frictionless" in-person, mobile, and online payments, improved delivery and return procedures, and more adaptable payment alternatives.

Read More:

https://introspectivemarketresearch.com/reports/payments-as-a-servicepaas-market/

Market Dynamics:

Driver:

Increased smartphone usage and widespread internet access in many nations fuel the need for online payments, which in turn fuels the expansion of the global market for payment-as-a-service. A significant factor in the market's expansion is the rising need to streamline the payment process and offer clients integrated and value-added services in order to sustain the need for digital processing.

Opportunities:

Particularly among rising markets like Australia, China, India, Singapore, and South Korea, developing economies present considerable prospects for payment as-a-service providers to extend and develop their solutions. Increased regulatory support is also being given to the payment industry's expansion and penetration by implementing partnerships with e-wallets, e-commerce distribution, and other payment platforms. As a result, it is anticipated that this will present profitable chances for the growth of the payment-as-a-service market in the upcoming years.

Get Access to the Exclusive Free Sample of Payment as a Service (PaaS) Market Report @

https://introspectivemarketresearch.com/request/8109

Market Segment:

By Component

• Platform

• Services

By Vertical

• BFSI

• Retail & eCommerce

• Travel & Hospitality

• Healthcare

• Others

By Region

• North America (U.S., Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

• Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC)

• Middle East & Africa (Turkey, Saudi Arabia, Iran, UAE, Africa, Rest of MEA)

• South America (Brazil, Argentina, Rest of SA)

Top Key Players Covered In Payment as a Service (PaaS) Market

• Verifone

• Agilysys Inc.

• PaySafe

• Alpha Fintech

• TSYS (Global Payments Inc.)

• Aurus

• First American Payments Systems

• Rapyd Financial Network Ltd.

• First Data (Fiserv Inc.)

• Helcim

• FIS

• Ingenico

• Pineapple Payments

• Magna International Inc. And Other Major Players.

Key Industry Development In The Payment as a Service (PaaS) Market

In July 2021, Rapyd, a global Fintech as a Service company, announced a definitive agreement to acquire Valitor, an Icelandic payments solutions company, from Arion Banki (Arion Bank). The transaction is worth $100 million and is subject to regulatory approval (Approved on 23rd May 2022). Rapyd's existing payment capabilities in Europe will be supplemented by the acquisition of Valitor, as will its issuing portfolio.

Covid-19 Impact Analysis On Payment as a Service (PaaS) Market

The COVID-19 pandemic has had a significant impact on the payment as a service industry, owing to an increase in consumer usage and adoption of online and digitalized payment methods globally. Furthermore, payment as a service is rapidly expanding as consumers become acquainted with the market's payment technology. Furthermore, a significant increase in retailer adoption of digital payments has been observed, owing to an increase in COVID-19 patients, which has further reduced the trend of carrying and paying with cash. As a result, during the global health crisis, this has become one of the major growth factors for the payment as a service market.

Key Reasons to Purchase Payment as a Service (PaaS) Market Report

- The market report considers major market trends, historical data, and future estimates in the target markets.

- Market researchers thoroughly examined real-world data on manufacturers, sales, and output in each major geographic region.

- The global market report is the result of significant research and a thorough examination of the different aspects influencing regional growth.

Limited Time Offer | Buy this Premium Research Report with Exclusive Discount @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=8109

(After multiple levels of research activities have been finished, the research report is prepared to ensure that the data presented in the research report is authentic and important for market participants.)

Browse More Related Reports

https://introspectivemarketresearch.com/reports/security-as-a-service-market/

https://introspectivemarketresearch.com/reports/mobile-device-as-a-service-market/

https://introspectivemarketresearch.com/reports/managed-software-as-a-service-market/

https://introspectivemarketresearch.com/reports/consulting-services-market/

https://introspectivemarketresearch.com/reports/bitcoin-wallet-market/

https://introspectivemarketresearch.com/reports/financial-risk-management-solutions-market/

Contact Us:

Mike Cooper

Business Development Manager

3001 S King Drive, Chicago, Illinois,

U.S. A 60616

Contact No: USA: +1 (773)-382-1047 / IND: +91-81-8009-6367

Email: sales@introspectivemarketresearch.com

About Us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment as a Service (PaaS) Market Size Worth USD 28.99 Billion By 2028| Payment as a Service Industry Expected CAGR 15.9% From 2022 To 2028. here

News-ID: 2816043 • Views: …

More Releases from Introspective Market Research

Absorbed Glass Mat (AGM) Separator Batteries Market To Reach USD 38.55 Billion b …

Absorbed Glass Mat (AGM) Separator Batteries Market was valued at USD 23.81 Billion in 2023 and is expected to reach USD 38.55 Billion by the year 2032.

Absorbed Glass Mat (AGM) batteries are advanced lead-acid batteries designed for higher electrical output, making them ideal for start-stop vehicle systems and increasingly popular in electric vehicles. Unlike conventional batteries, AGM batteries are sealed, maintenance-free, non-spillable, and highly resistant to vibrations, with improved…

Automotive Fuel Injection Systems Market: Business Research Analysis By 2032

Automotive Fuel Injection Systems are crucial for optimizing engine performance, fuel efficiency, and reducing emissions in modern vehicles. These systems, which include fuel injectors, a fuel pump, a pressure regulator, and an ECU, precisely control fuel delivery either through Direct Fuel Injection or Port Fuel Injection. With growing demand for fuel-efficient, environmentally-friendly vehicles, advanced technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI) are driving market growth…

North America Coal to Liquid Market to Reach 3.02 Mn at CAGR 8.1% | DKRW Energy, …

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through…

India Green Hydrogen Market Next Big Thing | Adani Green Energy, JSW Energy, NTP …

IMR posted new studies guide on India Green Hydrogen Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the India Green Hydrogen marketplace became specifically driven with the aid of the growing R&D spending internationally.

India Green Hydrogen Market Size Was Valued at USD 2.51 Billion in 2023, and…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…