Press release

Tax Software Market to exceed US$ 24,845.7 Million by 2027, says The Insight Partners

Tax Software Market Research study 2020-2027 enhances the decision making capabilities and helps to create potent counter strategies to obtain competitive advantage says a latest research report at The Insight Partners. The Tax Software Market analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development statusGet Sample PDF Now: https://www.theinsightpartners.com/sample/TIPRE00009740/?utm_source=OpenPR&utm_medium=10452

Rise in digitalization is projected to escalate the tax software market at a CAGR of 11.2%

Due to the advent of digitalization across regions, companies are adopting advanced technologies for reducing manual business process and implementing automated process for increasing productivity and achieving efficient business outcomes. Owing to the internet and various platforms, such as desktop and smartphone, there is no need for individuals to visit a Tax Office; they can file a tax return and make a tax payment remotely. End users such as commercial enterprises and individuals are adopting tax software as it automates tax processes and reduces the manual efforts of computing tax. The software allows registering the information of the taxpayer, and it is then automatically entered into tax returns; it also enables automatic calculation.

Companies Profiled in this report includes:

• Avalara, Inc.

• Chetu Inc.

• Drake Software

• H & R Block

• Intuit Inc.

• The Sage Group plc

• Thomson Reuters Corporation

• Vertex, Inc.

• Wolters Kluwer (cch incorporated)

• Xero Limited

The Tax Software market research report provides an in depth examination of the key factors stimulating market expansion. It also sheds light on the challenges or restraining factors that are poised to hinder industry growth over the forecast timeframe. Growth rate, market share captured, and valuation estimates for each region, segment, and company are documented as well.

The document entails a detailed rundown of the impact of the key factors on the development and growth of the of the business sphere over the forecast timeframe. Promising opportunities in the Tax Software have also been mentioned in the study.

To know more Speak to our Analyst at: https://www.theinsightpartners.com/speak-to-analyst/TIPRE00009740?utm_source=OpenPR&utm_medium=10452

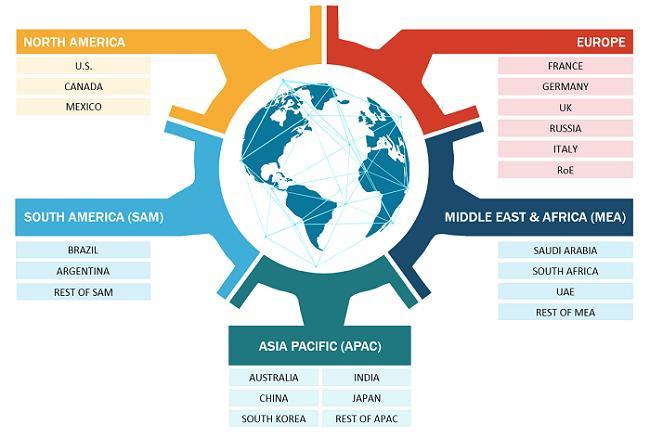

Furthermore, the market is segmented based on type, application, and region in order to study it exhaustively and provide the data in a systematic manner. Speaking of competitive landscape, the study includes a list of leading companies along with their product and service offerings, strategic decisions, SWOT analysis, latest developments, market share captured, growth rate, and valuation. The challenges faced by these companies are analyzed and solutions for them are given as well.

The report segments the global tax software market as follows:

Global Tax Software Market - By Product Type

• Software

• Service

Global Tax Software Market - By Tax Type

• Sales Tax

• Income Tax

• Corporate Tax

• Other Tax Types

Global Tax Software Market - By Development Type

• Cloud

• On-Premise

Global Tax Software Market - By End-User

• Individual

• Commercial Enterprises

Global Tax Software Market - By Vertical

• BFSI

• IT & Telecom

• Healthcare

• Government

• Retail

• Other Verticals

Essential points covered in Tax Software report are:-

1 What will the market size and the growth rate be in 2027?

2 What are the key growth stimulants of Tax Software market?

3 What are the key market trends impacting Tax Software market valuation?

4 What are the challenges to market proliferation?

5 Who are the key vendors in the Tax Software?

6 Which are the leading companies contributing to Tax Software valuation?

7 What was the market share held by each region in 2021?

8 What is the estimated growth rate and valuation of Tax Software in 2021?

Buy Complete Report at: https://www.theinsightpartners.com/buy/TIPRE00009740/?utm_source=OpenPR&utm_medium=10452

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Healthcare, Manufacturing and Construction, Media and Technology, Chemicals, and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Software Market to exceed US$ 24,845.7 Million by 2027, says The Insight Partners here

News-ID: 2561890 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…