Press release

Fintech Technologies Market size was valued at USD 113.24 Billion in 2021, growing at a CAGR of 20.60% from 2022 to 2032: Evolve Business Intelligence

The global Fintech Technologies market size was valued at USD 113.24 Billion in 2021 growing at the CAGR of 20.60% from 2022 to 2032. Evolve Business Intelligence provides an in-dept research study that contains the ability to focus on the major market dynamics in several region across the globe. Moreover, a details assessment of the market is conducted by our analysts on various geographic including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa to provide clients with opportunity to dominate the emerging markets. The Fintech Technologies market study includes growth factors, restraining factors, challenges, and Opportunities which allows the businesses to assess the market capability of the industry. The report delivers market size from 2020 to 2032 with forecast period of 2022 to 2032. The report also contains revenue, production, sales consumption, pricing trends, and other factors which are essential for assessing any market.Request Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016086

Key Highlights:

• The global Fintech Technologies market size was valued at USD 113.24 Billion in 2021 growing at the CAGR of 20.60% from 2022 to 2032.

• North America dominated the market in 2021

• Asia Pacific is expected to grow at a highest CAGR from 2022 to 2032

Key Players

The Fintech Technologies market report gives comprehensive information about the company and its past performance. The report also provide a detail market share analysis along with product benchmarking with key developments.

The key players profiled in the report are:

● Stripe

● YapStone

● Braintree

● Adyen

● Lending Club

● Addepar

● Commonbond

● Kabbage

● Robinhood

● Wealthfront

The Global Fintech Technologies Logistic report also includes information on company profiles, product descriptions, revenue, market share data, and contact details for several regional, global, and local companies. Due to increased technological innovation, R&D, and M&A operations in the sector, the market is becoming more popular in particular niche sectors. Additionally, a large number of regional and local vendors in the Fintech Technologies market provide specialised product offerings according to geographical regions in keeping with the global manufacturing footprint. Due to the reliability, quality, and technological modernity of the worldwide suppliers, it is difficult for the new market entrants to compete.

COVID Impact

In terms of COVID 19 impact, the Fintech Technologies market report also includes the following data points:

● COVID19 Impact on Fintech Technologies market size

● End-User/Industry/Application Trend, and Preferences

● Government Policies/Regulatory Framework

● Key Players Strategy to Tackle Negative Impact/Post-COVID Strategies

● Opportunity in the Fintech Technologies market

Get a Free Sample Copy of This Report @ https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016086

Scope of the Report:

Market Segment By Type:

o Mobile Based

o Web Based

Market Segment By Application:

o Security Solutions

o Payment Solutions

o Wealth Management

o Insurance

For more information: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016086

Key Region/ Countries Covered

● North America (US, Canada, Mexico)

● Europe (Germany, U.K., France, Italy, Russia, Rest of Europe)

● Asia-Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

● Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of MEA)

● Latin America (Mexico, Brazil, Argentina, Rest of Latin America)

Reasons to Buy this Report:

• Detail analysis of the impact of market drivers, restraints, and oppotunities

• Competitive Intelligence providing the understanding about the ecosystem

• Details analysis of Total Addressable Market (TAM) of your products

• Investment Pockets and New Business Opportunities

• Demand-supply gap analysis

• Strategy Planning

Contact Us:

Evolve Business Intelligence

India

Contact: +1 773 644 5507 (US) / +441163182335 (UK)

Email: sales@evolvebi.com

Website: www.evolvebi.com

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging the pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Technologies Market size was valued at USD 113.24 Billion in 2021, growing at a CAGR of 20.60% from 2022 to 2032: Evolve Business Intelligence here

News-ID: 2776353 • Views: …

More Releases from Evolve Business Intelligence

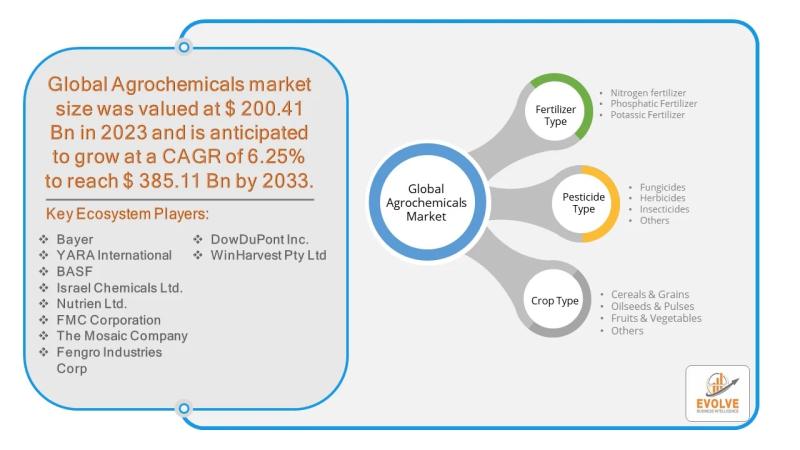

Agrochemical Market Forecast to Reach USD 394.8 Billion by 2033

The global agrochemical market is a multi-billion dollar industry, valued at an estimated USD 297.7 billion in 2024 and projected to reach USD 394.8 billion by 2033. At the heart of this growth lies the cereals and grains segment, which represents a massive opportunity. With global population growth driving the need for food security, the cultivation of staple crops like wheat, rice, and maize is a primary focus for farmers…

