Press release

Ductile Iron Pipes Market Is Expected To Grow At 6% CAGR By 2031

Global Ductile Iron Pipes Industry Current Scenario and Future OutlookThe impact of the COVID-19 outbreak has compelled several manufacturers and industries to rethink their operations to gradually recover from the losses incurred for years to come. The Ductile Iron Pipes industry suffered a huge setback due to halted production and a limited supply of raw materials.

With the vaccination process picking up pace in countries like China, India, the U.S., the U.K., and Germany, manufacturers are gradually heading towards the road to recovery with an improved supply chain and streamlined production activities.

Request Sample- https://www.factmr.com/connectus/sample?flag=S&rep_id=4182

Key Market Segments Covered in Ductile Iron Pipes Industry Analysis

By Diameter

DN 80 - DN 300 Ductile Iron Pipes

DN 350 - DN 600 Ductile Iron Pipes

DN 700 - DN 1000 Ductile Iron Pipes

DN 1200 - DN 2000 Ductile Iron Pipes

DN 2000 & Above Ductile Iron Pipes

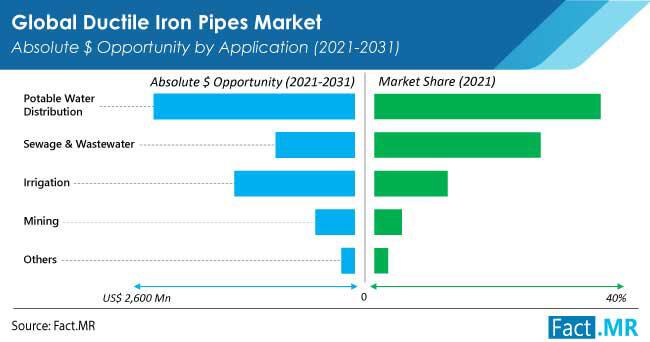

By Application

Ductile Iron Pipes for Potable Water Distribution

Ductile Iron Pipes for Sewage & Wastewater

Ductile Iron Pipes for Irrigation

Ductile Iron Pipes for Mining

Centrifugal DI Pipes

Others

By External Protection

Zn/Zn-Al + Bitumen/Epoxy Ductile Iron Pipes

PE Ductile Iron Pipes

PU Ductile Iron Pipes

Ceramic Epoxy Ductile Iron Pipes

Electrosteel DI Pipes

By Sales Channel

Direct Sales of Ductile Iron Pipes

Indirect Sales of Ductile Iron Pipes

Request Customization- https://www.factmr.com/connectus/sample?flag=RC&rep_id=4182

Infrastructure Expansion in the U.S. is Fueling Demand for Ductile Iron Pipes

The Ductile Iron Pipes chemical industry in the U.S. suffered a huge setback due to the coronavirus outbreak in 2022, halting operations in industries such as construction, automotive, and pharmaceutical.

However, with the gradual resumption of production activities and improvements in the supply chain globally, manufacturers operating in the Ductile Iron Pipes chemical industry are gearing up to retain the industry's post-pandemic status.

Rising demand for Ductile Iron Pipes dispersants from the construction and oil & gas industry is driving the Ductile Iron Pipes chemical industry in the U.S. Ductile Iron Pipes dispersants are widely used in the construction industry, and the anticipated growth is attributable to the wide expanse of real estate in the country.

Increasing housing infrastructure projects are propelling Ductile Iron Pipes dispersant sales, thus augmenting the growth of the Ductile Iron Pipes chemical industry. The presence of leading players in the country is also driving sales and export in the Ductile Iron Pipes chemical industry.

Buy Now - https://www.factmr.com/checkout/4182

Competitive Landscape

Majority of companies have focused on product launches and expanding their manufacturing units in developing regions. Strategies include innovation, collaborations with key players, partnerships, strategic alliances, and strengthening of regional and global distribution networks.

Some of the key developments are:

In 2021, Jindal SAW Ltd accepted to supply ductile iron pipes for 3 projects of Etihad Water & Electricity in Northern Emirates, which is divided to 43.5 km, 17.7 km and 42 Km. Supply of Dip has begun in April 2021. Along with the existing project, company also agreed to support all upcoming U.A.E. projects as well.

On April 3, 2019, Saint Gobain PAM has decided to sell its loss making unit "Pont a mousson" positioned in France to a Chinese ductile iron pipes giant Xingxiang.

In August 2019, Tata Metaliks has announced its plan to double its production capacity of ductile iron pipes. This would be in operation by the end of 2021. The company is looking forward to increase the percentage contribution of ductile iron pipes segment from 55% to 70% with this strategic move.

On April 1, 2021 McWane, Inc. acquired Clear Water Manufacturing Corp, It will expand our existing fabricated pipe business into regions other than US and improve our ability to service distribution partners in other parts of the country.

Similarly, recent developments related to companies manufacturing ductile iron water pipes have been tracked by the team at Fact.MR, which are available in the full report.

