Press release

Work Opportunity Tax Credit Services Trends and Forecast Report 2022 | By Players, Types, Applications and Regions

The QY Research released a latest market research report on the global and United States Work Opportunity Tax Credit Services market, which is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Work Opportunity Tax Credit Services will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.For United States market, this report focuses on the Work Opportunity Tax Credit Services size by players, by Type and by Application, for the period 2017-2028. The key players include the global and local players, which play important roles in United States.

For More Information About This Report, Please Enter:

https://us.qyresearch.com/reports/354275/work-opportunity-tax-credit-services

Market Analysis and Insights: Global and United States Work Opportunity Tax Credit Services Market

This report focuses on global and United States Work Opportunity Tax Credit Services market, also covers the segmentation data of other regions in regional level and county level.

Due to the COVID-19 pandemic, the global Work Opportunity Tax Credit Services market size is estimated to be worth US$ million in 2022 and is forecast to a readjusted size of US$ million by 2028 with a CAGR of % during the forecast period 2022-2028. Fully considering the economic change by this health crisis, by Type, White Silicone Grease accounting for % of the Work Opportunity Tax Credit Services global market in 2021, is projected to value US$ million by 2028, growing at a revised % CAGR from 2022 to 2028. While by Application, Semiconductor Integrated Circuits was the leading segment, accounting for over percent market share in 2021, and altered to an % CAGR throughout this forecast period.

In United States the Work Opportunity Tax Credit Services market size is expected to grow from US$ million in 2021 to US$ million by 2028, at a CAGR of % during the forecast period 2022-2028.

Global Work Opportunity Tax Credit Services Scope and Market Size

Virtual Dog Training market is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Work Opportunity Tax Credit Services market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.

For United States market, this report focuses on the Work Opportunity Tax Credit Services market size by players, by Type and by Application, for the period 2017-2028. The key players include the global and local players, which play important roles in United States.

Market Analysis and Insights: Global and United States Work Opportunity Tax Credit Services Market

This report focuses on global and United States Work Opportunity Tax Credit Services market, also covers the segmentation data of other regions in regional level and county level.

Due to the COVID-19 pandemic, the global Work Opportunity Tax Credit Services market size is estimated to be worth US$ million in 2022 and is forecast to a readjusted size of US$ million by 2028 with a CAGR of % during the forecast period 2022-2028. Fully considering the economic change by this health crisis, by Type, Regular Power Electrode accounting for % of the Work Opportunity Tax Credit Services global market in 2021, is projected to value US$ million by 2028, growing at a revised % CAGR from 2022 to 2028. While by Application, Steel Mill was the leading segment, accounting for over percent market share in 2021, and altered to an % CAGR throughout this forecast period.

In United States the Work Opportunity Tax Credit Services market size is expected to grow from US$ million in 2021 to US$ million by 2028, at a CAGR of % during the forecast period 2022-2028.

Global Work Opportunity Tax Credit Services Scope and Market Size

Virtual Dog Training market is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Work Opportunity Tax Credit Services market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.

For United States market, this report focuses on the Work Opportunity Tax Credit Services market size by players, by Type and by Application, for the period 2017-2028. The key players include the global and local players, which play important roles in United States.

Segment by Enterprise Type

Large Enterprise

SMEs

Segment by Application

Information Technology

Chemical Industry

Electronic Industry

Transportation Equipment

Scientific Research and Development Services

Machinery

Finance and Insurance

Others

By Region

North America

United States

Canada

Europe

Germany

France

U.K.

Italy

Russia

Asia-Pacific

China

Japan

South Korea

India

Australia

China Taiwan

Indonesia

Thailand

Malaysia

Latin America

Mexico

Brazil

Argentina

Middle East & Africa

Turkey

Saudi Arabia

UAE

By Company

PwC

EY

Deloitte

KPMG

RSM US

BDO USA

CBIZ

BKD

Withum Smith+Brown

Alvarez & Marsal Holdings

Think

SOURCE ADVISORS

Anchin

Global Tax Management

Engineered Tax Services

RKL

Hull & Knarr

KBKG

ADP

The Goal of the Report

To study and analyze the global Work Opportunity Tax Credit Services consumption (value & volume) by key regions/countries, type and application, history data from 2017 to 2022, and forecast to 2028.

To understand the structure of Work Opportunity Tax Credit Services by identifying its various sub segments.

