Press release

Peer-to-Peer Lending Market A Positive Business Approach towards New Technology and Product Development Will Help to Develop Company Players 2022

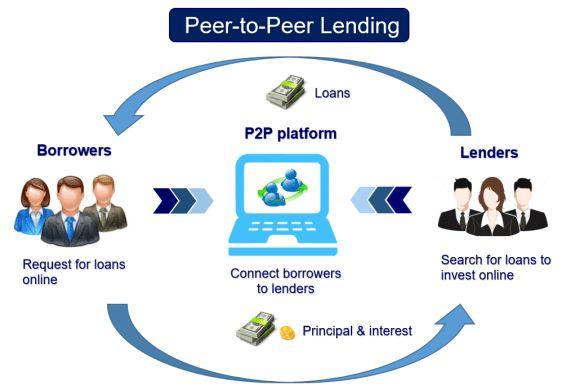

The global Peer-to-Peer Lending Market was accounted for US$ 124.9 Billion in terms of value in 2019 and is expected to grow at CAGR of 48.2% for the period 2019-2027.Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman. Websites that facilitate P2P lending have greatly increased its adoption as an alternative method of financing. Peer-to-peer lending is a mechanism which connects individuals in need of credit with others willing to lend. The platforms purely acts as an intermediary or marketplace that connects borrowers and lenders. You can register as a borrower or lender on any platform after undergoing a verification process by furnishing relevant details.

๐๐ผ๐ผ๐ธ๐ถ๐ป๐ด ๐ณ๐ผ๐ฟ ๐๐ ๐ฐ๐น๐๐๐ถ๐๐ฒ ๐ ๐ฎ๐ฟ๐ธ๐ฒ๐ ๐๐ป๐๐ถ๐ด๐ต๐๐ ๐ณ๐ฟ๐ผ๐บ ๐๐๐๐ถ๐ป๐ฒ๐๐ ๐๐ ๐ฝ๐ฒ๐ฟ๐๐? ๐ฅ๐ฒ๐พ๐๐ฒ๐๐ ๐ฎ ๐ฆ๐ฎ๐บ๐ฝ๐น๐ฒ ๐ฅ๐ฒ๐ฝ๐ผ๐ฟ๐ @

https://www.coherentmarketinsights.com/insight/request-sample/3677

๐๐ผ๐บ๐ฝ๐ฒ๐๐ถ๐๐ถ๐๐ฒ ๐๐ป๐ฎ๐น๐๐๐ถ๐ ๐๐ป๐ฐ๐น๐๐ฑ๐ฒ:

โผ Daric Inc.

โผ Prosper Marketplace Inc.

โผ Pave Inc.

โผ CommonBond Inc.

โผ Social Finance Inc.

โผ Upstart Network Inc.

โผ Social Finance Inc.

โผ Funding Circle Limited

โผ Peerform

โผ CircleBack Lending Inc.

A new business intelligence report on the Global Peer-to-Peer Lending Market has recently been added to the Dynamic Report Repository and has been published to provide an exclusive hands-on reference to the various market dynamics that will enable high potential growth of the market. These Peer-to-Peer Lending market research methodologies collect data from such as primary research, secondary research, SWOT analysis, and more such techniques data accuracy, efficiency, and accountability by delivering quality information for the open market.

๐๐ซ๐๐ ๐๐ง๐๐จ๐ซ๐ฆ๐๐ญ๐ข๐จ๐ง:

The report helps the Peer-to-Peer Lending market participants make well-informed business decisions by offering industry-relevant and fact-based insights gathered from various industries. The study identifies target customers, market competitors, pricing patterns, and market intelligence to roust the competition. The primary data provided in the global Peer-to-Peer Lending market report is extensively validated by subject matter experts such as CXOs, VPs, project managers, and other business professionals who are leaders in the Peer-to-Peer Lending market.

๐ฃ๐๐: ๐ฆ๐ฎ๐บ๐ฝ๐น๐ฒ ๐ฅ๐ฒ๐พ๐๐ฒ๐๐ ๐ถ๐ ๐๐๐ฎ๐ถ๐น๐ฎ๐ฏ๐น๐ฒ โฉ https://www.coherentmarketinsights.com/insight/request-pdf/3677

๐๐๐๐ซ-๐ญ๐จ-๐ฉ๐๐๐ซ ๐ฅ๐๐ง๐๐ข๐ง๐ ๐ฉ๐ซ๐จ๐ฏ๐ข๐๐๐ฌ ๐ฌ๐จ๐ฆ๐ ๐ฌ๐ข๐ ๐ง๐ข๐๐ข๐๐๐ง๐ญ ๐๐๐ฏ๐๐ง๐ญ๐๐ ๐๐ฌ ๐ญ๐จ ๐๐จ๐ญ๐ก ๐๐จ๐ซ๐ซ๐จ๐ฐ๐๐ซ๐ฌ ๐๐ง๐ ๐ฅ๐๐ง๐๐๐ซ๐ฌ:

โช Higher returns to the investors: P2P lending generally provides higher returns to the investors relative to other types of investments.

