Press release

Saudi Arabia's huge surge in recent times with respect to digital transactions, serving as one of the major factors leading to rise of digital credit lending such as that of BNPL in the country: Ken Research

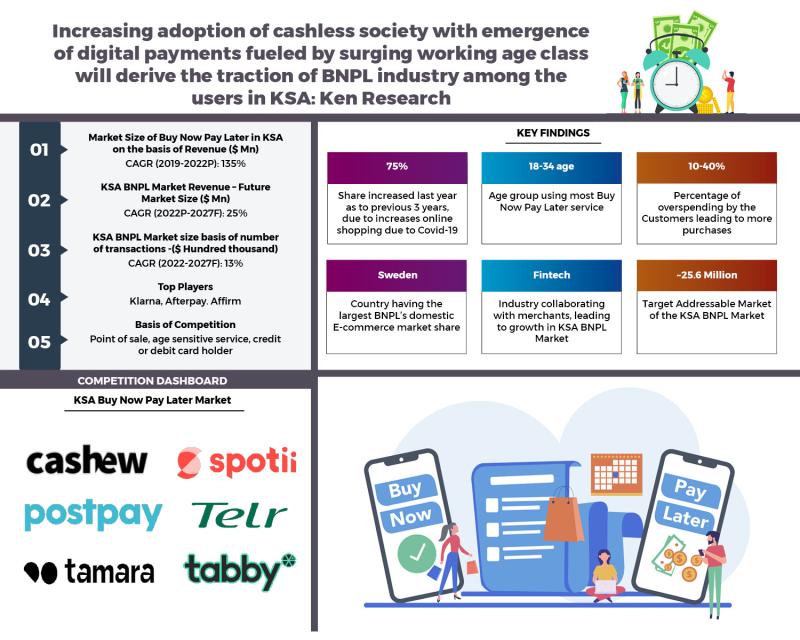

Increasing number of BNPL Players and its customer base: In just one year, the Middle East region has witnessed an upsurge in the number of companies offering BNPL solutions. With so much action happening on the BNPL ground, its user base is making equally big strides. A major chunk of Saudi Arabian consumers has used BNPL payment methods such as Tamara in 2021 when compared to previous years, with more customers exploring the BNPL services.Inception of digital economy: Saudi Arabia has witnessed a huge surge in recent times with respect to digital transactions, serving as one of the major factors leading to rise of digital credit. With e-commerce growing at 2.5 times faster than before the pandemic coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry.

Credit recovery and overspending: BNPL service issuers Horne a risk of not being able to recover loan amounts that consumers fail to pay on time. There is a huge risk of overspending anywhere from 10%-40% more on purchases, as these purchases are easier to make. That's where BNPL might start to resemble credit cards.

Government regulations: BNPL approved in SAMA's Regulatory Sandbox comes as part of SAMA's endeavor to support e-commerce, increase the level of financial inclusion, in addition to promoting and diversify the financial services offered within the financial sector, Amid the growing adoption of BNPL products in Saudi Arabia, the Saudi Arabian central bank has made it mandatory for all (BNPL) firms to get a permit. Failing to get a permit from the central bank in Saudi Arabia will lead to legal actions.

For more information on the research report, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/ksa-buy-now-pay-later-market-outlook-to-2027/596046-93.html

Myriad of Merchant On boarding: BNPL players are currently in the process of on boarding a huge chunk of merchants in order to increase their presence in the region. Cashew Payments has recently partnered with health and wellness players as there is a huge chunk of Emirati youth ready to spend their money in this space. Key Target audience is between 24 to 35 and 35 to 45 but essentially the largest chunk is between 24 to 36. This is perhaps the reason why the industry is booming here because a lot of young people live to shop and shop to live so and of course the need for a credit check because essentially the credit card is not very easily granted.

Spike in Global investors: Since TAMARA's launch in September 2020, there has been a radical change in the mind-set of global investors towards the region as compared to before. Investors are now more and more open to investing in the region which has led to a spike in global investor interest from Venture Capital (VC) to Private Equity (PE) firms to investment banks.

The report "KSA Buy Now Pay Later Market Outlook to 2027- Driven by digitalization, government support as a part of Saudi vision 2030 increasing Genz & millennials population due to influx of expatriates coupled with shifting preference towards easy interest free extra credit line sources" by Ken Research provides a comprehensive analysis of the potential of Buy Now Pay Later Industry in Saudi Arabia. The report also covers overview and genesis of the industry, market size in terms of revenue generated; market segmentation by types of services, by end users, by revenue division on the basis of Number of Transactions, on the basis of Number of Transactions, by Age Group of Consumers; growth enablers and drivers, challenges and bottlenecks, trends driving adoption of digital innovation; regulatory framework; end user analysis, industry analysis, competitive landscape including competition scenario, market shares of major players. The report concludes with future market projections of each product segmentation and analyst recommendations.

