Press release

Microinsurance Market Trends, Size, Share, Growth Analysis, Opportunities, Top Companies and Report 2022-2027

The latest report by IMARC Group, titled "Microinsurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027," offers a comprehensive analysis of the industry, which comprises insights on global microinsurance market. The report also includes competitor and regional analysis, and contemporary advancements in the global market.The global microinsurance market reached a value of US$ 78.4 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 111.84 Billion by 2027, exhibiting at a CAGR of 6.1% during 2022-2027. Microinsurance represents a microfinance product that offers insurance plans to low-income households with low-valued assets and limited income access. It usually formulates tailor-made coverage for individuals who belong to the weaker sections of the society and provides them compensation in case of injury, disabilities, illness, death, etc. In line with this, microinsurance merges small financial units into a massive structure to offer a safety net against excessive interest rates charged by unorganized money lenders. Presently, it is delivered via various institutional channels, such as licensed insurers, microfinance institutions, healthcare providers, community-based organizations, non-governmental organizations, etc.

We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

Request Free Sample Report: https://www.imarcgroup.com/microinsurance-market/requestsample

Important Attribute and highlights of the Report:

• Detailed analysis of the global market share

• Market Segmentation

• Historical, current, and projected size of the market in terms of volume and value

• Latest industry trends and developments

• Competitive Landscape

• Strategies of major players and product offerings

Global Microinsurance Market Trends:

The growing utilization of virtual networks and multichannel interaction platforms by numerous organizations to build an effective insurance value chain is primarily driving the microinsurance market. Additionally, the increasing digitization levels across the insurance sector are further catalyzing the market growth. Besides this, various finance industry stakeholders, including non-governmental organizations and donors, are adopting microinsurance products, owing to their cost-efficient schemes and the transparent dynamics between the service provider and the insurer, which is acting as another significant growth-inducing factor. Moreover, microinsurance provides a promising alternative for poor women to manage risk and use their assets more productively. This, in turn, is also propelling the global market. Furthermore, the introduction of peer-to-peer models is projected to fuel the microinsurance market in the coming years.

Explore Full Report with TOC & List of Figures: https://www.imarcgroup.com/microinsurance-market

Key Market Segmentation:

Breakup by Provider:

• Microinsurance (Commercially Viable)

• Microinsurance Through Aid/Government Support

Breakup by Product Type:

• Property Insurance

• Health Insurance

• Life Insurance

• Index Insurance

• Accidental Death and Disability Insurance

• Others

Breakup by Model Type:

• Partner Agent Model

• Full-Service Model

• Provider Driven Model

• Community-Based/Mutual Model

• Others

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Competitive Landscape with Key Players:

The competitive landscape of the market has also been analyzed with the detailed profiles of the key players operating in the market.

Key highlights of the Report:

• Market Performance (2016-2021)

• Market Outlook (2022-2027)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

TOC for the Report:

• Preface

• Scope and Methodology

• Executive Summary

• Introduction

• Global Market

• SWOT Analysis

• Value Chain Analysis

• Price Analysis

• Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Browse Latest Reports 2022:

• Lubricant Additives Market Report 2022: https://www.digitaljournal.com/pr/pea-protein-market-2022-2027-price-trends-size-share-growth-analysis-outlook-and-forecast-report

• Pea Protein Market Report 2022: https://www.digitaljournal.com/pr/lubricant-additives-market-report-2022-2027-industry-analysis-share-global-size-trends-growth-rate-and-forecast

• Refrigerant Market Report 2022: https://www.digitaljournal.com/pr/refrigerant-market-global-forecast-2022-2027-price-size-share-trends-top-leaders-value-and-report

• Data Center Rack Market Report 2022: https://www.digitaljournal.com/pr/data-center-rack-market-global-forecast-2022-2027-industry-share-size-growth-analysis-and-report

• Computational Fluid Dynamics Market Report 2022: https://www.digitaljournal.com/pr/computational-fluid-dynamics-cfd-market-2022-2027-global-industry-size-share-price-analysis-growth-and-scope-report

IMARC Group

30 N Gould St, Ste R

Sheridan, WY (Wyoming) 82801 USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market Trends, Size, Share, Growth Analysis, Opportunities, Top Companies and Report 2022-2027 here