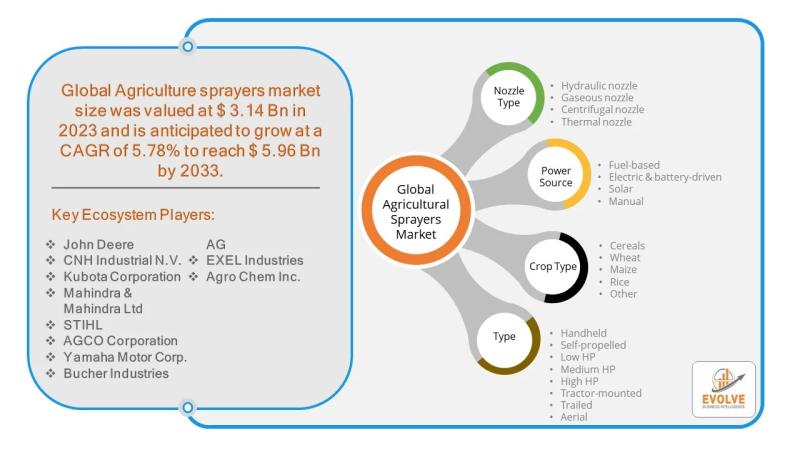

Agriculture Sprayers Market Forecast to Reach USD 5.96 Billion by 2033

The global agriculture sprayers market is on a trajectory of significant growth, with a projected value of USD 5.96 billion by 2033, up from USD 3.14 billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 5.78%. This expansion is largely driven by technological advancements and the increasing adoption of precision agriculture. While the market presents vast opportunities, it is not without its challenges. The high initial cost…

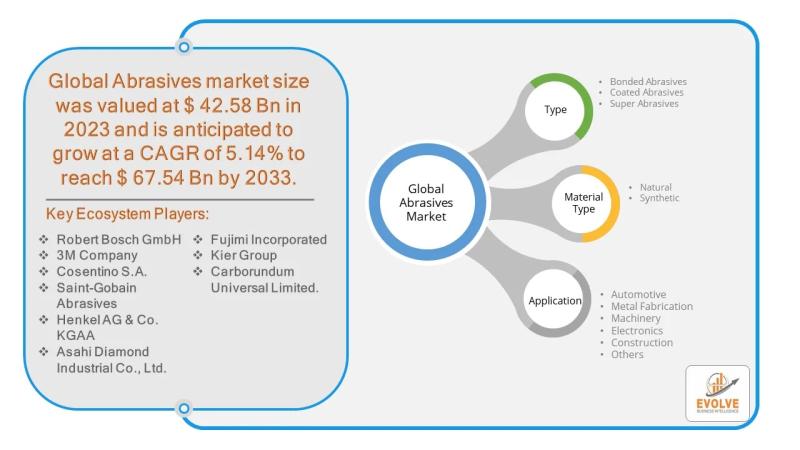

Abrasives Market Forecast to Reach USD 67.54 Billion by 2033

The global abrasives market, a critical component of industrial manufacturing, is demonstrating a robust and high-opportunity landscape for the metal fabrication sector. Valued at $42.58 billion in 2023, the market is projected to reach $67.54 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 5.14%. A significant driver of this growth is the increasing demand from the metalworking and automotive industries. As industries reliant on metal fabrication,…

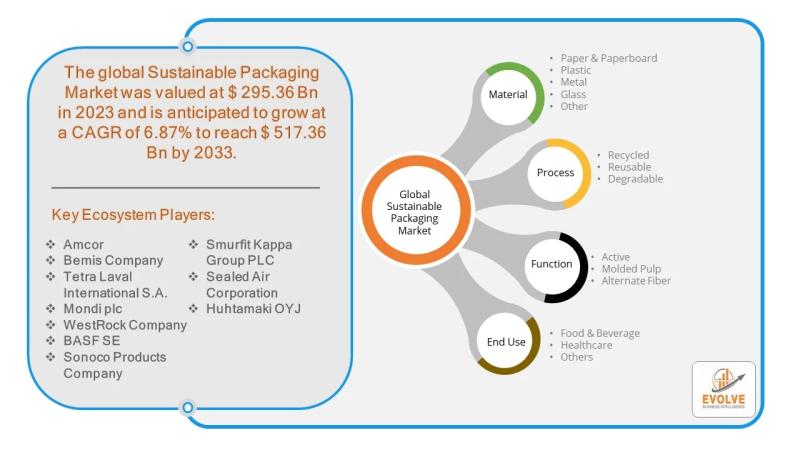

Sustainable Packaging Market Forecast to Reach USD 517.36 Billion by 2033

The global sustainable packaging market is experiencing remarkable growth, driven by an increasing demand for eco-friendly solutions. Valued at $295.36 billion in 2023, the market is forecasted to reach $517.36 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.87%. This presents a significant opportunity for reusable packaging, a segment gaining momentum as a key solution to environmental challenges.

Download the full report now to discover market trends, opportunities,…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…