U.K is Capitalizing on Ductile Iron Pipes Binders for Sustainable Construction Activities

The U.K. has been at the forefront in terms of technological advancements and the adoption of sustainable technology in production globally, which is a key factor augmenting the growth of the Ductile Iron Pipes chemical industry.

In 2022, the country suffered huge setbacks due to the adverse effects caused by the COVID-19 pandemic. However, manufacturers operating in the Ductile Iron Pipes chemical industry are striving to achieve the pre-pandemic status by opting for various Ductile Iron Pipes and inDuctile Iron Pipes growth strategies.

In the U.K, the growth of the Ductile Iron Pipes industry can be attributed to the surging demand for Ductile Iron Pipes binders. The environment-friendly nature, low energy consumption, and cost-effectiveness offered by Ductile Iron Pipes binders are key factors leading the sales and demand.

Growing urbanization and rapid increments in infrastructure activities across the country are fueling the demand for Ductile Iron Pipes binders, thus creating lucrative opportunities for several players operating in the Ductile Iron Pipes chemical industry in the upcoming decade.

China is Incorporating Ductile Iron Pipes Pigments in Textiles and Visual Arts

The global hub for the Ductile Iron Pipes chemical industry, China, is picking up pace in its post-covid recovery, due to the timely eradication of the virus. With little to no restrictions, most production-related activities have resumed across the country, acting as anchors for various local and global manufacturers.

China is a lucrative ground for the Ductile Iron Pipes industry due to the presence of leading manufacturers and several industries such as textile, pharmaceutical, plastic, and paint. Due to the abundance of these industries, the demand for Ductile Iron Pipes pigments is also gaining immense traction in China.

Ductile Iron Pipes pigments are non-toxic, cost-effective, and offer good color strength, making them a favorable choice for usage in various end-use sectors. Increasing the use of Ductile Iron Pipes pigments in plastics, textiles, paints, and coatings will continue driving the growth in the Ductile Iron Pipes industry.

Additionally, the wide range of unique shades available in Ductile Iron Pipes pigments makes them a preferred choice for visual arts as well. The consumption of Ductile Iron Pipes pigments in high-tech applications such as photo-reprographics, optoelectronic displays, and optical data storage are fueling the demand for Ductile Iron Pipes pigments and creating lucrative opportunities for players operating in the Ductile Iron Pipes industry.

India Will Showcase High Demand for Speciality Ductile Iron Pipes

India is emerging as a lucrative market for the Ductile Iron Pipes chemical industries for players across the world. With gradual resumptions in the restrictions on movement, the country is slowly getting back on track to achieve post-pandemic status in the coming years.

The Ductile Iron Pipes industry in India is capitalizing on various sectors such as paints, pharmaceuticals, adhesives, pesticides, and dyes, making it one of the most important industries in the country.

Leading players operating in the Ductile Iron Pipes industry are focusing on enhancing their product portfolio by adding specialty chemicals such as polymer additives, water treatment chemicals, and lubricating additives, which will further drive growth and sales in the industry in the upcoming decade.

The newly discovered natural gas reserves in the country will also enable manufacturers to procure diverse Ductile Iron Pipes and will continue augmenting the growth of the Ductile Iron Pipes chemical industry.

Key Long-Term Trends

The global Ductile Iron Pipes industry is gradually recovering in 2021 and is expected to gain momentum in the upcoming years. With a noteworthy surge in activities in industries such as infrastructure, construction, pharmaceutical, and oil & gas, the Ductile Iron Pipes industry will show an upward trend in the coming years. Some new trends that are augmenting the market growth are:

Chemoinformatic

The Ductile Iron Pipes industry will largely benefit from chemoinformatic due to various factors such as the ease of evaluating specific properties of large compounds. The use of computational and informational techniques will help manufacturers gain insights into the new and existing chemicals and how to incorporate them into Ductile Iron Pipes chemical products.

For More Insights- https://www.prnewswire.com/news-releases/dredging-industry-looks-for-a-revival-in-government-contracts-factmr-study-301210878.html

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

Corporate Headquarter:

Unit No: AU-01-H Gold Tower (AU),

Plot No: JLT-PH1-I3A,

Jumeirah Lakes Towers,

Dubai, United Arab Emirates

Visit Our Website: https://www.factmr.com

About Us:

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ductile Iron Pipes Market Is Expected To Grow At 6% CAGR By 2031 here

