Press release

Healthcare RCM Outsourcing Market to Reach US$ 53.5 Billion by 2027 | CAGR of 17.6%

According to the latest report by IMARC Group, titled "Healthcare RCM Outsourcing Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027", the global healthcare RCM outsourcing market reached a value of US$ 20.1 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 53.5 Billion by 2027, exhibiting at a CAGR of 17.6% during 2022-2027. Revenue cycle management (RCM), also known as medical billing, is one of the vital aspects of a healthcare business. Successful RCM activities can help an organization in optimizing non-medical services which range from registration and scheduling appointments to final balance payments. In recent years, an increasing number of healthcare organizations have shifted from in-house management towards outsourcing RCM activities as it helps in efficient allocation of financial and human resources. Moreover, technological advancements and changing government regulations have led various healthcare organizations to seek expert assistance for their RCM activities.Request Free Report Sample: https://www.imarcgroup.com/healthcare-rcm-outsourcing-market/requestsample

Global Healthcare RCM Outsourcing Market Trends:

Healthcare RCM outsourcing provides a number of other benefits besides reducing the non-clinical task burden on hospitals and physicians. An expert RCM provider offers improved coverage of unpaid accounts along with enhancing the cash flow. In addition, outsourcing reduces staffing issues and training as the organizations stay acquainted with the latest coding systems and other changes in healthcare regulations. This helps in increasing the overall productivity of the healthcare organization as well as improves patient and physician satisfaction. Moreover, RCM service providers offer the ability to easily scale up the provider's requirement, thereby creating opportunities for business expansion without any need for either human or infrastructure resources. However, outsourcing is not a viable option for healthcare providers with limited budget as the fee is higher for smaller number of claims.

Healthcare RCM Outsourcing Market 2021-2026 Competitive Analysis and Segmentation:

Some of these key players include:

Conifer Health Solutions

Emdeon Business Services

MedAssets

McKesson

Parallon Business Solutions

The SSI Group

Key Market Segmentation:

The report has segmented the global healthcare RCM outsourcing market on the basis of type, services, end-user, end user and region.

Breakup by Type:

Pre-intervention

Intervention

Post-intervention

Breakup by Services:

Back-end

Middle

Front-end

Breakup by End-User:

Hospitals

Others

Breakup by Region:

North America

Europe

Asia Pacific

Middle East and Africa

Latin America

Explore Full Report with TOC & List of Figure: https://www.imarcgroup.com/healthcare-rcm-outsourcing-market

Note: We are updating our reports, If you want the report with the latest primary and secondary data (2022-2027) including industry trends, market size and Competitive landscape, etc. Click request free sample report, published report will be delivered to you in PDF format via email within 24 to 48 hours.

Key highlights of the report:

Market Performance (2016-2021)

Market Outlook (2022-2027)

Market Trends

Market Drivers and Success Factors

Impact of COVID-19

Value Chain Analysis

Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Browse Related Reports:

Bluetooth Speaker Market: https://www.imarcgroup.com/bluetooth-speaker-market

Saudi Arabia Pet Food Market: https://www.imarcgroup.com/saudi-arabia-pet-food-market

India Facility Management Market: https://www.imarcgroup.com/india-facility-management-market

Printed Electronics Market: https://www.imarcgroup.com/printed-electronics-market

Oil Filter Market: https://www.imarcgroup.com/oil-filter-market

Saudi Arabia Led Lights Market: https://www.imarcgroup.com/saudi-arabia-led-lights-market

IMARC Group

30 N Gould St Ste R

Sheridan, WY 82801 USA - Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: - +1 631 791 1145 | Africa and Europe: - +44-702-409-7331 | Asia: +91-120-433-0800

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Healthcare RCM Outsourcing Market to Reach US$ 53.5 Billion by 2027 | CAGR of 17.6% here

News-ID: 2630600 • Views: …

More Releases from imarc

India Luxury Fashion Industry Size, Share, Growth Trends, Top Brands & Market Ou …

According to the latest report by IMARC Group, titled "India Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033," the report presents a thorough review featuring the India luxury fashion market share, size, growth, trends, and research of the industry.

