Press release

AI in Fintech Market Report, Growth Segments - Business Size with Forthcoming Developments, Share, Revenue and Global Trends Forecast 2022 to 2028

Artificial Intelligence (AI) in the fintech market is part of the data collection, analysis of the data, facilitating and securing transactions, providing customer-centric modules, and streamlining the process. Also, it provides better analytics, stronger security, virtual assistance, chatbot, and insight. AI in fintech allows fintech organizations to predict customer behavior by collecting their behavioral data. In recent times, AI in the fintech organization has witnessed a significant demand for AI technology in the fintech institution owing to the lower time consumption for the query and easier processing for monetary uses. Moreover, the covid pandemic has changed the behavioral structure of both institutional organizations & customers and allows the organization to implement faster as well as more convenient processes and propel the incorporation of AI in the fintech sector.Download a Sample Copy of this Report @ https://univdatos.com/get-a-free-sample-form-php/?product_id=26129

According to UnivDatos Market Insights (UMI)' research report "Global AI in Fintech Market", the market is expected to witness robust growth of 30% during the forecast period (2022-2028). This is mainly due to the increasing demand for fraud detection, virtual helpers coupled with easy transactions, and chatbots for quick and instant query solutions. The increasing partnership among the industries is also propelling the demand for AI technology in fintech organizations. For instance, Activ.Ai and Talisma have partnered to provide an improved customer experience using a conversational AI-enabled chatbot in the BSFI sector.

For more informative information, please visit us @ https://univdatos.com/report/ai-in-fintech-market/

Based on type, the market is segmented into service and solution. The solution segment witnesses a significant CAGR during the forecast period and is expected to remain the same during the forecast period owing to the adoption of AI and ML in the field of banking and financial institution services to manage big data analytics and to generate significant insight from the collected data. The companies in the market are focusing on innovative and lucrative products & solutions for the user to increase the adoption of AI-enabled technology among the users. For instance, in January 2022, Temenos organization which is the provider of enterprise software solutions for financial institutions and banks announced the first AI-powered buy now pay later solution on its own temenos banking cloud.

Download a Sample Copy of this Report @ https://univdatos.com/get-a-free-sample-form-php/?product_id=26129

Based on the deployment, the market is categorized into on-premises and cloud segments. The on-premises segment has shown significant market growth for the year 2021 and is expected to remain the same during the forecast period owing to the enhanced security feature, greater flexibility for data management, and provide better usability for the organization. However, the cloud segment also witnesses significant growth during the forecast period due to the involvement of the hypercloud service providers and the advantage of the pay-on-use facility.

North America to witness extensive growth

For a better understanding of the market adoption of the AI in fintech industry, the market is analyzed based on its worldwide presence in the countries such as North America (U.S., Canada, Rest of North America), Europe (Germany, U.K., France, Spain, Italy, Rest of Europe), Asia-Pacific (China, Japan, India, Rest of Asia-Pacific), Rest of World. APAC is anticipated to grow at a substantial CAGR during the forecast period. This is mainly due to the increasing research & development expenditure coupled with the technological advancement in AI, ML, and big data analytics. Also, the increasing number of startups and the growing number of enterprises in the region are supporting AI in the fintech market for instance, according to a leading firm, Canada has approximately 700 fintech organizations with 18 found in the year 2020. Furthermore, the increasing investment by the individual and institutional bodies propel the market in the coming time. For instance, in March 2021, HighRadius, a startup for AI-based products for fintech received the USD 300 million in series C funding.

According to UnivDatos Market Insights (UMI)', the key players with a considerable market share in the AI in fintech market are IBM, Narrative Science, Amazon Web Services Inc., Microsoft, HCL Technologies, HP Enterprise Development LP, Intel Corporation, SAP SE, Salesforce Inc., and CISCO System.

"Global AI in Fintech Market" provides comprehensive qualitative and quantitative insights on the industry potential, key factors impacting sales and purchase decisions, hotspots, and opportunities available for the market players. Moreover, the report also encompasses the key strategic imperatives for success for competitors along with strategic factorial indexing measuring competitors' capabilities on different parameters. This will help companies in the formulation of go-to-market strategies and identifying the blue ocean for its offerings.

For more informative information, please visit us @ https://univdatos.com/report/ai-in-fintech-market/

Market Segmentation:

1. By Type (Service and Solution)

2. By Deployment (Cloud and on-Premises)

3. By Application (Chatbots, Customer Behavioral Analytics, Business Analytics & Reporting, and Others)

4. By Region (North America, Europe, Asia-Pacific, Rest of the World)

5. By Company (IBM, Narrative Science, Amazon Web Services Inc., Microsoft, HCL Technologies, HP Enterprise Development LP, Intel Corporation, SAP SE, Salesforce Inc., and CISCO System.)

Key questions answered in the study:

1. What are the current and future trends of the global AI in fintech industry?

2. How the industry has been evolving in terms of type, deployment, and application?

3. How the competition has been shaping across the countries followed by their comparative factorial indexing?

4. What are the key growth drivers and challenges for the global AI in fintech industry?

5. What is the customer orientation, purchase behavior, and expectations from the global AI in fintech suppliers across various region and countries?

