Press release

SME Insurance Market: Global and Regional Analysis with Forecast till 2028, Business Opportunities, Post COVID Scenario

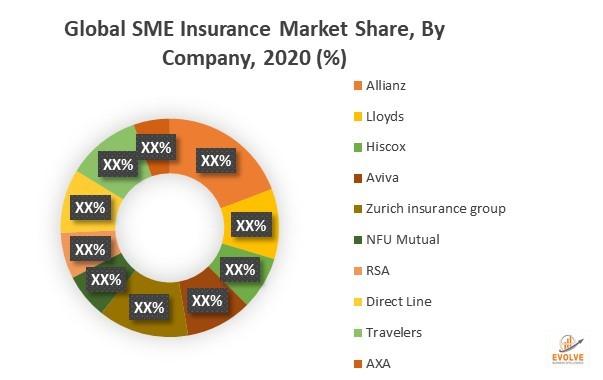

According to the report, The global SME Insurance market size was valued at $23.14 Billion in 2020 and is expected to reach $38.99 Billion by 2028 growing at the CAGR of 6.68% from 2021 to 2028. The increasing adoption of SME (small and medium-sized enterprises) insurance products by small business owners is the major driver for the growth of the SME insurance market. Similarly, rise in demand for these products on account of surrounding revenue risks, employee health issues, legal protection, technology errors on platforms/servers, data theft expenses among other claims are further boosting the growth of this market.Request Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005922

Our most recent research on the Global SME Insurance Market , published by our partner Evolve Business Intelligence, examines the industry in the context of major market aspects including market size & forecasts, key players, SWOT analysis (strengths, weaknesses, opportunities and threats. There are currently several key trends that hold immense potential for driving profits through the industry, but there are also some obstacles that can hinder how successful your business venture will be overall. Market share values are discussed within these sections as well as assumptions regarding current projections for where this particular industry is headed over the upcoming few years.

Research shows that the market is being influenced by a number of different indicators. Specifically, we have identified 4 major indications in our analysis: Drivers, Restraints, Key Trends, and Challenges. The total sum of these sections will help you understand what strategies will be best to adopt in order to prosper through this industry over a few short years. The sum of all these elements will help you understand what strategies to adopt in order to succeed. The quantitative research study that we published as a supplement to it includes our findings out of this research study as well as the actual findings supplemented with further advice for those who want to grasp new opportunities or those who want to plan against threats that might hinder the development of the market.

Impact of COVID-19

The on-going Covid-19 pandemic has had a devastating effect on the market. The industry report on SME Insurance Market includes financial impacts and market disturbance that have been felt over a long period of time. Our research has interviewed numerous delegates from this industry and got involved in the primary and secondary research to collect information from different delegates from this market across many geographical markets in order to gather data and strategies that will be helpful for addressing potential challenges people might face with COVID-19 pandemic plus its impact on the industry going forward.

The New Normal

During the COVID-19 pandemic, businesses were forced to shift focus on numerous occasions, having to react to crisis after crisis. As businesses recover from the COVID-19 pandemic, they have a lot of new priorities to deal with due to all of the shifting situations throughout this crisis. Throughout this pandemic, they were always trying to cope with changing circumstances and most often fell short of their ultimate goals. Now that the pandemic is subsiding, they will need to recuperate from this by setting forth new objectives for themselves in order to succeed in the future.

In terms of COVID 19 impact, the SME Insurance Market report also includes the following data points:

• Impact of COVID-19

• Government Aids and Policies for Industry Revival

• Companies Recent Developments to Tackle Negative Impact

• Opportunity Window & Post COVID Trend

For Any Query or Customization, Ask Our Industry Experts@ https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005922

Key Players

Some of the major SME Insurance Market players holding highest market share include Allianz, Lloyds, Hiscox and Aviva. These players use new product development as a key strategy to gain significant market share to compete with market leaders.

.

The key players profiled in the report are:

● Allianz

● Lloyds

● Hiscox

● Aviva

● Zurich insurance group

● NFU Mutual

● RSA

● Direct Line

● Travelers

● AXA

Segmental Analysis

Market Segment By Type with focus on market share, consumption trend, and growth rate of SME Insurance Market :

• Micro 0-9 employees

• Small 10-49 employees

• Medium 50-250 employees

Market Segment By End-user with focus on market share, consumption trend, and growth rate of SME Insurance Market :

● Agriculture

● Construction

● Hospitality

● Professional Services

● Utility sector

● Retail

● Real Estate

● Others

For more information: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005922

Global SME Insurance Market Geographic Coverage:

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Rest of Asia Pacific

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool – EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune’s global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market: Global and Regional Analysis with Forecast till 2028, Business Opportunities, Post COVID Scenario here

