Press release

Cloud Tax Management Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends

According to a report from Evolve Business Intelligence, the global CLOUD TAX MANAGEMENT market is set to grow at CAGR of XX% from 2022 to 2030. The study covers insights regarding growth leveraging factors and investment strategies for each of the reader's analysts. The reader will gain valuable insights regarding key players and their developmental outlook for 2019, 2020 and 2021. This latest report on Pre-COVID-19 and Post-COVID-19 impact analysis will help investors with keeping up-to-date with current market activity and plan future investments accordingly.To request a free sample, Go To: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008094

The report includes 10 key players in the Cloud Tax Management market ecosystem that have been strategically profiled, along with the market ranking/share for major players. The key players profiled in the report are:

• Avalara

• Automatic Data Processing

• Wolters Kluwer NV

• Thomson Reuters

• Intuit

• H&R Block

• SAP SE

• Blucora

The research team has conducted a study of the Cloud Tax Management market. This study has indicated a positive outlook for the future based on current and past data as well as an in-depth examination of key trends that could impact the long-term performance of this sector. Based on our findings, we see opportunities for growth in some key specific areas that we believe are ripe for new applications. To determine the amounts of these opportunities, we closely investigated factors such as how accessible the required raw materials were and how easily accessible sources could be to those who would be potentially interested in knowing more about these materials and their unique qualities so that they could consider incorporating them into their manufacturing process or commercializing them.

The study discusses the growth potential of the Cloud Tax Management market on a global scale, by region and by country. The report analyzes how and why market trends affect the market in different parts of the world. Then, it sheds light on opportunities available for companies looking to get involved in this industry irrespective of the product or service they are offering.

Impact of COVID-19 & Post Covid Scenerio

The COVID-19 pandemic has been impacting the industry for the past year. Several financial impacts including disruptions have been felt over a long period of time across diverse markets. Our research has interviewed hundreds of people in the same geographical markets to collect information.

In terms of COVID 19 impact, the Cloud Tax Management market report also includes the following data points:

• Impact of COVID-19

• Government Aids and Policies for Industry Revival

• Companies Recent Developments to Tackle Negative Impact

• Opportunity Window & Post COVID Trend

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008094

Market Segment By Product Type with focus on market share, consumption trend, and growth rate of Cloud Tax Management Market:

• Indirect Tax

• Direct Tax

Market Segment By Application with focus on market share, consumption trend, and growth rate of Cloud Tax Management Market:

• Banking Financial Services and Insurance (BFSI)

• Information Technology (IT) and Telecom

• Energy and Utilities

• Healthcare and Life Sciences

Global Cloud Tax Management Geographic Coverage:

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Rest of Asia Pacific

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

For any customization, contact us through - https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=008094

Key Matrix

• Base Year: 2021

• Estimated Year: 2022

• CAGR: 2022 to 2030

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cloud Tax Management Market Analysis and Forecast to 2028: COVID-19 and Post-COVID Impact, Opportunities and Trends here

News-ID: 2579357 • Views: …

More Releases from Evolve Business Intelligence

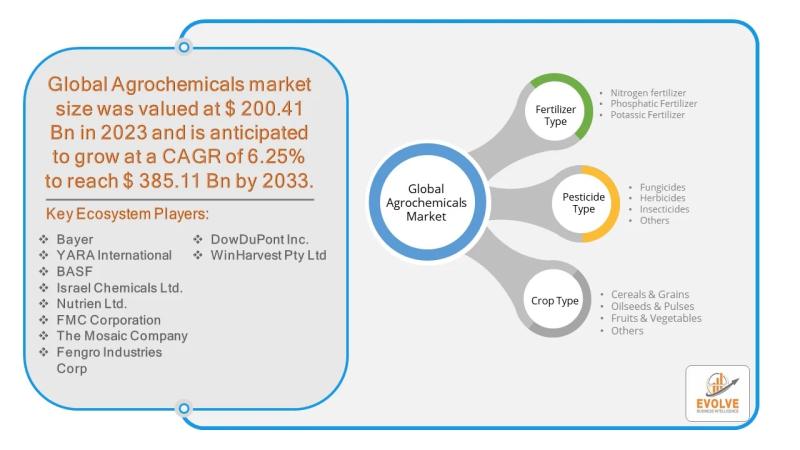

Agrochemical Market Forecast to Reach USD 394.8 Billion by 2033

The global agrochemical market is a multi-billion dollar industry, valued at an estimated USD 297.7 billion in 2024 and projected to reach USD 394.8 billion by 2033. At the heart of this growth lies the cereals and grains segment, which represents a massive opportunity. With global population growth driving the need for food security, the cultivation of staple crops like wheat, rice, and maize is a primary focus for farmers…