Download a Sample Copy of this Report @ https://univdatos.com/get-a-free-sample-form-php/?product_id=26129

Table of content-

1 MARKET INTRODUCTION

2 RESEARCH METHODOLOGY OR ASSUMPTION

3 MARKET SYNOPSIS

4 EXECUTIVE SUMMARY

5 IMPACT OF COVID-19 ON THE AI IN FINTECH MARKET

6 AI IN FINTECH MARKET REVENUE (USD BN), 2020-2028F

7 MARKET INSIGHTS BY TYPE

8 MARKET INSIGHTS BY DEPLOYMENT

9 MARKET INSIGHTS BY APPLICATION

10 MARKET INSIGHTS BY REGION

11 AI IN FINTECH MARKET DYNAMICS

12 AI IN FINTECH MARKET OPPORTUNITIES

13 AI IN FINTECH MARKET TRENDS

14 DEMAND AND SUPPLY-SIDE ANALYSIS

15 VALUE CHAIN ANALYSIS

16 COMPETITIVE SCENARIO

17 COMPANY PROFILED

18 DISCLAIMER

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature and geography. Please let us know If you have any custom needs.

For more informative information, please visit us @ https://univdatos.com/report/ai-in-fintech-market/

Contact us:

UnivDatos Market Insights (UMI)

Email: sales@univdatos.com

Web: https://univdatos.com

Ph: +91 7838604911

About Us:

UnivDatos Market Insights (UMI), is a passionate market research firm and a subsidiary of Universal Data Solutions. Rigorous secondary and primary research on the market is our USP, hence information presented in our reports is based on facts and realistic assumptions. We have worked with 200+ global clients, including some of the fortune 500 companies. Our clientele praises us for quality of insights, In-depth analysis, custom research abilities and detailed market segmentation.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in Fintech Market Report, Growth Segments - Business Size with Forthcoming Developments, Share, Revenue and Global Trends Forecast 2022 to 2028 here

News-ID: 2780781 • Views: …

More Releases from UnivDatos Market Insights (UMI)

Airline Route Profitability Software Market - Industry Size, Share, Growth & For …

The Airline Route Profitability Software Market is expected to grow at a steady rate of around 10% owing to the increased adoption of technologies such as artificial intelligence, mobile and conversational commerce coupled with business analytics and market intelligence. Thus, helping airlines to identify demand trends and increase profit margins by calculating and evaluating the cost of currently operated routes. Moreover, the rising need to find shorter as well as…

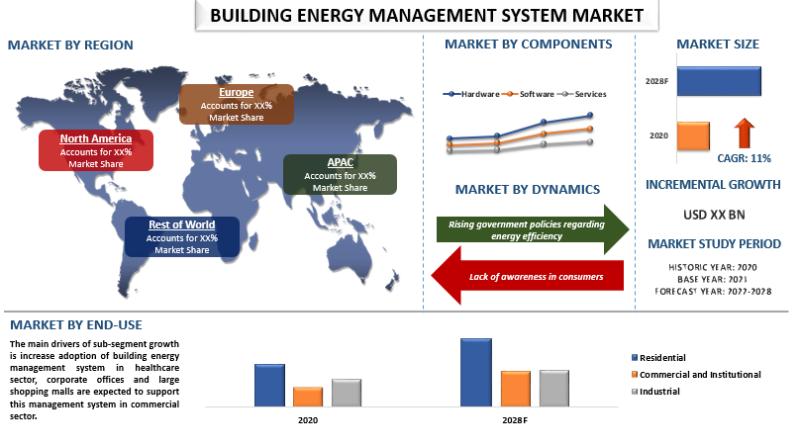

Building Energy Management System Market - Industry Size, Share, Growth & Foreca …

Global Building Energy Management System market is expected to register a CAGR of around 11% over the period of 2022-2028. A building energy management system (BEMS) is a computer-based system that monitors and controls a building's electrical and mechanical equipment such as lighting, power systems, heating, and ventilation. Growth in technological advancement has made building energy management systems a vital component for managing energy demand, especially in large building sites.…

Cloud Computing Market - Industry Analysis by Size, Share, Growth & Forecast (20 …

Internet penetration rate and data generated yearly are some of the most prominent factors driving the growth of the cloud computing market because as the size of generated data increases the need for this data to be stored either in physical storage devices or in cloud storage also increases. Moreover, physical storage devices are easy to access but they are more expensive and less secure than cloud storage, there is…

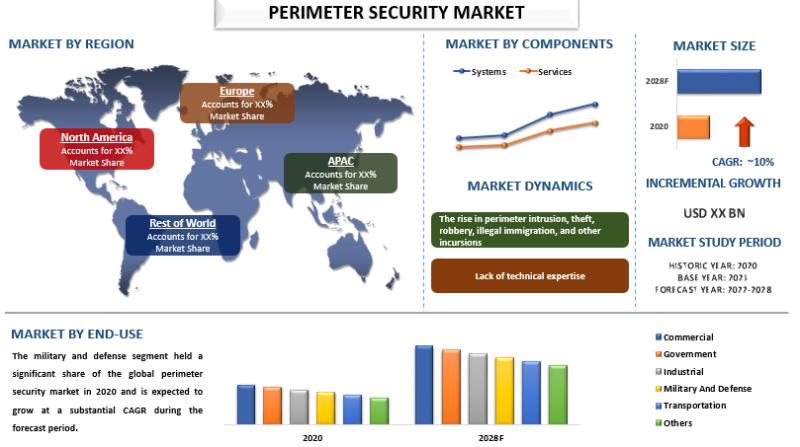

Perimeter Security Market Report 2022 - Global Business Trends, Emerging Growth, …

Perimeter security refers to an integrated system that enables the physical security of a facility. It helps in protecting against unauthorized physical intrusion. Outdoor perimeter security includes technologies such as video surveillance systems, access control systems, communication and notification systems, and intruder detection systems. Recent technological advances have introduced infrared, microwave, radar, and seismic sensors. This has contributed to the robustness of these systems.

Download a Sample Copy of this Report…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…