Press release

Tax Management Market Application and Specification, Industrial Chain Structure, and CAGR of 11.3% Till 2022-2030

The global Tax management market size is expected to reach USD 47.26 Billion by 2030 according to a new study by Polaris Market Research.Increasing demand for cost-effective tax-filing solutions coupled with automated taxation is expected to increase the demand for the market over the forecast period. Moreover, the market is expected to grow with the increasing digital banking transactions throughout the world. This, in turn, will increase the adoption of advanced tax solution software over the projected period.

BSFI's vertical segment is expected to dominate the global industry over the projected period. This is due to the increasing adoption of digital technologies and modernization along with the rising number of customers using banking services.

Request Sample Copy of Research Report @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market/request-for-sample

Asia Pacific is expected to dominate the industry over the projected period due to the rapid economic growth of emerging countries along with increasing modernization across different sectors. In contrast, North America is expected to grow at a significant pace due to the increasing adoption of the latest technologies, which will create opportunities for industry growth.

Some of the major players operating in the global industry include Avalara, Blucora, Automatic Data Processing, Canopy Tax, Defmacro Software, DAVO Technologies, Drake Enterprises, EXEMPTAX, H&R Block, LOVAT Software, Intuit, SafeSend, Sailotech, SAP SE, Sales Tax DataLINK, Sovos Compliance, TaxCloud, TaxJar, Taxback International, TaxSlayer, Vertex, Webgility, Wolters Kluwer N.V, Thomson Reuters, and Xero.

Inquire more about this report before purchase @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market/inquire-before-buying

Polaris Market Research has segmented the tax management market report on the basis of component, tax type, deployment, organization size, vertical:

Tax Management, Component Outlook (Revenue - USD Billion, 2018 - 2030)

• Software

• Services

Tax Management, Tax Type Outlook (Revenue - USD Billion, 2018 - 2030)

• Indirect Tax

• Direct Tax

Tax Management, Deployment Mode Outlook (Revenue - USD Billion, 2018 - 2030)

• Cloud

• On-premises

Tax Management, Organization Type Outlook (Revenue - USD Billion, 2018 - 2030)

• Small and Medium-sized Enterprises (SMEs)

• Large Enterprises

Tax Management, Vertical Outlook (Revenue - USD Billion, 2018 - 2030)

• Banking, Financial Services and Insurance (BFSI)

• Information Technology (IT) and Telecom

• Manufacturing

• Energy and Utilities

• Retail

• Healthcare and Life Sciences

• Media and Entertainment

• Others

Browse detailed report with in-depth TOC@ https://www.polarismarketresearch.com/industry-analysis/tax-management-market

Contact Us:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

About Us:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Application and Specification, Industrial Chain Structure, and CAGR of 11.3% Till 2022-2030 here

News-ID: 2727125 • Views: …

More Releases from Polaris Market Research & Consulting

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

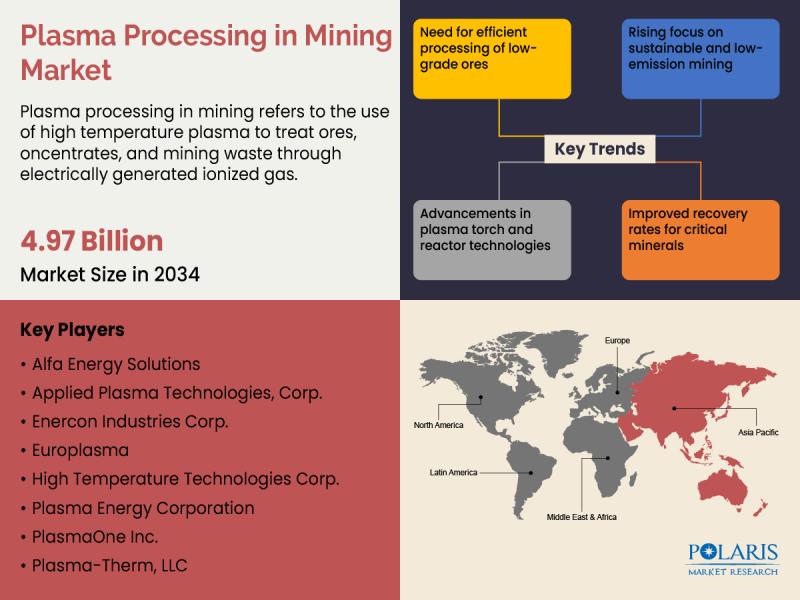

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…