News-ID: 2486485 • Views: …

More Releases from Evolve Business Intelligence

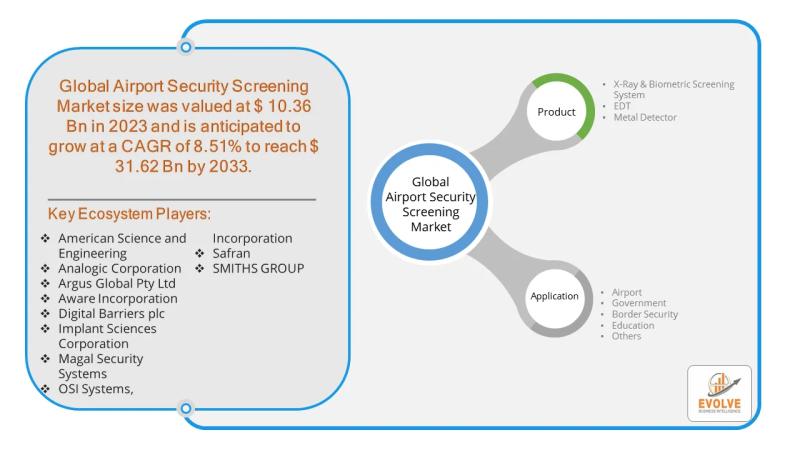

Airport Security Screening Market Forecast to Reach USD 31.62 Billion by 2033

The global airport security screening market is undergoing a significant transformation, driven by an increasing need for robust security measures and the continuous rise in air travel. Within this evolving landscape, metal detectors present a high-growth opportunity, largely due to their cost-effectiveness, reliability, and efficiency. While the market is seeing rapid growth in advanced technologies like Advanced Imaging Technology (AIT), metal detectors continue to hold a dominant position, accounting for…

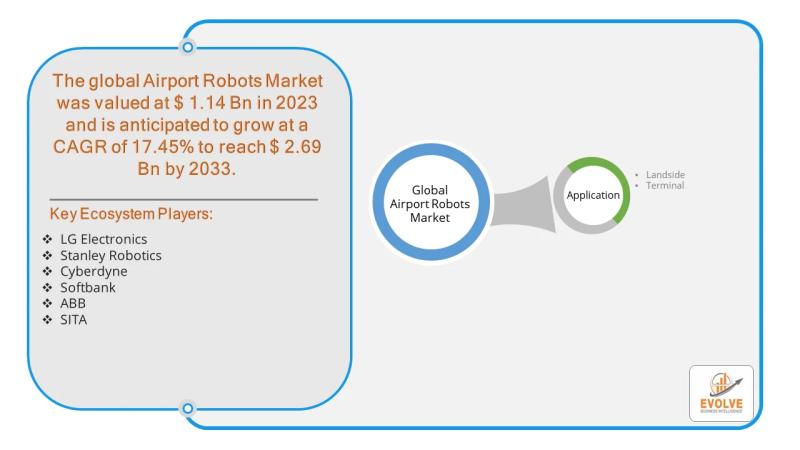

Airport Robots Market Forecast to Reach USD 6.5 Billion by 2035

The global Airport Robots Market is poised for significant growth, driven by the need for increased operational efficiency, enhanced security, and an improved passenger experience. According to recent market analysis, the industry is projected to grow from an estimated $1.4 billion in 2025 to a remarkable $6.5 billion by 2035, expanding at a robust Compound Annual Growth Rate (CAGR) of 16.6%. A key driver of this growth is the "Terminal"…

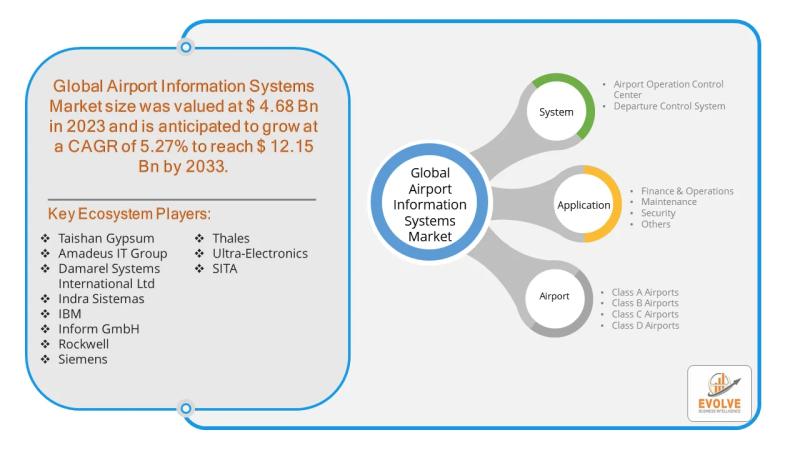

Airport Information Systems Market Forecast to Reach USD 12.15 Billion by 2033

The Airport Information Systems (AIS) Market, valued at USD 4.68 billion in 2023 and projected to reach USD 12.15 billion by 2033, is a rapidly evolving sector. While the Airport Operation Control Center (AOCC) has traditionally dominated this space, a significant and growing opportunity lies within the Departure Control System (DCS) segment. As air travel continues its strong recovery and expansion, especially in emerging economies, the need for efficient and…