Focuses on the key global Work Opportunity Tax Credit Services manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Work Opportunity Tax Credit Services with respect to individual growth trends, prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges, and risks).

To project the consumption of Work Opportunity Tax Credit Services sub markets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies.

Target Audience

> Work Opportunity Tax Credit Services companies

> Research organizations

> Government Organizations

> Research/Consultancy firms

Table of Contents

1 Study Coverage

1.1 Work Opportunity Tax Credit Services Revenue in Work Opportunity Tax Credit Services Business (2017-2022) & (US$ Million) Introduction

1.2 Global Work Opportunity Tax Credit Services Outlook 2017 VS 2022 VS 2028

1.2.1 Global Work Opportunity Tax Credit Services Market Size for the Year 2017-2028

1.2.2 Global Work Opportunity Tax Credit Services Market Size for the Year 2017-2028

1.3 Work Opportunity Tax Credit Services Market Size, United States VS Global, 2017 VS 2022 VS 2028

1.3.1 The Market Share of United States Work Opportunity Tax Credit Services in Global, 2017 VS 2022 VS 2028

1.3.2 The Growth Rate of Work Opportunity Tax Credit Services Market Size, United States VS Global, 2017 VS 2022 VS 2028

1.4 Work Opportunity Tax Credit Services Market Dynamics

1.4.1 Work Opportunity Tax Credit Services Industry Trends

1.4.2 Work Opportunity Tax Credit Services Market Drivers

1.4.3 Work Opportunity Tax Credit Services Market Challenges

1.4.4 Work Opportunity Tax Credit Services Market Restraints

1.5 Study Objectives

1.6 Years Considered

2 Work Opportunity Tax Credit Services by Enterprise Type

2.1 Work Opportunity Tax Credit Services Market Segment by Enterprise Type

2.1.1 Large Enterprise

2.1.2 SMEs

2.2 Global Work Opportunity Tax Credit Services Market Size by Enterprise Type (2017, 2022 & 2028)

2.3 Global Work Opportunity Tax Credit Services Market Size by Enterprise Type (2017-2028)

2.4 United States Work Opportunity Tax Credit Services Market Size by Enterprise Type (2017, 2022 & 2028)

2.5 United States Work Opportunity Tax Credit Services Market Size by Enterprise Type (2017-2028)

3 Work Opportunity Tax Credit Services by Application

3.1 Work Opportunity Tax Credit Services Market Segment by Application

3.1.1 Information Technology

3.1.2 Chemical Industry

3.1.3 Electronic Industry

3.1.4 Transportation Equipment

3.1.5 Scientific Research and Development Services

3.1.6 Machinery

3.1.7 Finance and Insurance

3.1.8 Others

3.2 Global Work Opportunity Tax Credit Services Market Size by Application (2017, 2022 & 2028)

3.3 Global Work Opportunity Tax Credit Services Market Size by Application (2017-2028)

3.4 United States Work Opportunity Tax Credit Services Market Size by Application (2017, 2022 & 2028)

3.5 United States Work Opportunity Tax Credit Services Market Size by Application (2017-2028)

4 Global Work Opportunity Tax Credit Services Competitor Landscape by Company

4.1 Global Work Opportunity Tax Credit Services Market Size by Company

4.1.1 Top Global Work Opportunity Tax Credit Services Companies Ranked by Revenue (2021)

4.1.2 Global Work Opportunity Tax Credit Services Revenue by Player (2017-2022)

4.2 Global Work Opportunity Tax Credit Services Concentration Ratio (CR)

4.2.1 Work Opportunity Tax Credit Services Market Concentration Ratio (CR) (2017-2022)

4.2.2 Global Top 5 and Top 10 Largest Companies of Work Opportunity Tax Credit Services in 2021

4.2.3 Global Work Opportunity Tax Credit Services Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

4.3 Global Work Opportunity Tax Credit Services Headquarters, Revenue in Work Opportunity Tax Credit Services Business (2017-2022) & (US$ Million) Type

4.3.1 Global Work Opportunity Tax Credit Services Headquarters and Area Served

4.3.2 Global Work Opportunity Tax Credit Services Companies Revenue in Work Opportunity Tax Credit Services Business (2017-2022) & (US$ Million) Type

