Press release

Africa Insurance Industry to Reach US$ 115.9 Billion by 2027

According to IMARC Group's latest research report, titled "Africa Insurance Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2022-2027," offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.The Africa insurance market reached a value of US$ 75.3 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 115.9 Billion by 2027, exhibiting a CAGR of 7.4% during 2022-2027. Insurance is a guaranteed agreement that provides protection to the insurer from financial losses. It is a contract in which an entity or individual receives reimbursement or protection from an insurance firm in the form of a policy. Additionally, it promotes trade and commerce while improving financial stability for sustainable economic growth and development while mitigating losses. A wide range of insurance policies is available for consumers to protect against the risk of big and small financial losses caused by liability for damage or damage to the insured's property. Some of the popular insurances include health, life, automobile, cyber, and property insurance policies. Due to the availability of affordable insurance across Africa, this is gaining widespread prominence among the masses.

Get Free Sample Copy of Report at - https://www.imarcgroup.com/africa-insurance-market/requestsample

Industry Demand Analysis:

The market in Africa is majorly driven by the increasing awareness regarding the benefits of insurance among individuals. Along with this, the rising demand to maintain a compulsory minimum level of insurance due to the escalating need to strengthen the capital and regulatory requirements of insurance companies is significantly supporting the market growth. Due to liberalization and deregulation across the region, there has been a considerable increase in the adoption of insurance policies among the masses. Moreover, the advent of online platforms and new technologies, such as the widespread deployment of blockchain technology to decentralize claim processing to streamline operations and enhance data accuracy, this is creating a positive market outlook. Some of the other factors driving the market growth include the growing working population, easy access to insurance through wider distribution channels and increasing partnership activities.

Do you know more information, Contact to our analyst at- https://www.imarcgroup.com/africa-insurance-market

Key Market Segmentation:

Key Players Included in Africa Insurance Market Research Report:

• African Life Assurance Limited

• The Liberty Holdings Limited

• Libya Insurance Company

• Misr Insurance Holding Company

• Momentum Metropolitan Holdings Limited

• Old Mutual Limited Group

• Sage Term Life Insurance

• Sanlam Life Insurance Limited

• Santam Limited

• Société Nationale Des Assurances

• SPA

Breakup by Type:

• Life Insurance

• Non-life Insurance

o Automobile Insurance

o Fire Insurance

o Liability Insurance

o Other Insurances

Breakup by Country:

• South Africa

• Morocco

• Nigeria

• Egypt

• Kenya

• Algeria

• Angola

• Namibia

• Tunisia

• Mauritius

• Others

Contact us:

IMARC Group

30 N Gould St, Ste R

Sheridan, WY (Wyoming) 82801 USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

Who we are:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Africa Insurance Industry to Reach US$ 115.9 Billion by 2027 here