Key Segments Covered in KSA BNPL Market:-

Market Size of Buy Now Pay Later in KSA

on the basis of Revenue, 2019-2022P

on the basis of Number of Transactions, 2019-2022P

on the basis of Average Order Value, 2019-2022P

Market Segmentation By mode of payment

Online

Offline

Market Segmentation By end user

Ecommerce Giants

Physical Retailers

Travel and entertainment Merchants

Food Merchants

Market Segmentation By age group:

Below 24

24-36

36-50

Above 50

Key Target Audience:-

Bankers and associations

Government associations

Corporates

Investment firms

Government Bodies & Regulating Authorities

Fintech companies

Venture capitalists

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ2

Time Period Captured in the Report:-

Historical Year: 2019-2021

Base Year: 2022

Forecast Period: 2023- 2027F

Companies Covered:-

Tabby

Spotii

Tamara

Cashew

PostPay

Key Topics Covered in the Report:-

BNPL Industry positioning

Socio demographic Outlook of Saudi Arabia

Economic Landscape and Expatriate Population of Saudi Arabia

Overview of Global BNPL Industry

Presence of Global BNPL Players

Disruptors of Credit card Globally

Case Studies of Leading Global BNPL Providers

Trends of BPNL Industry

Market size of BPNL

BNPL transaction process

Key Features and developments in KSA BPNL

Ecosystem of Major Entities in Buy Now Pay Later Industry in KSA

SWOT Analysis of KSA BNPL

Issues and Challenges in KSA BNPL

Investment Analysis of players in BNPL Space

Role of Government and regulations in KSA BNPL

Porter's Five force Analysis in KSA BPNL

Market Size of Buy Now Pay Later in KSA on the basis of Revenue, Number of Transactions and Average Order Value, 2019-2022P

Market Segmentation by mode of payment, by end user, and by age group

Future Market Size of Buy Now Pay Later in KSA on the basis of Revenue

Future Market Segmentation by Mode of Payments, by end user and by age group

Future Market Size of BNPL in KSA

Industry Speaks

Analyst Recommendations

Research Methodology

For more information on the research report, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/ksa-buy-now-pay-later-market-outlook-to-2027/596046-93.html

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/uae-buy-now-pay-later-industry-outlook-to-2027/588867-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/south-africa-buy-now-pay-later-market-outlook-to-2027/596049-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Support@kenresearch[dot]com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

We currently cater to 300+ sectors with 150,000+ research repository across 196+ countries serving 1000+ clients and have partnered with almost 25+ content aggregators.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia's huge surge in recent times with respect to digital transactions, serving as one of the major factors leading to rise of digital credit lending such as that of BNPL in the country: Ken Research here

News-ID: 2775632 • Views: …

More Releases from Ken Research Pvt .Ltd

Indonesia Plant-Based Dairy Alternatives Market Surpasses USD 540 million Milest …

Comprehensive market analysis outlines exponential growth prospects, investment opportunities, and strategic actions for industry players in the rapidly expanding Indonesian plant-based dairy alternatives sector.

Jakarta, Indonesia - February 6, 2026 - Ken Research released its comprehensive market analysis titled "Indonesia Plant-Based Dairy Alternatives Market," revealing that the current market size is valued at USD 540 million, based on a detailed five-year historical analysis. The study highlights how the market is positioned…

Ken Research Stated India's Online Furniture Rental & Leasing Platforms Market t …

Comprehensive market analysis outlines exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in India's rapidly evolving online furniture rental ecosystem.

Delhi, India - February 6, 2026 - Ken Research released its strategic market analysis titled "India Online Furniture Rental & Leasing Platforms Market," revealing that the current market size is valued at USD 4.1 million, based on a five-year historical analysis. The detailed study outlines how the market…

Ken Research Stated Middle East & Africa's Energy Drink Market to Reach USD 4.5 …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the region's rapidly evolving energy drink ecosystem.

Delhi, India - February 5, 2026 - Ken Research released its strategic market analysis titled "Middle East & Africa Energy Drink Market Outlook to 2030," revealing that the current market size is valued at USD 4.5 billion, based on a five-year historical analysis. The detailed study outlines how…

Saudi Arabia Aquaculture Market - Ken Research Stated the Sector Valued at ~ USD …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the Kingdom's rapidly evolving aquaculture ecosystem.

Delhi, India - February 5, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Aquaculture Market," revealing that the current market size is valued at USD 385 million, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…