Press release

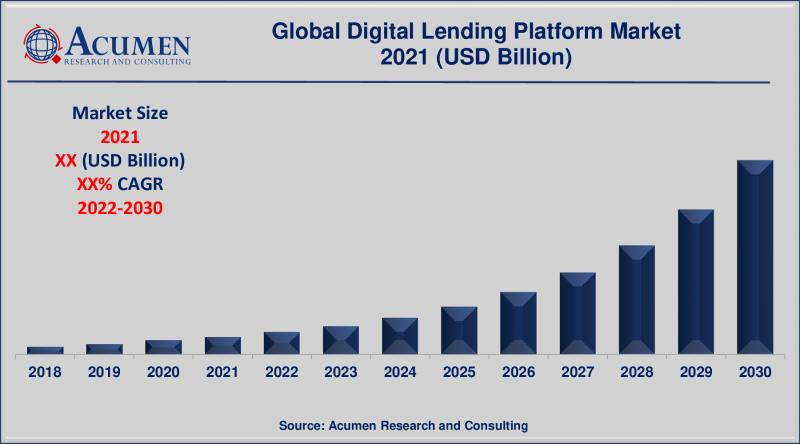

Digital Lending Platform Market Size, Report 2022-2030

Acumen Research and Consulting has announced the addition of the "Digital Lending Platform Market" report to their offering.The Digital Lending Platform Market Report 2030 is an in depth study analyzing the current state of the Digital Lending Platform Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Digital Lending Platform Market provides analysis of China market covering the industry trends, recent developments in the market and competitive landscape. Competitive analysis includes competitive information of leading players in China market, their company profiles, product portfolio, capacity, production, and company financials. In addition, report also provides upstream raw material analysis and downstream demand analysis along with the key development trends and sales channel analysis. Research study on Digital Lending Platform Market also discusses the opportunity areas for investors.

The report provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Download Sample Report Copy From Here: https://www.acumenresearchandconsulting.com/request-sample/2716

Market Players as below:

The prominent players of the global digital lending platform market involve KreditBee, Kissht, PolicyBazaar, Loanboox GmbH, Credible, Tyro Payments Limited, Fundbox, On Deck Capital, Funding Circle, and among others

The major market segments of Digital Lending Platform Market are as below:

Market By Solution

Business Process Management

Lending Analytics

Loan Management

Loan Origination

Risk & Compliance Management

Others

Market By Service

Design & Implementation

Training & Education

Risk Assessment

Consulting

Support & Maintenance

Market By Deployment

On-premise

Cloud

Market By End-use

Banks

Insurance Companies

Credit Unions

Savings & Loan Associations

Peer-to-Peer Lending

Others

Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Latin America

• Mexico

• Brazil

• Rest of Latin America

Asia-Pacific

• India

• Japan

• China

• Australia

• South Korea

• Rest of Asia-Pacific

The Middle East & Africa (MEA)

• Gulf Cooperation Council (GCC)

• South Africa

• Rest of the Middle East & Africa

Ask Query Here: frank@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

Table Of Contents:

CHAPTER 1. Industry Overview of Digital Lending Platform

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Digital Lending Platform Market By Solution

CHAPTER 5. Digital Lending Platform Market Revenue By Service

CHAPTER 6. Digital Lending Platform Market By Deployment

CHAPTER 7. Digital Lending Platform Market By End-use

CHAPTER 8. North America Digital Lending Platform Market By Country

CHAPTER 9. Europe Digital Lending Platform Market By Country

CHAPTER 10. Asia Pacific Digital Lending Platform Market By Country

CHAPTER 11. Latin America Digital Lending Platform Market By Country

CHAPTER 12. Middle East & Africa Digital Lending Platform Market By Country

CHAPTER 13. Player Analysis Of Digital Lending Platform

CHAPTER 14. Company Profile

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/2716

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market Size, Report 2022-2030 here

News-ID: 2700533 • Views: …

More Releases from Acumen Research and Consulting

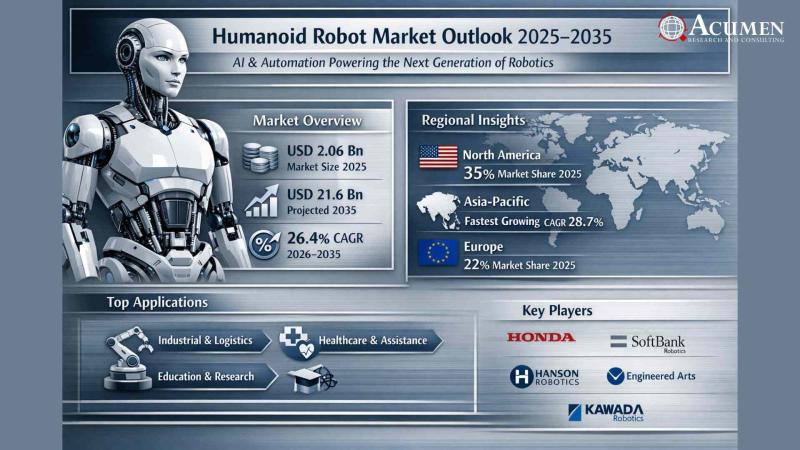

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

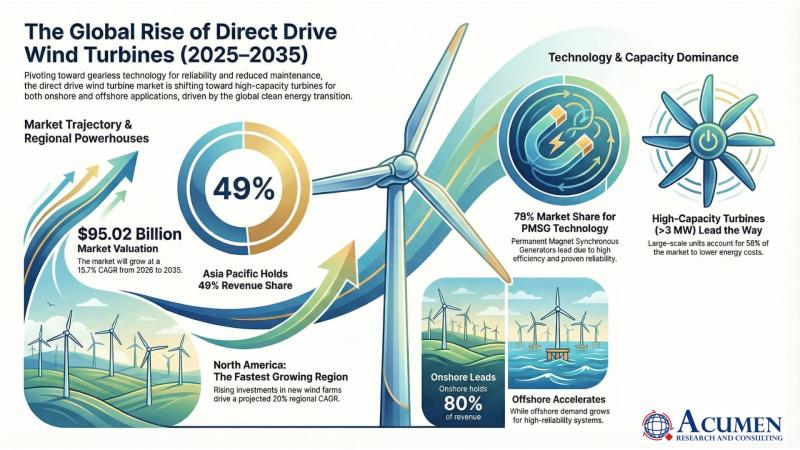

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…