Press release

Tax Management Market Share To Rise At 11.3% CAGR, To Reach USD 47.26 Billion By 2030

A recently published 110+ pages research report by Polaris Market Research titled Tax Management Market : By Size, Trends, Share, Growth, Segments, Industry Analysis and Forecast, 2030 delivers a detailed overview of the report in terms of segmentation by size, share, by top players, type, by end-user, and by region."According to the research report published by Polaris Market Research, the Global Tax Management Market Size Is Expected To Reach USD 47.26 Billion By 2030, at a CAGR of 11.3% during the forecast period."

An Overview:

Tax management refers to the management of finances, for the purpose of paying taxes. Tax Management deals with filing Returns in time, getting the accounts audited, deducting tax at source etc. Tax Management helps in avoiding payment of interest, penalty, prosecution.

The report provides in-depth research on many aspects of the industry. The report demonstrates a transparent picture of the current and future conditions of the industry based on facts and accurate data. It gives a detailed outlook of the industry by providing authentic data to its client, which helps to make essential decisions. The report offers a comprehensive analysis of the market size of the Tax Management Market along with the globe as regional and country level size analysis, CAGR estimation of growth during the forecast period, revenue, and competitive background.

The research evaluates upcoming growth prospects and vital statistics on structure and size. Many aspects are covered, such as growth trends, revenue growth, growth rate, and share of the Tax Management Market, to showcase their influence on the market's expansion over the forecast period. The report sheds light on the important events and transformations in terms of dynamics, revenue share, recent developments, and innovations in the market. It delivers expertise and comprehensive studies on market subtleties, including drivers, restrictions, and opportunities that are affecting the industry.

Request for a sample report @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market/request-for-sample

Sample Report Includes

Market Overview

Industry segmentation

Growth Trends

Graphical Representation of Size, Share, and Trends

List of Table & Figures

Investment opportunities

Regional Analysis

Cost structure analysis

Competitive landscape

Industry drawbacks & challenges

Facts and Factors Methodology

Value Chain and Sales Analysis

Market Forecast

Segments Breakdown

The recent study aims to split the breakdown data by regions, type, companies, and application. The report encloses qualitative and quantitative assessments based on market segmentation of Tax Management Market covering both economic as well as non-economic factors. The regions and segments expected to witness the fastest growth are identified further in the report. It highlights the crucial data of each segment at an extensive level.

Some of the Prominent/Emerging key Players in the Report:

Automatic Data Processing

Avalara

Blucora

Canopy Tax

DAVO Technologies

Defmacro Software

Drake Enterprises

EXEMPTAX

H&R Block

Intuit

LOVAT Software

SafeSend

Sailotech

Sales Tax DataLINK

SAP SE

Sovos Compliance

Taxback International

TaxCloud

TaxJar

TaxSlayer

Thomson Reuters

Vertex

Webgility

Wolters Kluwer N.V

Xero.

Exploring the Report Key Drivers & Trends Analysis

The report provides readers with a comprehensive study of all the development opportunities, drivers, challenges, and obstacles of both emerging as well as developed regions. It comprises an examination of key contributors to the market's expansion. Recent trends with their positive or negative impact on the Tax Management Market have been encompassed in the report.

The study gives an analysis of the current designs and other basic characteristics. Market size by type is estimated with regard to production value share, price, and production share by product type. Also, the report discusses application overview based on consumption. Future performance of the industry is projected through Porter's five forces analysis.

Inquire more about this report before purchase @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market/inquire-before-buying

Competitive Landscape Analysis

The competitive overview of Tax Management Market is included to provide details on competitors. The report analyzes the leading players operating in the market coupled with their size, share, and demand in accordance with historical and future values. The details added are company overview, company financials, revenue, potential, investment in research and development, new initiatives, presence, production sites and facilities, and production capacities. The latest strategies acquired by the key players and manufacturers, including new product launches, partnerships, joint ventures, investments, and mergers and acquisitions, are highlighted in this section.

Customize this report according to your requirements @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market/request-for-customization

Regional Analysis

The geographical analysis examines the industry size and in-depth analysis of key players across the globe with regional and country level size analysis of the Tax Management Market and its CAGR estimations during the forecast period. It provides information on consumption in each regional market on the basis of country, application, and product type. The production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Browse detailed report with in-depth TOC @ https://www.polarismarketresearch.com/industry-analysis/tax-management-market

Our latest report include:

Gives analysis of the global market, including projections of compound annual growth rates through 2030

Provides facts and figures concerning market drivers and deterrents

Discusses emerging technology trends, opportunities, and gaps in the market

Some of The Key Questions Answered In This Report:

What will the market growth rate, acceleration, or growth momentum carry during the forecast period?

What was the size of the progressing market by value?

Who are the key vendors in the Tax Management Market?

What will be the expected size of the emerging market?

Which region is predicted to register the highest share in the market?

What are the new opportunities by which the industry will grow in the upcoming years?

What trends, barriers, and challenges will impact the growth and sizing of the market?

What are their winning strategies to stay ahead in the competition?

Contact Us:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

About Us:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures, present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Share To Rise At 11.3% CAGR, To Reach USD 47.26 Billion By 2030 here

News-ID: 2713238 • Views: …

More Releases from Polaris Market Research & Consulting

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

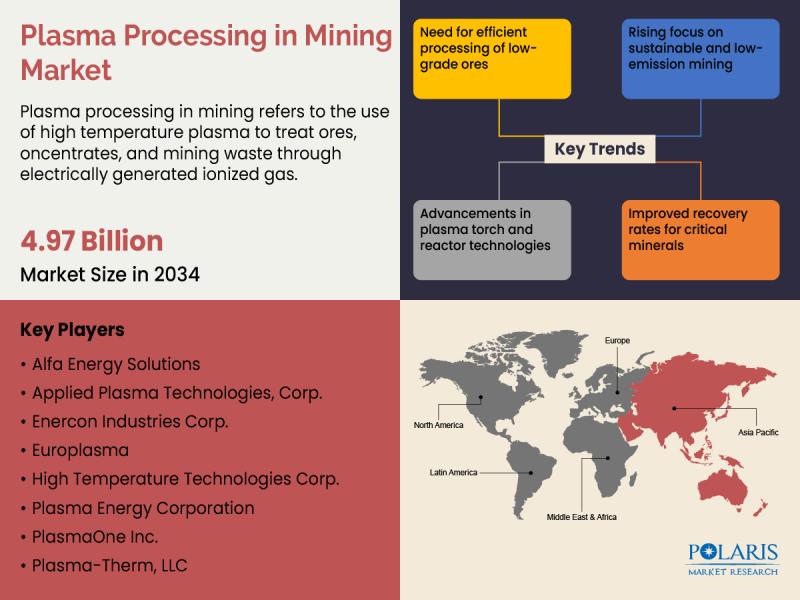

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…