Press release

Fintech Lending Market Growth Sturdy at healthy CAGR to COVID-19 Impact and Global Analysis by ReportsnReports Market Insights, Top Companies

The Fintech Lending report presents information related to restraints, key drivers, and opportunities, along with a detailed global market share analysis. The current market is quantitatively analyzed from 2022 to 2029 to highlight the global market growth scenario. The competitive landscape comprises key players, strategies, and new developments in the upcoming years.Download FREE Sample Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=6210332

Top Key Players are covered in this report:

- Ant Group

- JD Digits

- GrabFinance

- Du Xiaoman Finance

- SoFi

- Atom Bank

- Lending Club

- Prosper

- Upstart

- Enova

- Avant

- Funding Circle

- OnDeck

- Zopa

- October

- RateSetter (Metro Bank)

- Auxmoney

- GreeSky

- Borro

- Affirm

- Tala

- Best Egg

- Earnest

- Kabbage

- CreditEase

- Lufax

- Renrendai

The report divides the international Fintech Lending market by application. By region, by type, and by end user. Each segment of the market is examined broadly to deliver trustworthy knowledge for market investments. The Fintech Lending research report reveals the current market norms, latest important revolutions of outcomes, and market players. Hence, this research report will help the customers in the global market plan their next future towards the environment of the marketâs future. It additionally discusses about the market size and growth parts of different Segments. Studying and analyzing the impact of Coronavirus COVID-19 on the Fintech Lending industry, the report gives an in-depth analysis and expert suggestions on how to face the post COIVD-19 period. This market research study presents actionable market insights with which environmental and profitable business approaches can be created.

Regional Assessment: Global Fintech Lending Market

This referential document assessing the market has been compiled to understand diverse market developments across specific regional pockets such as Europe, North and Latin American countries, APAC nations, as well as several countries across MEA and RoW that are directly witnessing maneuvering developments over the years. A specific understanding on country level and local level developments has also been mindfully included in the report to encourage high rise growth declining market constraints and growth retardants.

North America includes the United States, Canada, and Mexico

Europe includes Germany, France, UK, Italy, Spain

South America includes Colombia, Argentina, Nigeria, and Chile

The Asia Pacific includes Japan, China, Korea, India, Saudi Arabia, and Southeast Asia

Global Fintech Lending Market by Application:

Private Lending

Company Lending

Others

Global Fintech Lending Market by Type:

- P2P Business Lending

- P2P Consumer Lending

- Others

The market research includes historical and forecast data from like demand, application details, price trends, and company shares of the Fintech Lending by geography, especially focuses on the key regions like United States, European Union, China, and other regions.

In addition, the report provides insight into main drivers, challenges, opportunities and risk of the market and strategies of suppliers. Key players are profiled as well with their market shares in the global Fintech Lending market discussed. Overall, this report covers the historical situation, present status and the future prospects of the global Fintech Lending market for 2022-2028.

This Fintech Lending Report Provides a superior market perspective in terms of product trends, marketing strategy, future products, new geographical markets, future events, sales strategies, customer actions or behaviors. This market research study presents actionable market insights with which sustainable and money-spinning business strategies can be created.

Studying and analyzing the impact of Coronavirus COVID-19 on the Fintech Lending industry, the report provides in-depth analysis and professional advices on how to face the post COIVD-19 period.

Feel free to ask your queries at https://www.reportsnreports.com/contacts/inquirybeforebuy.aspx?name=6210332

The essential aspects like the latest market dynamics, development trends, and growth opportunities are presented, along with industry barriers, developmental threats, and risk factors. The report provides a concise market view that will provide ease of understanding. Also, the study presents the analytical depiction of the global market industry with the current and future estimations of the market.

Contact Us:

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

+ 1 888 391 5441

sales@reportsandreports.com

About Us: ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Lending Market Growth Sturdy at healthy CAGR to COVID-19 Impact and Global Analysis by ReportsnReports Market Insights, Top Companies here

News-ID: 2753078 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

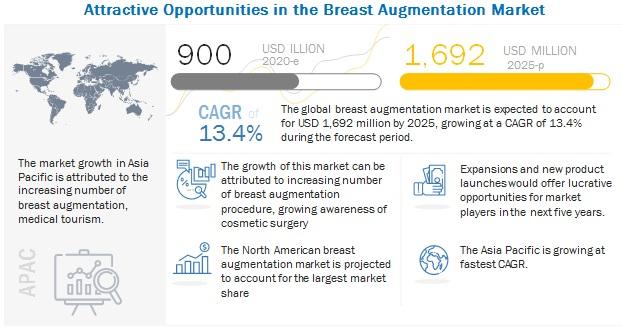

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…