Press release

How do you manage cash flow effectively in 2022

Managing cash flow has always been a top priority for businesses as it plays a pivotal role in determining their financial well-being. But in today's uncertain economy, it's more important than ever for companies to have efficient financial resources and services such as accounting, tax compliance, and accurate bookkeeping services to thrive in the demand-driven market. Small businesses must be especially mindful of their cash flow or the timing of money inflows and outflows, as it helps them keep track of business growth. Let's understand some key details related to cash flow statements and their significance through the lens of accurate accounting practices:What is a cash flow Statement?

A cash flow statement is a financial document that provides insights into how a company is generating and using cash. The purpose of a cash flow statement is to give stakeholders visibility into a company's cash inflows and outflows, which can be used to make decisions about investing, spending, and managing finances. A cash flow statement can be broken down into three sections: operating activities, investing activities, and financing activities.

Operating activities: include selling goods or services, collecting receivables, and paying expenses.

Investing activities: involve buying or selling investments, such as property or equipment.

Financing activities: include issuing debt, repaying debt, and issuing equity.

Each section of the cash flow statement shows how much cash is coming in (inflows) and going out (outflows) for that particular activity. In accounting for small businesses the goal is to have more cash inflows than outflows, which results in a positive cash flow.

How is the cash flow Statement prepared?

The cash flow statement is one of a business's most important documents required during financial accounting. There are three ways to prepare a cash flow statement: the direct method, the indirect method, and the reconciliation method.

Direct:

The direct method starts with net income and then adjusts for items that do not affect cash, such as depreciation. This method is less common because it can be more challenging to calculate during accounting for small businesses.

Indirect:

The indirect method begins with net income and then adds or subtracts items that affect cash flow but are not included in net income, such as changes in accounts receivable or inventory. This method is more common because it is easier to calculate.

Reconciliation:

The reconciliation method reconciles the differences between the two methods. This method is the most accurate, but it can be tedius. No matter which method you use, the goal is to determine a figure for net cash flow from operating activities. This figure shows how much cash is coming in and going out of the company from its normal day-to-day operations.

Accounting software and third-party accounting services typically generate cash flow statements for businesses. However, small business owners need to understand the underlying concepts to ensure that the accounting software is configured correctly and has accurate results, along with good bookkeeping services.

When reviewing cash flow statements, paying close attention to the net cash position for each period is essential. This gives a good indication of whether the business can cover expenses and maintain a positive cash balance.

How Cash Flow Statement helps in decision making

The cash flow statement denotes the critical movements of cash inflow and outflow during accounting. Therefore, it is essential to manage cash flow effectively to keep the business afloat and avoid financial difficulties. Accurate cash flow statements can help enterprises derive significant benefits, especially in decision-making. Here are three critical ways that cash flow statements can help in decision-making:

Identification: It can help you to identify when you need to cut costs or boost revenue. If you see more money going out than coming in, you need to take action to improve your cash flow situation. This may involve reducing costs, increasing prices, or finding new sources of revenue.

Assessment: Cash flow statements can also help you assess whether a particular investment is worth pursuing. If an asset requires a large upfront payment but will not generate any income for some time, it may not be worth pursuing from a cash flow perspective.

Visibility: Cash flow statements can also give insight into which parts of your business are doing well and which parts need improvement. If you see that certain expenses consistently outpacing revenues, then you know that something needs to be changed for the business to succeed in the long term.

The importance of accurate accounting in cash flow management

Accurate accounting and bookkeeping services are the foundation of effective cash flow management, providing insights into where money is coming in and going out. This information is essential for making sound financial decisions and ensuring the long-term health of your business.

There are several ways to improve your accounting and cash flow management. Hiring a qualified company for accounting or bookkeeping services is an excellent first step. They can help you set up an efficient system for tracking incoming and outgoing funds. It's also essential to stay on top of invoicing and payments during accounting, keeping careful records of what is owed to you and when payments are due.

Another critical element of effective cash flow management is forecasting. This involves predicting future cash needs based on past patterns and current trends. This can help you anticipate slow periods and plan accordingly, ensuring that you have enough money on hand to meet your obligations.

Conclusion

The key to managing cash flow is ensuring that businesses have accurate accounting, financial reporting, and tax preparation services. NSKT Global helps businesses do this by providing a comprehensive suite of professional services tailored specifically to each client's needs. Having a team of experts who are familiar with the ins and outs of cash flow management assists businesses in a plan that will improve the bottom line to keep the companies running smoothly and efficiently. These services include:

Accounting and Bookkeeping services

Forecasting Services

Cash flow management

Forensic Accounting

Cash flow management is an essential skill for any business owner or manager, so small businesses should take the time to learn about it and put it into practice for growth and increased revenue.