โช More accessible source of funding: For some borrowers, peer-to-peer lending is a more accessible source of funding than conventional loans from financial institutions. This may be caused by the low credit rating of the borrower or the atypical purpose of the loan.

โช Lower interest rates: P2P loans usually come with lower interest rates because of the greater competition between lenders and lower origination fees.

๐๐๐ญ๐๐ข๐ฅ๐๐ ๐๐๐ ๐ฆ๐๐ง๐ญ๐๐ญ๐ข๐จ๐ง:

By End User

โก Consumer Credit

โก Small Business

โก Student Loans

โก Real Estate

By Business Model

โก Traditional P2P Lending

โก Marketplace Lending

Reasons to buy:

โ Procure strategically important competitor information, analysis, and insights to formulate effective R&D strategies.

โ Recognize emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

โ Develop tactical initiatives by understanding the focus areas of leading companies.

โ Plan mergers and acquisitions meritoriously by identifying Top Manufacturer.

โ Formulate corrective measures for pipeline projects by understanding Peer-to-Peer Lending depth.

โ Develop and design in-licensing and out-licensing strategies by identifying prospective partners with the most attractive projects to enhance and expand business potential and Scope.

โ The report will be updated with the latest data and delivered to you with updated information.

โ Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

โ Create regional and country strategies on the basis of local data and analysis.

(๐๐น๐ฎ๐ ๐ฎ๐ฌ๐ฌ๐ฌ ๐จ๐ฆ๐ ๐๐ถ๐๐ฐ๐ผ๐๐ป๐) ๐๐ป๐พ๐๐ถ๐ฟ๐ฒ ๐ฎ๐ป๐ฑ ๐๐ฒ๐ ๐๐ผ๐บ๐ฝ๐น๐ฒ๐๐ฒ ๐ฅ๐ฒ๐ฝ๐ผ๐ฟ๐ ๐๐ถ๐๐ต ๐๐ถ๐๐ฐ๐ผ๐๐ป๐ @

https://www.coherentmarketinsights.com/promo/buynow/3677

Contact Us:

Coherent Market Insights

1001 4th Ave, #3200 Seattle, WA 98154, U.S.

Email: sales@coherentmarketinsights.com

United States of America: +1-206-701-6702

United Kingdom: +44-020-8133-4027

Japan: +050-5539-1737

India: +91-848-285-083

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Market A Positive Business Approach towards New Technology and Product Development Will Help to Develop Company Players 2022 here

News-ID: 2566257 • Views: โฆ

More Releases from Coherent Market Insights

Credit Cards Market Is Going to Boom| Visa โข Mastercard โข American Express โ โฆ

The latest study by Coherent Market Insights, titled "Credit Cards Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrantsโฆ

Terminal Tractor Market Outlook 2026-2033: Growth Drivers, Trends, and Strategic โฆ

Latest Report, titled Terminal Tractor Market Trends, Share, Size, Growth, Opportunity and Forecast 2026-2033, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

โค The report features a comprehensive table of contents, figures, tables, and charts, as well as insightful analysis. The Terminal Tractor Market has beenโฆ

Electric Light Commercial Vehicle Market Size 2026 Emerging Demands, Share, Tren โฆ

Coherent Market Insights' most recent research study, "Global Electric Light Commercial Vehicle Market Size, Share, Pricing, Trends, Growth, Opportunities and Forecast 2026-2033," provides a thorough overview of the market for Electric Light Commercial Vehicle Market on a global scale. The research contains future sales projections, consumer demand, regional analyses, and other crucial data about the target market, as well as the numerous motivators, inhibitors, opportunities, and dangers. In addition toโฆ

Remote Patient Monitoring (RPM) Market Outlook Through 2026-2033: Growth Drivers โฆ

The qualitative latest Research report (2026-2033) on the Remote Patient Monitoring (RPM) Market by Coherent Market Insights Provides a deep dive into key market trends, drivers, challenges, and the competitive landscape. It analyzes market size, revenue, production, and CAGR using validated methodologies to ensure precision. The report highlights tech innovation, pricing trends, consumer behavior, and investment potential - empowering businesses to make informed, strategic moves.

โค Request a Sample Copy (Completeโฆ

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, newโฆ

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le โฆ

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have usedโฆ

Peer-to-peer Lending โ Growing Popularity and Emerging Trends in the Market | โฆ

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lendingโฆ

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart โฆ

The โ Alternative Lending marketโ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, marketโฆ

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee โฆ

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lendingโฆ

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len โฆ

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,โฆ