4.3.3 Date of International Companies Enter into Work Opportunity Tax Credit Services Market

4.4 Companies Mergers & Acquisitions, Expansion Plans

4.5 United States Work Opportunity Tax Credit Services Market Size by Company

4.5.1 Top Work Opportunity Tax Credit Services Players in United States, Ranked by Revenue (2021)

4.5.2 United States Work Opportunity Tax Credit Services Revenue by Players (2020, 2021 & 2022)

5 Global Work Opportunity Tax Credit Services Market Size by Region

5.1 Global Work Opportunity Tax Credit Services Market Size by Region: 2017 VS 2022 VS 2028

5.2 Global Work Opportunity Tax Credit Services Market Size by Region (2017-2028)

5.2.1 Global Work Opportunity Tax Credit Services Market Size by Region: 2017-2022

5.2.2 Global Work Opportunity Tax Credit Services Market Size by Region (2023-2028)

6 Segment in Region Level & Country Level

6.1 North America

6.1.1 North America Work Opportunity Tax Credit Services Market Size YoY Growth 2017-2028

6.1.2 North America Work Opportunity Tax Credit Services Market Facts & Figures by Country (2017, 2022 & 2028)

6.1.3 United States

6.1.4 Canada

6.2 Asia-Pacific

6.2.1 Asia-Pacific Work Opportunity Tax Credit Services Market Size YoY Growth 2017-2028

6.2.2 Asia-Pacific Work Opportunity Tax Credit Services Market Facts & Figures by Region (2017, 2022 & 2028)

6.2.3 China

6.2.4 Japan

6.2.5 South Korea

6.2.6 India

6.2.7 Australia

6.2.8 China Taiwan

6.2.9 Indonesia

6.2.10 Thailand

6.2.11 Malaysia

6.3 Europe

6.3.1 Europe Work Opportunity Tax Credit Services Market Size YoY Growth 2017-2028

6.3.2 Europe Work Opportunity Tax Credit Services Market Facts & Figures by Country (2017, 2022 & 2028)

6.3.3 Germany

6.3.4 France

6.3.5 U.K.

6.3.6 Italy

6.3.7 Russia

6.4 Latin America

6.4.1 Latin America Work Opportunity Tax Credit Services Market Size YoY Growth 2017-2028

6.4.2 Latin America Work Opportunity Tax Credit Services Market Facts & Figures by Country (2017, 2022 & 2028)

6.4.3 Mexico

6.4.4 Brazil

6.4.5 Argentina

6.5 Middle East and Africa

6.5.1 Middle East and Africa Work Opportunity Tax Credit Services Market Size YoY Growth 2017-2028

6.5.2 Middle East and Africa Work Opportunity Tax Credit Services Market Facts & Figures by Country (2017, 2022 & 2028)

6.5.3 Turkey

6.5.4 Saudi Arabia

6.5.5 UAE

7 Company Profiles

7.1 PwC

7.1.1 PwC Company Details

7.1.2 PwC Business Overview

7.1.3 PwC Work Opportunity Tax Credit Services Introduction

7.1.4 PwC Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.1.5 PwC Recent Development

7.2 EY

7.2.1 EY Company Details

7.2.2 EY Business Overview

7.2.3 EY Work Opportunity Tax Credit Services Introduction

7.2.4 EY Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.2.5 EY Recent Development

7.3 Deloitte

7.3.1 Deloitte Company Details

7.3.2 Deloitte Business Overview

7.3.3 Deloitte Work Opportunity Tax Credit Services Introduction

7.3.4 Deloitte Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.3.5 Deloitte Recent Development

7.4 KPMG

7.4.1 KPMG Company Details

7.4.2 KPMG Business Overview

7.4.3 KPMG Work Opportunity Tax Credit Services Introduction

7.4.4 KPMG Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.4.5 KPMG Recent Development

7.5 RSM US

7.5.1 RSM US Company Details

7.5.2 RSM US Business Overview

7.5.3 RSM US Work Opportunity Tax Credit Services Introduction

7.5.4 RSM US Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.5.5 RSM US Recent Development

7.6 BDO USA

7.6.1 BDO USA Company Details

7.6.2 BDO USA Business Overview

7.6.3 BDO USA Work Opportunity Tax Credit Services Introduction

7.6.4 BDO USA Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.6.5 BDO USA Recent Development

7.7 CBIZ

7.7.1 CBIZ Company Details

7.7.2 CBIZ Business Overview

7.7.3 CBIZ Work Opportunity Tax Credit Services Introduction

7.7.4 CBIZ Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.7.5 CBIZ Recent Development

7.8 BKD

7.8.1 BKD Company Details

7.8.2 BKD Business Overview

7.8.3 BKD Work Opportunity Tax Credit Services Introduction