India Luxury Fashion Market Overview

The India luxury fashion market size reached USD 9.37 Billion in 2024. It is expected to grow…

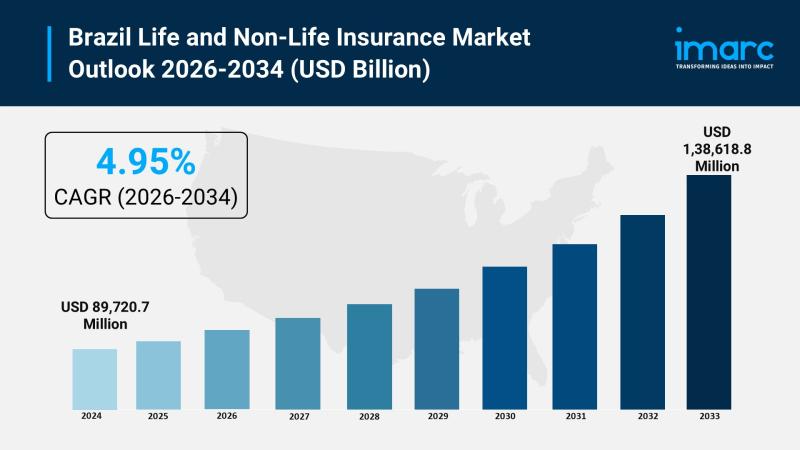

Brazil Life and Non-Life Insurance Market Outlook: Coverage Demand Trends, Digit …

Market Overview

The Brazil life and non-life insurance market reached a size of USD 89,720.7 Million in 2025. It is projected to grow at a CAGR of 4.95% during the forecast period of 2026 to 2034, ultimately reaching USD 138,618.8 Million by 2034. Growth is driven by rising awareness of financial security, increasing healthcare costs, government initiatives, urbanization, and a growing middle class demanding both life and non-life insurance coverage.

Study Assumption…

Proposal Planning Services Business Plan: Market Trends, Revenue Models, and Gro …

Overview:

IMARC Group's "Proposal planning services Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful Proposal planning services business. This in-depth report covers critical aspects such as market trends, investment opportunities, revenue models, and financial forecasts, making it an essential tool for entrepreneurs, consultants, and investors. Whether assessing a new venture's feasibility or optimizing an existing business, the report provides a deep dive into all components…

India Interior Design Market Size, Share, Industry Growth & Analysis Report by 2 …

According to IMARC Group's report titled "India Interior Design Market Size, Share, Trends and Forecast by Decoration Type, End User, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Short Summary:

The India interior design market size was valued at USD 34.00 Billion in 2024 and is projected to reach USD 71.00 Billion by 2033, growing at a CAGR of 8.50%…

More Releases for RCM

RCM Matter, a TechMatter Company, Introduces Next-Gen Medical Billing & RCM Soft …

GLENDALE, CA, UNITED STATES, August 27, 2025 -- RCM Matter, a subsidiary of TechMatter, announced the launch of its flagship product, a next-generation Medical Billing and Revenue Cycle Management (RCM) software solution that's built for modern-day healthcare practices. The platform empowers providers with automation, compliance, and transparency, helping them reduce administrative stress and strengthen financial performance.

Built from the ground up with healthcare teams in mind, the RCM software offers…

Healthcare RCM Outsourcing Market Report 2024 - RCM Outsourcing Market Trends, S …

"The Business Research Company recently released a comprehensive report on the Global Healthcare RCM Outsourcing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Murray,…

Investigation announced for Investors who lost money with shares of R1 RCM Inc. …

An investigation was announced over potential securities laws violations by R1 RCM Inc. in connection with certain financial statements.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of the securities of R1 RCM Inc. (NASDAQ: RCM) concerning whether a…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its…

Investigation announced for Investors in shares of R1 RCM Inc. (NASDAQ: RCM)

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Chicago,…