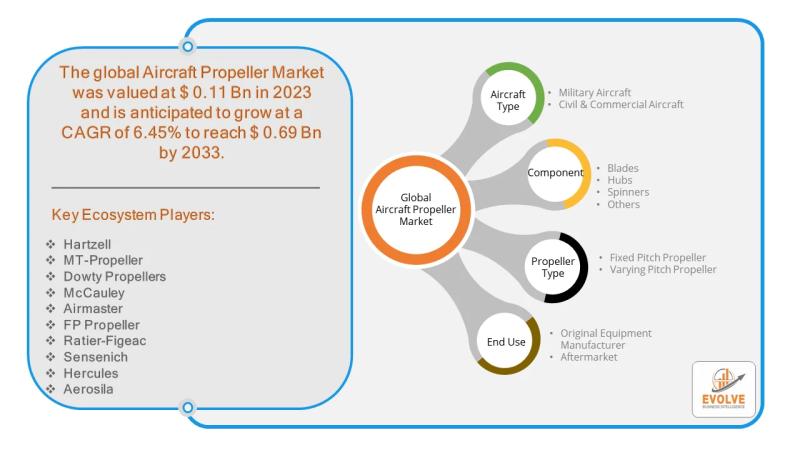

Aircraft Propeller Market Forecast to Reach USD 0.69 Billion by 2033

The Varying Pitch Propeller is emerging as a significant opportunity in the dynamic Aircraft Propeller Market, driven by a growing focus on fuel efficiency, environmental sustainability, and the expanding use of turboprop aircraft, especially in regional and general aviation. While fixed-pitch propellers are simpler and cheaper, varying pitch propellers allow pilots to adjust the blade angle to optimize performance across different flight phases-from takeoff and climb to cruise and landing.…

More Releases for SME

SME Insurance - Market Size | Valuates Reports

SME Insurance - Market Size | Valuates Reports

The global market for SME Insurance was estimated to be worth US$ 18010 million in 2023 and is forecast to a readjusted size of US$ 24100 million by 2030 with a CAGR of 4.2% during the forecast period 2024-2030

View Sample Report

https://reports.valuates.com/request/sample/QYRE-Auto-3D7510/China_SME_Insurance_Market_Report_Forecast_2021_2027

Report Scope

This report aims to provide a comprehensive presentation of the global market for SME Insurance, focusing on the total sales revenue, key…

SME Force Automation Market Investment Analysis

The SME force automation market is expected to witness market growth at a rate of 15.20% in the forecast period of 2021 to 2028. Data Bridge Market Research report on SME force automation market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rising adoption of cloud sales force automation (SFA) software is escalating…

UK SME Insurance Market Report- Competitor Dynamics | Insurers can challenge the …

The research study contains an in detail descriptive overview and analysis of the UK SME Insurance Market, a summary of the UK SME Insurance Market shares constituted by each component, the annual growth of each sector, and the revenue potential of the section. In addition, UK SME Insurance Market production and consumption data are used to determine the geographical features.

Get FREE PDF Sample of the Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=4430784

AXA and…

INDIA: Big March for SME

In keeping with recent and ongoing changes in the business landscape, business is focusing on mobility rather than stability, and the service business has evolved accordingly. Globalization is the buzzword as geographic boundaries cease to exist. Business is competing for opportunities in an international arena. Because the world is connected in a single unit, any crisis in one part of the world has repercussions in other parts, too.

Small and medium-sized…

IndiaMART.com Pushes for Cohesive SME Ecosystem through SME Learning Series

Partners with Smallenterpriseindia.com for the Series

Series aims to bring clear understanding of Finance, HR, IT, Communication, Marketing & other business verticals to SMEs

Roadshows in Delhi, Ghaziabad, Gurgaon, Bangalore & Vadodara receive huge response

New Delhi, 28th May, 2011: Small and Medium Enterprises (SMEs) have been playing a vital role in growth and development of Indian economy. They are credited with generating million of job opportunities every year along with contributing a…

IndiaMART.com Plans Massive SME Awareness Campaign

To be launched in 2-3 weeks, campaign's theme centers on boosting awareness amongst SMEs on the need to go online

- Educate buyers & suppliers on how they can leverage Internet for 24X7 global presence, cost-effective marketing & B2B matchmaking

- Highlight catalyzing role of B2B e-marketplaces like IndiaMART.com in growth of SMEs

- Nation-wide drive to be launched across newspapers, magazines, online, radio, electronic & outdoor media

New Delhi,…