Press release

Microinsurance Market would rocket up to USD 131.71 billion by 2029

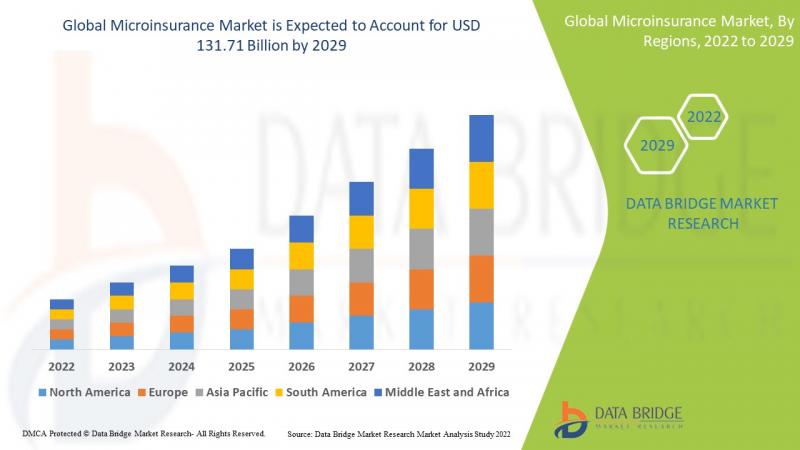

Microinsurance products offer coverage to low-income households or to individuals who have little savings. It is tailored specifically for lower valued assets and compensation for illness, injury, or death. Like conventional insurance, microinsurance covers a wide range of hazards. Both health and property threats are included in this. These risks include, among others, crop insurance, livestock/cattle insurance, insurance against fire or theft, health insurance, term life insurance, insurance against death, insurance against disability, and insurance against natural catastrophes.Data Bridge Market Research analyses that the microinsurance market which was USD 78.4 billion in 2021, would rocket up to USD 131.71 billion by 2029, and is expected to undergo a CAGR of 6.70% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Get a Sample PDF of the report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-microinsurance-market

Microinsurance Market Dynamics

Drivers

Upsurge in government initiatives

Factors driving the growth of the market include rising government initiatives for developing reimbursement policies for surgical procedures, rising geriatric population, rising chronic disease incidence, rising cost of healthcare services, and growing GDP and healthcare expenditure globally. The market for microinsurance will expand between 2022 and 2029 as a result of several new opportunities and rising medical expenditures.

Increasing accessibility of financial services

The main drivers of market growth are the global expansion of the insurance industry and the rising availability of financial services to all social strata. The market is also being positively impacted by recent innovations like peer-to-peer models and other similar consumer-friendly insurance models.

Improvement in client experiences

Low-income households are provided with insurance coverage through microinsurance since they have restricted income options. Additionally, microinsurance offers clear and affordable insurance plans between the service provider and the insurer, which supports the market's expansion. To improve client experiences and develop a sustainable value chain for microinsurance enterprises, many organisations are also implementing multichannel interaction platforms and virtual networks, which is resulting in a good outlook for the sector.

Opportunities

Microinsurance is becoming increasingly popular with accessibility and open operation, which benefits consumers. Additionally, a number of organisations are using multichannel platforms and virtual networks to create a value chain for the microinsurance industry and to offer incentives. A further factor driving the expansion of the microinsurance sector is the emergence of consumer-friendly insurance schemes like the peer-to-peer model. Automated portfolio monitoring is becoming more popular among businesses since it enables them to maintain track of their clients' credit flows, keep track of their progress, and act appropriately right away. By reducing their risks, the microinsurance businesses can increase revenues and profits.

Global Microinsurance Market Scope

The microinsurance market is segmented on the basis of type, age group, product, provider, distribution channel and model. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

Lifetime Coverage

Term Insurance

Age Group

Minor

Adult

Senior Citizens

Product

Property Insurance

Health Insurance

Life Insurance

Index Insurance

Accidental Death and Disability Insurance

Others

Provider

Microinsurance (Commercially Viable)

Microinsurance Through Aid/Government Support

Distribution Channel

Direct Sales

Financial Institutions

E-Commerce

Hospitals

Clinics

Others

Model

Partner Agent Model

Full-Service Model

Provider Driven Model

Community-Based/Mutual Model

Others

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report@- https://www.databridgemarketresearch.com/reports/global-microinsurance-market

Microinsurance Market Regional Analysis/Insights

The microinsurance market is analysed and market size insights and trends are provided by country, type, age group, product, provider, distribution channel and model as referenced above. The countries covered in the microinsurance market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the microinsurance market due to the growing number of geriatric population along with adoption of innovative medical technology. Asia-Pacific dominates the microinsurance market due to the improving national economies, increasing low-income population, and regional regulatory and lawmaking development.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Microinsurance Market Share Analysis

The microinsurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to microinsurance market.

Some of the major players operating in the microinsurance market are:

HDFC Ergo General Insurance Company Limited (India)

Hollard (Netherlands)

MicroEnsure Holdings Limited (U.K.)

National Insurance Commission (India)

Standard Chartered Bank (U.K.)

Wells Fargo (U.S.)

SAC Banco do Nordeste (Brazil)

MetLife Services and Solutions, LLC (U.S.)

Bandhan Bank (India)

ICICI Bank (India)

Tata AIA Life (India)

Browse the complete table of contents at- https://www.databridgemarketresearch.com/toc/?dbmr=global-microinsurance-market

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today! Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavours to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Data Bridge Market Research has over 500 analysts working in different industries. We have catered more than 40% of the fortune 500 companies globally and have a network of more than 5000+ clientele around the globe. Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

Contact Us:-

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email:- corporatesales@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market would rocket up to USD 131.71 billion by 2029 here

News-ID: 2714776 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

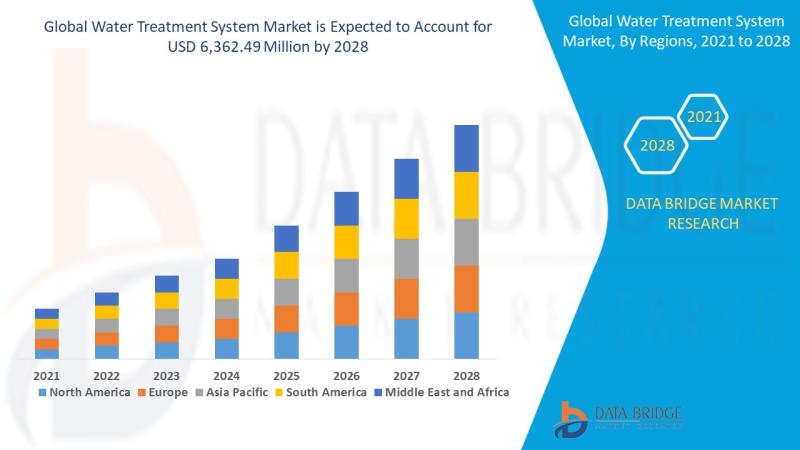

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…