7.8.4 BKD Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.8.5 BKD Recent Development

7.9 Withum Smith+Brown

7.9.1 Withum Smith+Brown Company Details

7.9.2 Withum Smith+Brown Business Overview

7.9.3 Withum Smith+Brown Work Opportunity Tax Credit Services Introduction

7.9.4 Withum Smith+Brown Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.9.5 Withum Smith+Brown Recent Development

7.10 Alvarez & Marsal Holdings

7.10.1 Alvarez & Marsal Holdings Company Details

7.10.2 Alvarez & Marsal Holdings Business Overview

7.10.3 Alvarez & Marsal Holdings Work Opportunity Tax Credit Services Introduction

7.10.4 Alvarez & Marsal Holdings Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.10.5 Alvarez & Marsal Holdings Recent Development

7.11 Think

7.11.1 Think Company Details

7.11.2 Think Business Overview

7.11.3 Think Work Opportunity Tax Credit Services Introduction

7.11.4 Think Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.11.5 Think Recent Development

7.12 SOURCE ADVISORS

7.12.1 SOURCE ADVISORS Company Details

7.12.2 SOURCE ADVISORS Business Overview

7.12.3 SOURCE ADVISORS Work Opportunity Tax Credit Services Introduction

7.12.4 SOURCE ADVISORS Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.12.5 SOURCE ADVISORS Recent Development

7.13 Anchin

7.13.1 Anchin Company Details

7.13.2 Anchin Business Overview

7.13.3 Anchin Work Opportunity Tax Credit Services Introduction

7.13.4 Anchin Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.13.5 Anchin Recent Development

7.14 Global Tax Management

7.14.1 Global Tax Management Company Details

7.14.2 Global Tax Management Business Overview

7.14.3 Global Tax Management Work Opportunity Tax Credit Services Introduction

7.14.4 Global Tax Management Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.14.5 Global Tax Management Recent Development

7.15 Engineered Tax Services

7.15.1 Engineered Tax Services Company Details

7.15.2 Engineered Tax Services Business Overview

7.15.3 Engineered Tax Services Work Opportunity Tax Credit Services Introduction

7.15.4 Engineered Tax Services Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.15.5 Engineered Tax Services Recent Development

7.16 RKL

7.16.1 RKL Company Details

7.16.2 RKL Business Overview

7.16.3 RKL Work Opportunity Tax Credit Services Introduction

7.16.4 RKL Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.16.5 RKL Recent Development

7.17 Hull & Knarr

7.17.1 Hull & Knarr Company Details

7.17.2 Hull & Knarr Business Overview

7.17.3 Hull & Knarr Work Opportunity Tax Credit Services Introduction

7.17.4 Hull & Knarr Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.17.5 Hull & Knarr Recent Development

7.18 KBKG

7.18.1 KBKG Company Details

7.18.2 KBKG Business Overview

7.18.3 KBKG Work Opportunity Tax Credit Services Introduction

7.18.4 KBKG Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.18.5 KBKG Recent Development

7.19 ADP

7.19.1 ADP Company Details

7.19.2 ADP Business Overview

7.19.3 ADP Work Opportunity Tax Credit Services Introduction

7.19.4 ADP Revenue in Work Opportunity Tax Credit Services Business (2017-2022)

7.19.5 ADP Recent Development

8 Research Findings and Conclusion

9 Appendix

9.1 Research Methodology

9.1.1 Methodology/Research Approach

9.1.2 Data Source

9.2 Author Details

9.3 Disclaimer

Access full Report Description, Table of Figure, Chart, FREE sample, etc. please click

https://us.qyresearch.com/reports/354275/work-opportunity-tax-credit-services

Any doubts and questions will be welcome.

Customization of the Report:

This report can be customized to meet the client's requirements. Please contact with us (global@qyresearch.com), who will ensure that you get a report that suits your needs.

About Us:

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company With over 15 years' experience and professional research team in various cities over the world,QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 59,000 clients across five continents. Let's work closely with you and build a bold and better future.

