Press release

Brazil Life and Non-Life Insurance Market Outlook: Coverage Demand Trends, Digital Distribution Growth and Forecast to 2033

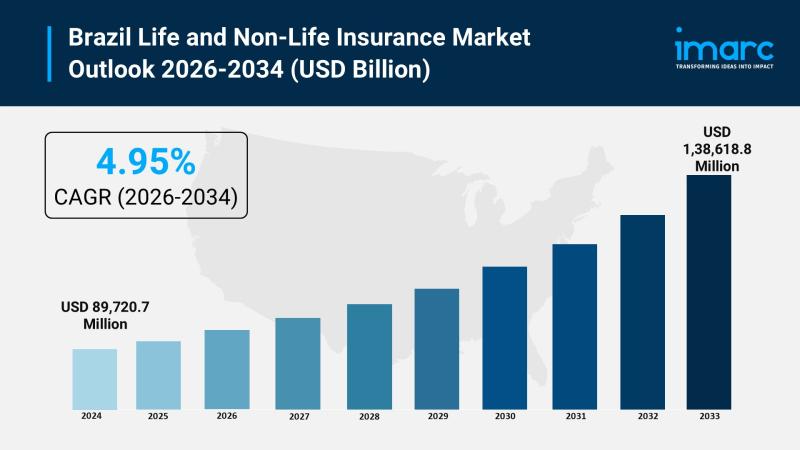

Market OverviewThe Brazil life and non-life insurance market reached a size of USD 89,720.7 Million in 2025. It is projected to grow at a CAGR of 4.95% during the forecast period of 2026 to 2034, ultimately reaching USD 138,618.8 Million by 2034. Growth is driven by rising awareness of financial security, increasing healthcare costs, government initiatives, urbanization, and a growing middle class demanding both life and non-life insurance coverage.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Brazil Life and Non-Life Insurance Market Key Takeaways

● Current Market Size: USD 89,720.7 Million in 2025

● CAGR: 4.95% (2026-2034)

● Forecast Period: 2026-2034

● Rising reinsurance contracts strengthen market stability, with reinsurance agreements totaling USD 22.3 Billion in October 2024-a 5% increase compared to 2023.

● Premium issuance surged by 16% to USD 18.6 Billion, signaling higher consumer and business demand.

● Regulatory reforms such as the approval of Bill No. 2,597/2024 in November 2024 aim to streamline insurance processes and improve claims handling.

● The reform standardizes policy treatment for mass-market and large-risk insurance and clarifies reinsurance matters.

● The market growth is supported by increased financial security awareness, rising healthcare costs, and urbanization.

Sample Request Link: https://www.imarcgroup.com/brazil-life-non-life-insurance-market/requestsample

Brazil Life and Non-Life Insurance Market Growth Factors

Brazilian life and non-life insurance markets are rapidly developing due to an increasing use of reinsurance contracts that provide insurance portfolio protection for large volume exposures.

Brazilian insurers had USD 22.3 Billion in reinsurance contracts as of October 2024. This increase of 5% from 2023 shows confidence in the market to assume larger total claims while maintaining financial security. This allows maintaining monetary balance while still retaining the incentive to take risks and speculate.

The premium issuance growth of 16% (USD 18.6 Billion) indicates that consumers and businesses are increasingly opting for thorough insurance coverage, with credit, collateral, life and auto insurance markets accounting for most of the growth. Damages also contributed to the growth.

In addition, regulatory changes are affecting the future of the market. Bill No. The Brazilian House of Deputies approved another bill (4199/2020). 2,597/2024 (November 2024) implements meaningful reforms to reduce bureaucracy of insurance business in line with common law.

Most meaningful policy provisions in 2,597/2024 include treating mass-market and large risk insurance equally, clarifying the role of reinsurance, improving claim processing through the minimization of delays and disputes, timely settlements, ultimately benefitting customers and improving market transparency.

Brazil Life and Non-Life Insurance Market Segmentation

Insurance Type Insights:

● Life Insurance

● Individual: Covers personal life insurance policies for individuals.

● Group: Includes insurance policies covering groups such as employees or members.

● Non-Life Insurance

● Home: Insurance policies protecting residential properties.

● Motor: Vehicle insurance policies for cars and other motor vehicles.

● Health: Insurance covering medical expenses.

● Rest of Non-Life Insurance: Encompasses other types of non-life insurance not specified above.