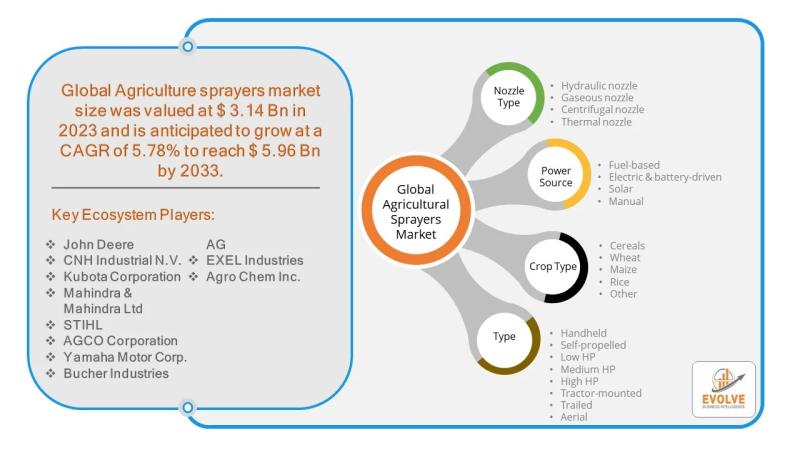

Agriculture Sprayers Market Forecast to Reach USD 5.96 Billion by 2033

The global agriculture sprayers market is on a trajectory of significant growth, with a projected value of USD 5.96 billion by 2033, up from USD 3.14 billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 5.78%. This expansion is largely driven by technological advancements and the increasing adoption of precision agriculture. While the market presents vast opportunities, it is not without its challenges. The high initial cost…

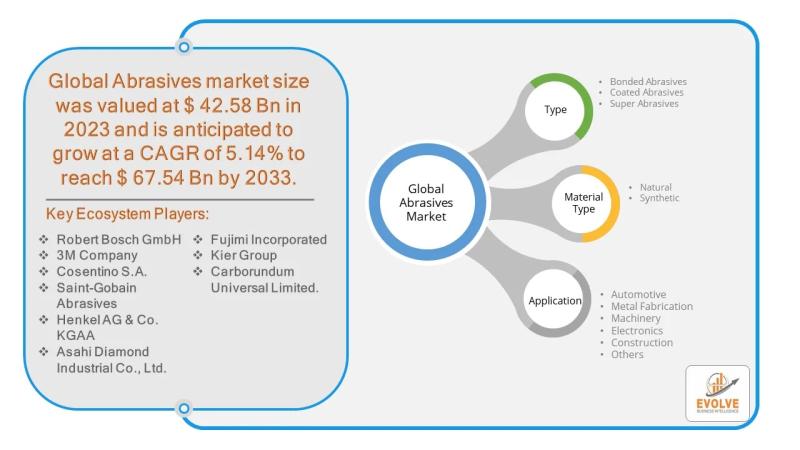

Abrasives Market Forecast to Reach USD 67.54 Billion by 2033

The global abrasives market, a critical component of industrial manufacturing, is demonstrating a robust and high-opportunity landscape for the metal fabrication sector. Valued at $42.58 billion in 2023, the market is projected to reach $67.54 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 5.14%. A significant driver of this growth is the increasing demand from the metalworking and automotive industries. As industries reliant on metal fabrication,…

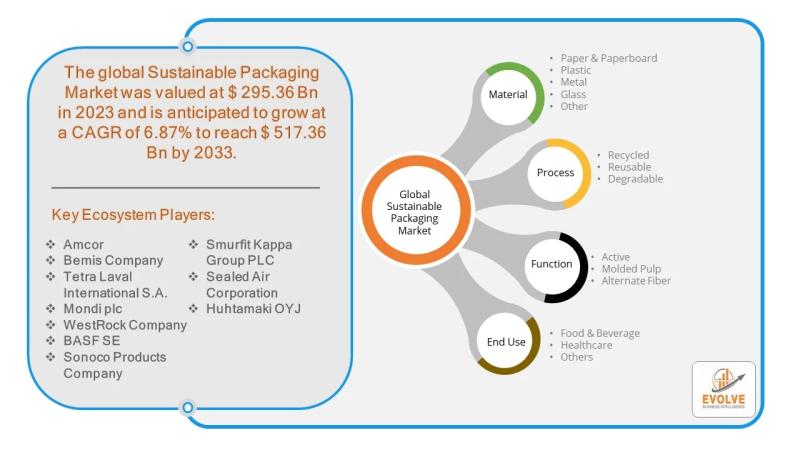

Sustainable Packaging Market Forecast to Reach USD 517.36 Billion by 2033

The global sustainable packaging market is experiencing remarkable growth, driven by an increasing demand for eco-friendly solutions. Valued at $295.36 billion in 2023, the market is forecasted to reach $517.36 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.87%. This presents a significant opportunity for reusable packaging, a segment gaining momentum as a key solution to environmental challenges.

Download the full report now to discover market trends, opportunities,…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…