News-ID: 2766246 • Views: …

More Releases from IMARC Group

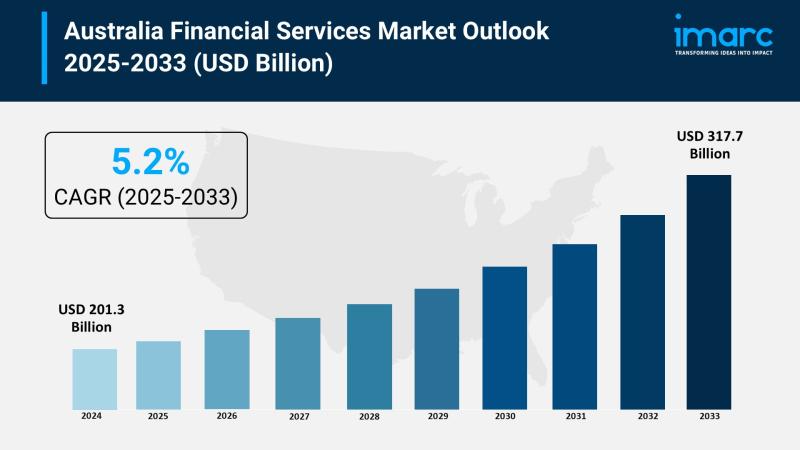

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

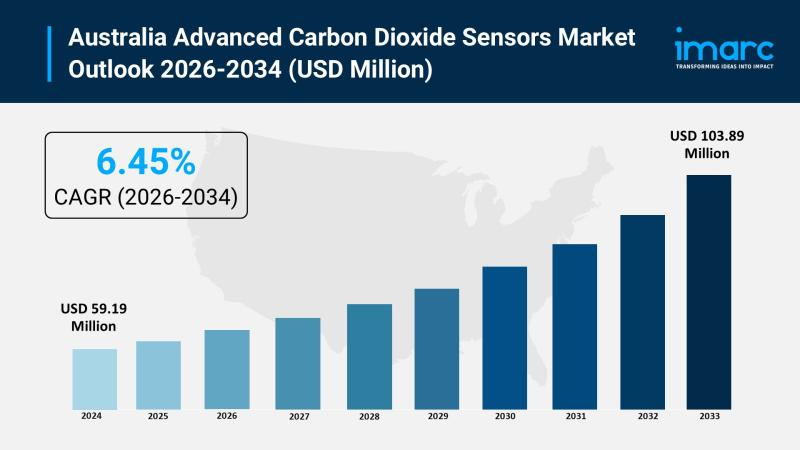

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

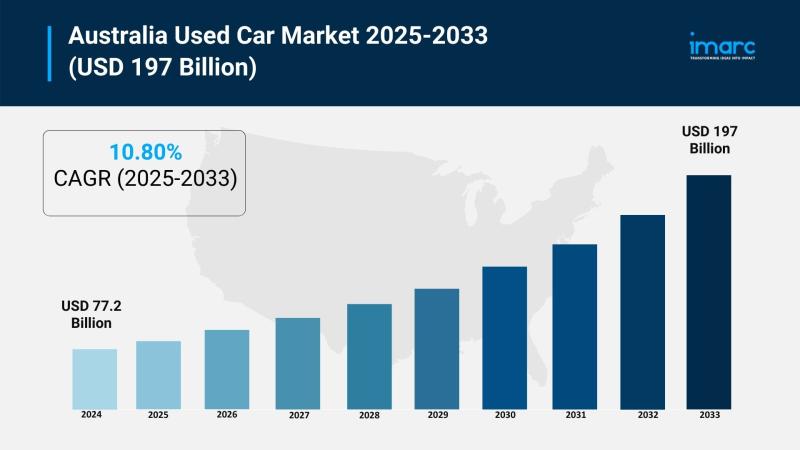

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

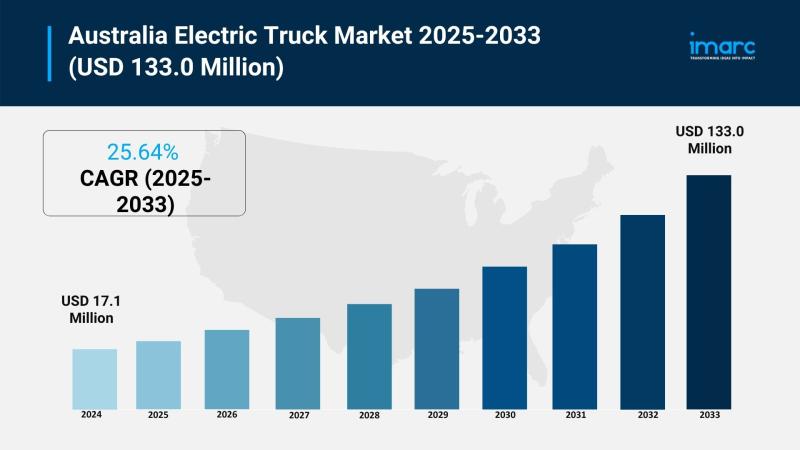

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…