Contact Us

QY Research

E-mail: global@qyresearch.com

Tel: +1-626-842-1666(US) +852-5808-0956 (HK)

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

Website: https://us.qyresearch.com

The QY Research released a latest market research report on the global and United States Work Opportunity Tax Credit Services market, which is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global Work Opportunity Tax Credit Services will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company With over 15 years' experience and professional research team in various cities over the world,QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 59,000 clients across five continents. Let's work closely with you and build a bold and better future.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Work Opportunity Tax Credit Services Trends and Forecast Report 2022 | By Players, Types, Applications and Regions here

News-ID: 2625862 • Views: …

More Releases from QY Research

High Margins, High Growth: Inside the Global Luxury Beauty Opportunity

Luxury beauty encompasses premium skincare, cosmetics, fragrance, haircare, dermo-cosmetics, and prestige personal care products positioned with superior ingredients, branding, exclusivity, and high ASPs.

Core value drivers include brand heritage, innovation in active ingredients, dermatological efficacy, sustainability claims, and experiential retail.

Consumers increasingly view luxury beauty as self-care + wellness investment, not discretionary spending alone.

Distribution mix: specialty beauty retail, department stores, travel retail, e-commerce, brand boutiques, medical aesthetic clinics.

Global Market Snapshot

Market size (2025):…

Security Seals Market 20252032: Smart Tech, Recurring Revenue, and Investor Upsi …

Single use security seals are tamper-evident mechanical or plastic locking devices designed for one-time application to secure containers, trucks, meters, ballot boxes, airline carts, cash bags, and logistics assets

Core function: theft deterrence, chain-of-custody control, compliance with customs, transport, and regulated industries

Widely used in logistics, utilities, aviation catering, banking, postal, healthcare, and e-commerce fulfillment

Market characterized by high volume, low ASP consumables with recurring replacement demand

Global Overview

Global market size (2025): USD 352…

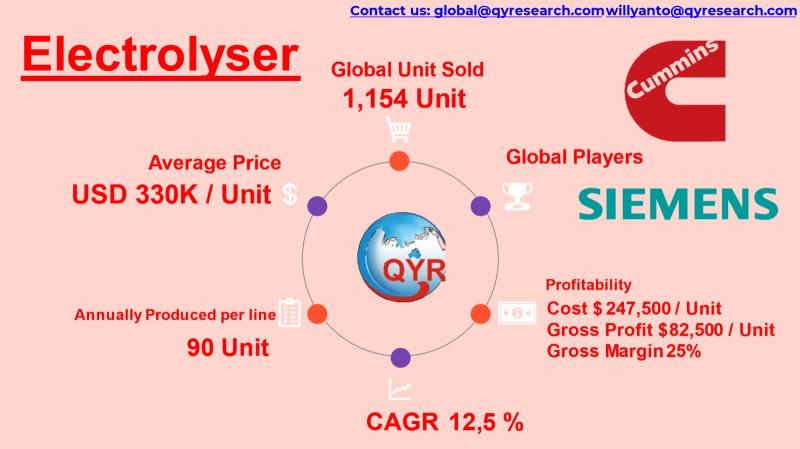

Hydrogen Infrastructure Surge: Why Electrolysers Are the Next Energy Investment …

Electrolyser systems are core equipment for producing green hydrogen through water electrolysis, converting electricity (increasingly renewable) into hydrogen and oxygen.

The industry underpins decarbonization across refining, fertilizers, steelmaking, mobility, and grid storage, making electrolysers a critical enabling technology for the global energy transition.

Technology categories include alkaline (AEL), proton exchange membrane (PEM), and solid oxide (SOEC), each optimized for different cost, efficiency, and operating profiles.

Global Market Overview

Global market size (2025): USD 381…

Top 30 Indonesian Dairy Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Indofood Sukses Makmur Tbk (INDF)

PT Indofood CBP Sukses Makmur Tbk (ICBP)

PT Ultrajaya Milk Industry & Trading Company Tbk (ULTJ)

PT Cisarua Mountain Dairy Tbk (CMRY)

PT Diamond Food Indonesia Tbk (DMND)

PT Mulya Boga Raya Tbk

PT Campina Ice Cream Industry Tbk

PT Kurniamitra Duta Sentosa Tbk

PT Greenfields Indonesia

PT Indolakto (subsidiary/brand under Indofood)

PT Ultra Jaya Frozen Foods (group affiliate)

PT Heilala Dairy Indonesia (export arm/processing)

PT Diamond Milk Products (non-listed…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…