Press release

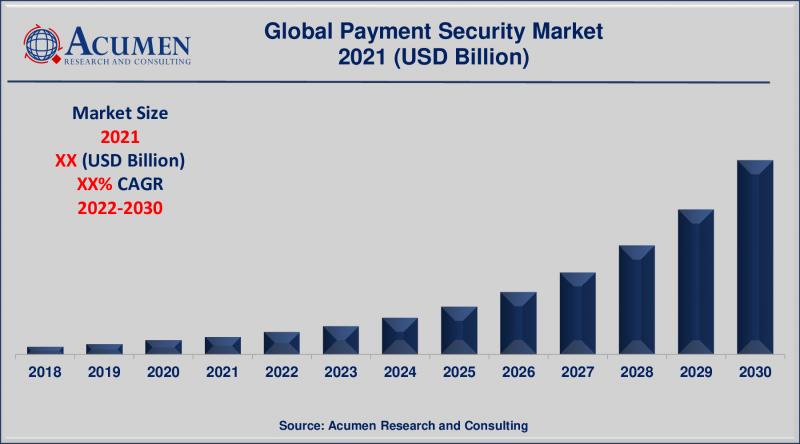

Payment Security Market Size, Share, Growth, Trends, Industry Forecast 2022 - 2030

Acumen Research and Consulting has announced the addition of the "Payment Security Market" report to their offering.The Payment Security Market Report 2030 is an in depth study analyzing the current state of the Payment Security Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Payment Security Market provides analysis of China market covering the industry trends, recent developments in the market and competitive landscape. Competitive analysis includes competitive information of leading players in China market, their company profiles, product portfolio, capacity, production, and company financials. In addition, report also provides upstream raw material analysis and downstream demand analysis along with the key development trends and sales channel analysis. Research study on Payment Security Market also discusses the opportunity areas for investors.

The report provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Download Sample Report Copy From Here: https://www.acumenresearchandconsulting.com/request-sample/2836

Market Players as below:

The prominent players of the global payment security involve Ingenico Epayments, Tokenex, Intelligent Payments, Bluefin Payment Systems, Geobridge Corporation, Cybersource, Index, Mastercard and Evalon among others

The major market segments of Payment Security Market are as below:

Market By Solution Type

• Fraud Detection and Prevention

• Encryption

• Tokenization

Market By Platform

• Web Based

• POS Based

Market By Application

• Healthcare

• E-commerce & Retail

• Travel

• Telecom & IT

• Media & Entertainment

• Education

• Others

Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Latin America

• Mexico

• Brazil

• Rest of Latin America

Asia-Pacific

• India

• Japan

• China

• Australia

• South Korea

• Rest of Asia-Pacific

The Middle East & Africa (MEA)

• Gulf Cooperation Council (GCC)

• South Africa

• Rest of the Middle East & Africa

Ask Query Here: frank@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

Table Of Contents:

CHAPTER 1. Industry Overview of Payment Security

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Payment Security By Solution Type

CHAPTER 5. Payment Security Revenue By Platform

CHAPTER 6. Payment Security By Application

CHAPTER 7. North America Payment Security By Country

CHAPTER 8. Europe Payment Security By Country

CHAPTER 9. Asia Pacific Payment Security By Country

CHAPTER 10. Latin America Payment Security By Country

CHAPTER 11. Middle East & Africa Payment Security By Country

CHAPTER 12. Player Analysis Of Payment Security

CHAPTER 13. COMPANY PROFILE

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/2836

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Market Size, Share, Growth, Trends, Industry Forecast 2022 - 2030 here

News-ID: 2695709 • Views: …

More Releases from Acumen Research and Consulting

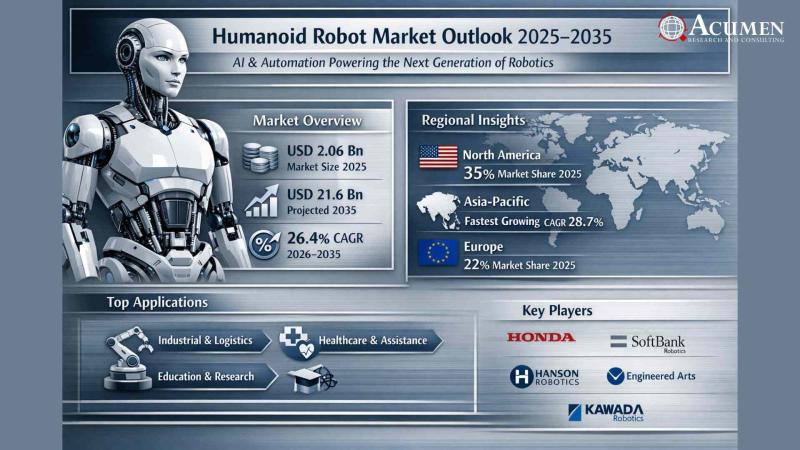

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

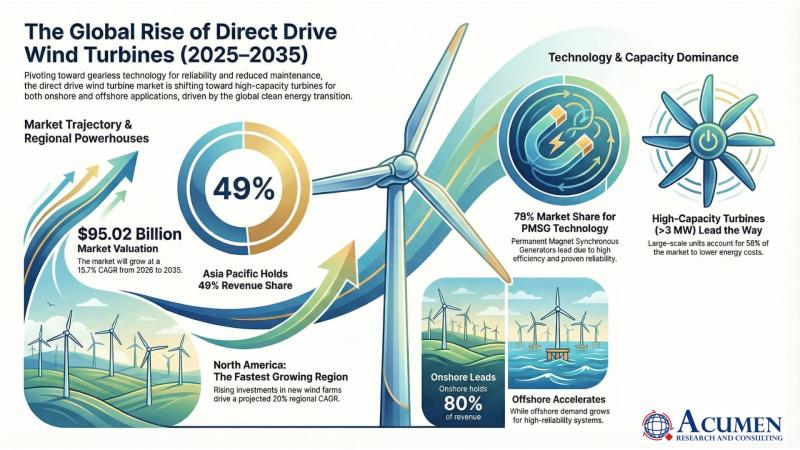

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…