News-ID: 2625085 • Views: …

More Releases from Fact.MR

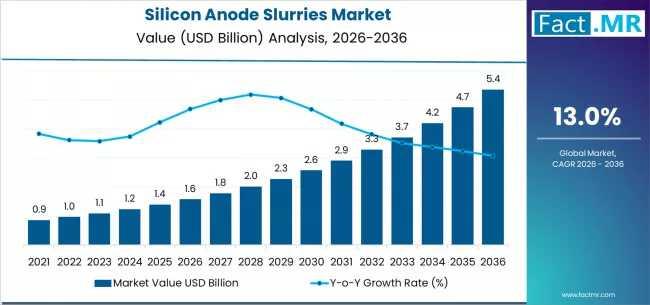

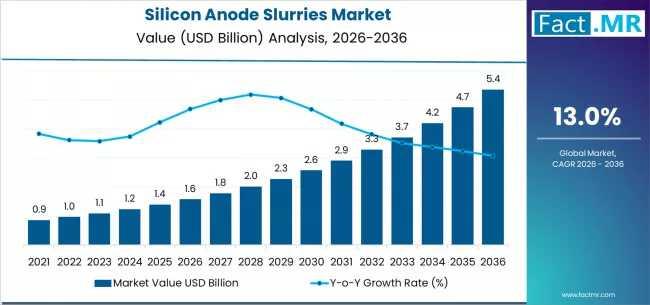

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

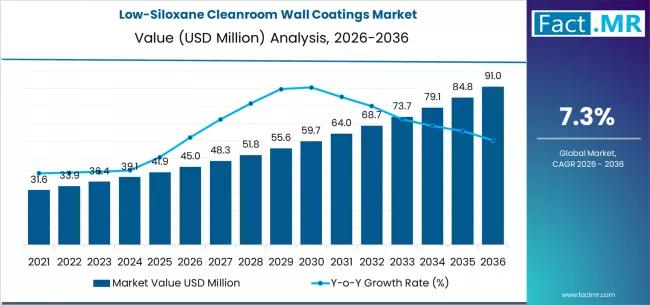

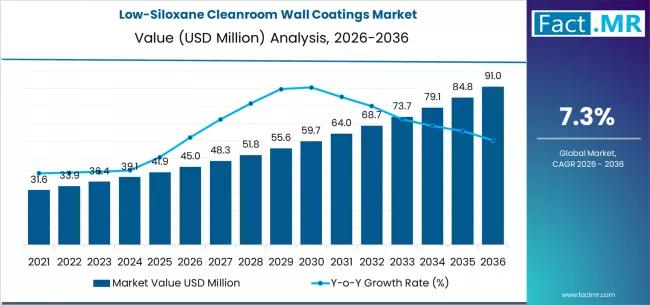

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Pipes

The difference between seamless pipes and welded steel pipes

This article will discuss the difference between seamless steel pipe and welded steel pipe to help you choose a better product:

1. Different materials:

*Welded steel pipe: Welded steel pipe refers to a steel pipe with surface seams that is formed by bending and deforming steel strips or steel plates into circular, square, or other shapes, and then welding. The billet used for welded steel pipe is steel plate or strip steel.

*Seamless…

Tobacco Pipe Industry Growth, Competitive Analysis, Future Prospects 2020:S. M. …

Worldwide Market Reports recently released "Global Tobacco Pipe Market Research Report 2020" that centers around the latest developing trends and technologies in the Commercial Tobacco Pipe Market having few Years of forecast period from 2020 to 2027 and considering Market status study from 2012 to 2027.

The report firstly introduced the Tobacco Pipe basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures, raw materials and so on.…

Global PVC pipes Market 2020 Kankai Pipes, Supreme Pipes, Dutron Group, Aashirva …

PVC pipes: Regional and Global Market Opportunities - Key Competitors, Industry Segments, and Strategic Analysis, 2020-2025

The market study is primarily based on primary and secondary data collected through systematic research approach. The research approach is defined by expert market analysts in line with business consultants and international research standards. Economic, political, and environmental regulations for PVC pipes market are examined to draw the conclusion on macroeconomic business environment. The market…

India PVC Pipes Market Study By Top Key Players Aashirvad Pipes, Supreme Pipes, …

The India PVC Pipes Market size was valued at $3,159 million in 2016 and is anticipated to expand at a CAGR of 10.2% to reach $6,224 million by 2023. Polyvinyl chloride (PVC) is the third largest selling plastic commodity after polyethylene & polypropylene. It is beneficial over other materials, owing to its chemical resistance, durability, low cost, recyclability, and others; thus, it can replace wood, metal, concrete, and clay in…

India PVC Pipes Market| Top Key Players- Aashirvad Pipes, Supreme Pipes, Astral …

A Comprehensive research study conducted by KD Market Insights on "India PVC Pipes Market by Type (Chlorinated, Plasticized, and Unplasticized), Material (PVC Resin, Stabilizers, Plasticizers, Lubricant, Pigment Base, and Others), Application (Irrigation, Water Supply, Sewerage, Plumbing, Oil & Gas, HVAC, and Others), and Region (North India, West India, East India, & South India) - Opportunity Analysis and Industry Forecast, 2015-2023" report offers extensive and highly detailed historical, current and future…

India PVC Pipes Market: Regional Study by Growth Rate, Sales, Revenue, Top Key P …

The India PVC Pipes Market size was valued at $3,159 million in 2016 and is anticipated to expand at a CAGR of 10.2% to reach $6,224 million by 2023. Polyvinyl chloride (PVC) is the third largest selling plastic commodity after polyethylene & polypropylene. It is beneficial over other materials, owing to its chemical resistance, durability, low cost, recyclability, and others; thus, it can replace wood, metal, concrete, and clay in…