Charlotte City Center 25 North Tryon Street Suite 1600, Charlotte North Carolina, 28202

NSKT Global possesses experience of over 10 years in the industry serving several SMEs as well as established businesses in the Middle East, North America, South America, Asia Pacific and Europe markets. The graph of our growth in the industry is because of our exceptional services provided to clients by our people who are among the best in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How do you manage cash flow effectively in 2022 here

News-ID: 2785997 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

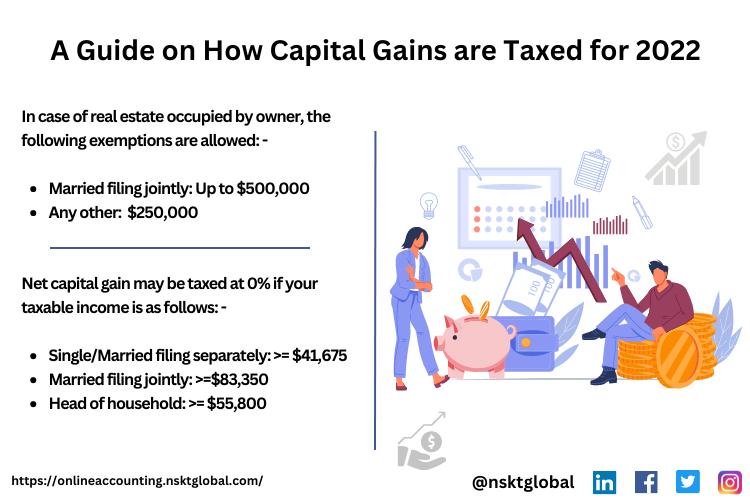

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

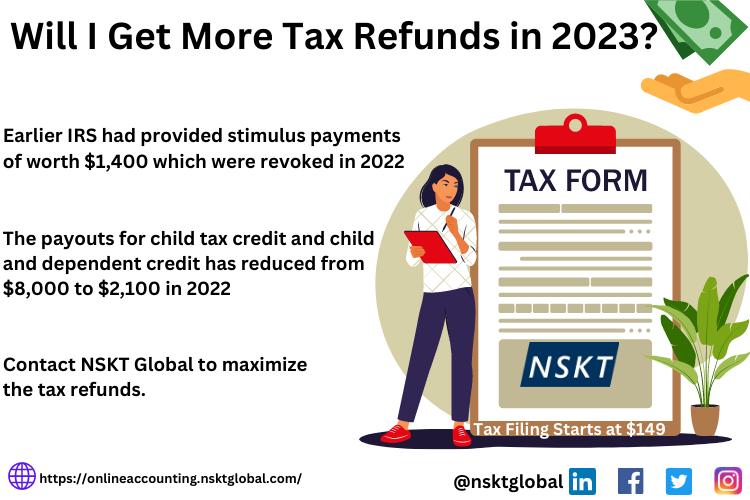

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for Cash

Your Cash Pro Unlocks Immediate Cash from Lapsed Life Insurance

Available to Policyholders Aged 65 or Older with Policies of $100,000 or More

Your Cash Pro is redefining what happens when a life insurance policy no longer fits. Built on transparency and compassion, the company helps policyholders convert lapsed or unneeded policies into immediate cash. Each transaction is structured to protect the policyholder's interests, and Your Cash Pro extends the impact by donating 50% of its own proceeds, never from the…

Teller Cash Recycler Market: Optimizing Cash Management for a Smarter Banking Fu …

The Teller Cash Recycler (TCR) market is witnessing strong momentum as financial institutions, retailers, and cash-heavy industries embrace automation to enhance operational efficiency. Valued at US$ 4,143.47 million in 2024, the market is projected to reach US$ 6,441.49 million by 2033, growing at a steady CAGR of 5.16%.

𝐓𝐡𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐬𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: - https://www.astuteanalytica.com/request-sample/teller-cash-recycler-market

TCRs automate cash deposit, dispensing, and recycling functions, significantly reducing manual cash handling and improving transaction…

Cell Phone Cash Review: Is Cell Phone Cash Legit? Find Out!

Ever wondered if you can make money just by using your smartphone? I started looking into cell phone cash with a lot of doubt. With so many sca.ms out there, figuring out if this program is real was key. This review aims to find out if cell phone cash is a genuine way to make money or just another sc.am.

Let's dive into this question together and see what I found…

Optimizing Cash Flow and Customer Satisfaction with Order to Cash Process Mining

Businesses have always been concerned about optimizing the process of business operations and the maximization of cash flow without compromising customer satisfaction. This has led many businesses today to use O2C process mining ( https://businessprocessxperts.com/process-mining/ ), a useful analytical method that helps them fulfill orders effectively and efficiently.

This analytical method helps in the identification of areas in the order fulfillment process, where there is a need for improvement and inefficiency.

𝗞𝗲𝘆…

"Cash Advance by Cash Tools" App Launched for iPhone Users

The "Cash Advance by Cash Tools" app offers up to $1,000 in quick, interest-free advances with flexible repayment options.

Image: https://www.abnewswire.com/uploads/6fb3472a9cfae1320523530583628e84.png

Cash Tools Inc., a financial technology company, has launched its latest service, "Cash Advance by Cash Tools," available now on the App Store [https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395] for iPhone users. This app aims to provide a straightforward and accessible way for individuals to manage short-term financial needs by offering immediate cash advances without traditional…

Car's Cash For Junk Clunkers Pays Cash On The Spot

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716349569.png

Car's Cash gives free quotes over the phone or by email. The buyers pick up the car and pays cash on the spot, sometimes on the same day. A pink slip is not needed.

Car's Cash For Junk Clunkers [https://carscashforjunkclunkerslosangelesca.com/] and Henry Ford are pleased to announce that they pay cash on the spot for junkers cluttering the landscape. Upfront free quotes are available over the phone or by…