Distribution Channel Insights:

● Direct: Insurance products sold directly to consumers without intermediaries.

● Agency: Policies distributed through insurance agents.

● Banks: Insurance products offered via banking institutions.

● Online: Digital channels for insurance sales.

● Others: Includes any other distribution channels not classified above.

Regional Insights

The major regional markets covered in the report include Southeast, South, Northeast, North, and Central-West Brazil. Notably, the Southeast region emerges as dominant due to its higher economic activity and concentration of the insurance market. However, no specific market share or CAGR figures by region are provided in the source. The report offers a comprehensive analysis of these regional markets, underpinning their role in the overall market growth.

Recent Developments & News

● In February 2025, Corpay announced the acquisition of, a leading Brazilian mobile payments company specializing in vehicle registration and compliance. This move expands Corpay's presence in Brazil and may integrate vehicle insurance solutions into platform.

● In January 2025, Ole Life secured USD 13 Million in Series B funding led by PayPal Ventures to expand digital life insurance across Latin America. This investment bolsters Ole Life's regional footprint and innovation in accessible, family-focused life protection solutions.

Key Players

● Corpay

● Ole Life

Customization Note: https://www.imarcgroup.com/request?type=report&id=32544&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Life and Non-Life Insurance Market Outlook: Coverage Demand Trends, Digital Distribution Growth and Forecast to 2033 here

News-ID: 4281904 • Views: …

More Releases from IMARC

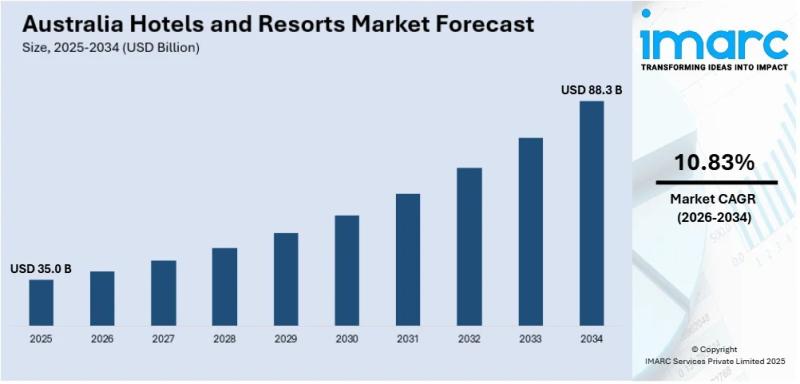

Australia Hotels and Resorts Market Projected to Reach USD 82.80 Billion by 2033

Market Overview

The Australia hotels and resorts market size reached USD 31.40 Billion in 2024 and is projected to expand at a CAGR of 11.40 % during 2025-2033, reaching approximately USD 82.80 Billion by 2033. Market growth is driven by rising domestic and international tourism, increasing disposable incomes, and greater investment in luxury, experiential, and eco-friendly accommodations. The surge in travel demand has led to heightened occupancy rates and average daily…

India Perfume Market Strategic Outlook Report: Growth Drivers, Value Pools & Com …

India Perfume Market 2025-2033

According to IMARC Group's report titled "India Perfume Market Report by Perfume Type (Premium, Mass), End User (Female, Male, Unisex), and Region 2025-2033", this report provides a structured assessment of the factors shaping the India perfume market through 2033. It outlines the sector's core growth drivers, emerging value pools, and the evolving competitive landscape. The analysis supports decision-makers in evaluating demand patterns, margin opportunities, and competitive positioning…

How to Start a Wine Tasting Events Business: Market Trends, Investment Requireme …

Overview

IMARC Group's "Wine Tasting Events Business Plan and Project Report 2025" provides a comprehensive framework for establishing and operating a successful wine tasting events business. This in-depth report analyzes key market trends, investment opportunities, operational models, revenue streams, and financial projections, offering actionable insights for entrepreneurs, hospitality brands, event organizers, wineries, and investors.

Whether launching a new experiential events venture or expanding an existing hospitality or lifestyle business, this report delivers…

India Luxury Fashion Industry Size, Share, Growth Trends, Top Brands & Market Ou …

According to the latest report by IMARC Group, titled "India Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033," the report presents a thorough review featuring the India luxury fashion market share, size, growth, trends, and research of the industry.

India Luxury Fashion Market Overview

The India luxury fashion market size reached USD 9.37 Billion in 2024. It is expected to grow…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…