News-ID: 2677200 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

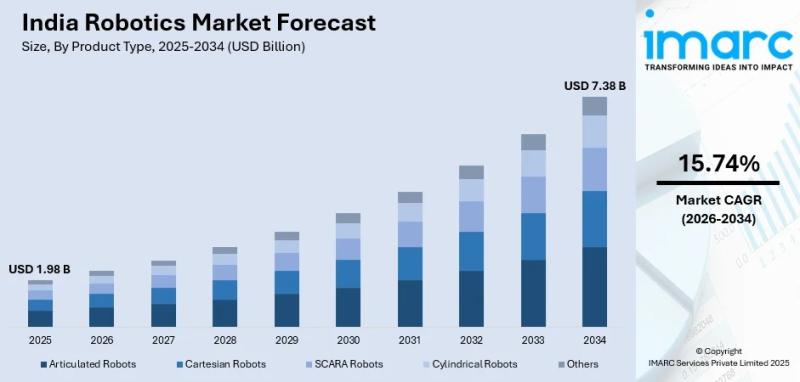

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

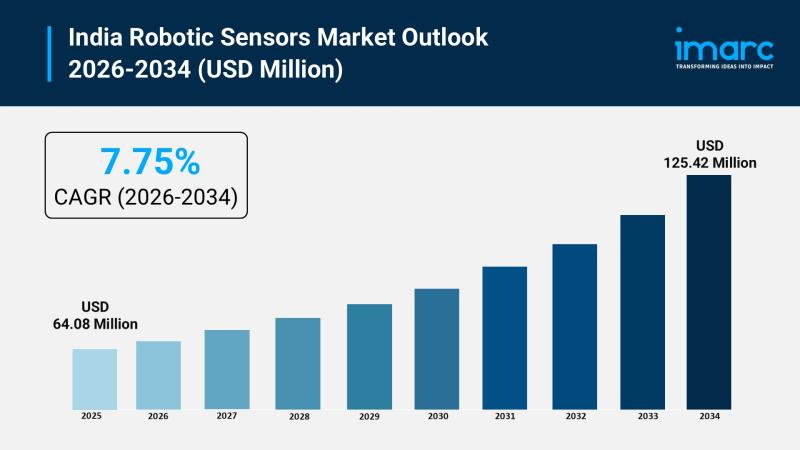

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

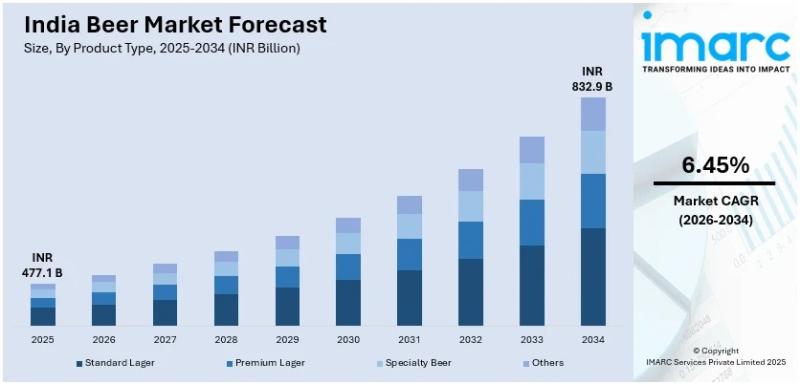

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Microinsurance

Microinsurance for Vulnerable Communities Market Is Booming Worldwide | Major Gi …

The latest analysis of the worldwide Microinsurance for Vulnerable Communities market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Microinsurance for Vulnerable Communities market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report…

Digital Microinsurance Market Hits New High | Major Giants BIMA, MicroEnsure, AX …

HTF MI just released the Global Digital Microinsurance Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Digital Microinsurance Market are: BIMA, MicroEnsure, AXA…

Microinsurance Market Size & Share | Growth Report - 2034

According to the report by Expert Market Research (EMR), the global microinsurance market reached a value of USD 82.87 billion in 2024. Aided by the growing demand for accessible and affordable insurance solutions among low-income populations, the market is projected to grow at a CAGR of 6.50% between 2025 and 2034, reaching USD 155.56 billion by 2034.

Microinsurance, a subset of insurance tailored for low-income individuals, provides financial protection against specific…

Government Initiatives Fueling Growth In The Microinsurance Market: Powering Inn …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts

What Is the Expected CAGR for the Microinsurance Market Through 2025?

In the past few years, we have observed significant expansion in the size of the microinsurance market. The market's growth is projected to rise from $95.69 billion in 2024 to $101.82 billion in 2025, experiencing a compound annual…

Government Initiatives Fueling Growth In The Microinsurance Market: A Significan …

The Microinsurance Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Microinsurance Market Size and Projected Growth Rate?

In recent times, the microinsurance market has seen impressive growth. The market is projected to expand from $95.69 billion in 2024 to $101.82 billion in 2025,…

Government Initiatives Fueling Growth In The Microinsurance Market Driver: A Maj …

What industry-specific factors are fueling the growth of the microinsurance market?

The microinsurance market is projected to see substantial growth due to increasing government-initiated programs for microinsurance. Government initiatives often consist of projects, policies, or actions instituted by governmental bodies, with the purpose of addressing societal issues, promoting specific interests, or achieving particular outcomes within a specific sector or within society at large. These initiatives often prove beneficial for small business…