Press release

Polysilicon industry to resume growth in 2013 – Bernreuter Research sees rising demand with new PV installations of 36 GW

Customers praise The 2012 Who's Who of Solar Silicon Production for its high information density and comprehensive market analysis

Polysilicon manufacturers will profit from the slightly accelerating growth of their largest customer, the photovoltaic (PV) industry, which makes up almost 90% of total polysilicon demand. "The global PV market will pick up speed – albeit at a slower pace than we originally assumed," says Johannes Bernreuter, head of Bernreuter Research and author of the global polysilicon market report The 2012 Who's Who of Solar Silicon Production. "We now expect new PV installations to reach 35 to 37 gigawatts (GW) in 2013. China, Japan and the USA will replace Germany and Italy as the PV growth locomotives."

In 2012 the polysilicon industry was plagued by overcapacities and a large inventory of 25,000 MT resulting from a production surplus in 2011. In addition, cash-strapped wafer manufacturers dumped their polysilicon stocks on the spot market in order to retain liquidity. The wave of secondary sales from wafer companies and traders accelerated the slump of the spot price: the average rate for high-purity polysilicon crashed by 47% to a record low of $15.35/kg in 2012 after it had already plummeted by 59% in 2011.

Since September 2011, the severe price decay has forced about 50 polysilicon manufacturers – most of them small and medium enterprises in China – to abandon or suspend production. In the third quarter of 2012, all top producers began to bow to the price pressure as well and reduced the utilization rates of their plants. According to preliminary estimates of Bernreuter Research, the global polysilicon production volume consequently fell to approximately 235,000 MT in 2012, a drop of almost 8% from the output of 255,000 MT in 2011.

"Along with the large inventories and the supply of thin-film modules, those 235,000 MT were nonetheless sufficient for a newly installed PV capacity of 33 to 34 GW worldwide in 2012," says analyst Bernreuter. However, the latest shipment guidance of 13 major public solar module manufacturers points to new installations of only 30 to 31 GW. "The actual result could still be somewhat higher for two reasons: thanks to a better fourth quarter, several of these manufacturers may have exceeded their guidance, and other producers have possibly gained additional market share," explains Bernreuter. "If the markets in China and the US had a strong finish, 31 to 32 GW are possible."

Although polysilicon inventories have not completely been digested yet, the spot price reached a bottom at the turn of the year. An installation rally in Japan ahead of a probable feed-in tariff cut in April, healthy demand for PV systems in China and the introduction of punitive duties on polysilicon imports to China anticipated in February will drive the spot price upwards in the first quarter.

Even if China should impose duty tariffs as high as 50%, as is rumored, Bernreuter Research does not expect a strong revival of the Chinese polysilicon industry. "The manufacturing costs of most producers are still too high and the quality of their product is too low," says Bernreuter. "We assume a lot of foreign polysilicon shipments for Chinese customers will be diverted to wafer manufacturers in Taiwan and then imported as wafers or solar cells to mainland China."

More details on the polysilicon, semiconductor and PV markets are provided in the current report of Bernreuter Research, The 2012 Who's Who of Solar Silicon Production. Customers praise the high information density, comprehensive market analysis and detailed technology assessment of the 100-page report. It is now available for only 990 euros instead of 1,250 euros. For more information on the report, please go to:

http://www.bernreuter.com/en/shop/solar-silicon-reports/2012-edition/report-details.html

Customer Opinions

"The report is comfortably compact with an extremely high density of information and allows targeted reading without wasting time."

Jochen Schneider, CEO of Schmid Silicon Technology GmbH

"The market analysis is very comprehensive and the assessment of the various technologies most informative – the perfect reference for anyone in or aspiring to enter the silicon business."

Prof. Mansoor Barati, Director of the Sustainable Materials Processing Research Lab, University of Toronto

"For our strategic business development, we rely on The 2012 Who's Who of Solar Silicon Production as the most detailed source of information on silicon production technologies."

Jan-Philipp Mai, CEO and Founder of JPM Silicon GmbH

About Bernreuter Research

Bernreuter Research was founded in 2008 by Johannes Bernreuter, one of the most reputable photovoltaic journalists in Germany, to publish global polysilicon market reports. As early as 2001, Bernreuter authored his first analysis of an upcoming polysilicon bottleneck and new production processes. In 2010 Bernreuter Research issued the Basic Edition of The Who's Who of Solar Silicon Production, which industry experts have praised as the most comprehensive and accurate polysilicon report on the market.

Press Contact:

Bernreuter Research – Polysilicon Market Reports

Huttenstr. 10, 97072 Würzburg, Germany

Your Contact Partner:

Johannes Bernreuter, Company Head

Telephone: +49/931/784 77 81

E-mail: info@bernreuter.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polysilicon industry to resume growth in 2013 – Bernreuter Research sees rising demand with new PV installations of 36 GW here

News-ID: 248431 • Views: …

More Releases from BERNREUTER RESEARCH

Top Ten Polysilicon Makers Nearly All Chinese

Wacker will stay in the ranking as only western producer, says Bernreuter Research

Würzburg (Germany), November 25, 2025 - Nine of the world's top ten polysilicon manufacturers are based in China today. "The Chinese polysilicon industry reached a share of 93.5% in the global output of 2024. This dominance is also reflected in the ranking of the world's largest manufacturers," says Johannes Bernreuter, author of the Polysilicon Market Outlook 2029 and…

Polysilicon Industry Is Risking New Shortage

Bernreuter Research: Shutdown of overcapacity could create undersupply by 2028

Würzburg (Germany), June 25, 2025 - The Chinese polysilicon industry will face a difficult balancing act in the next three years. "If too much overcapacity is eliminated, the market could run into a new shortage by 2028," predicts Johannes Bernreuter, head of Bernreuter Research and author of the new Polysilicon Market Outlook 2029 report.

Fueled by the shortage that culminated in a…

PV Installations Will Reach up to 660 GW in 2024

Bernreuter Research: Low module price will fuel demand in the second half of the year

Würzburg (Germany), June 18, 2024 - Global photovoltaic (PV) installations will land in a range of 600 to 660 gigawatts-direct current (GWdc) in 2024, according to the latest analysis from polysilicon market expert Bernreuter Research. "Once market participants come to the conclusion that the crash of the solar module price has reached its bottom, demand will…

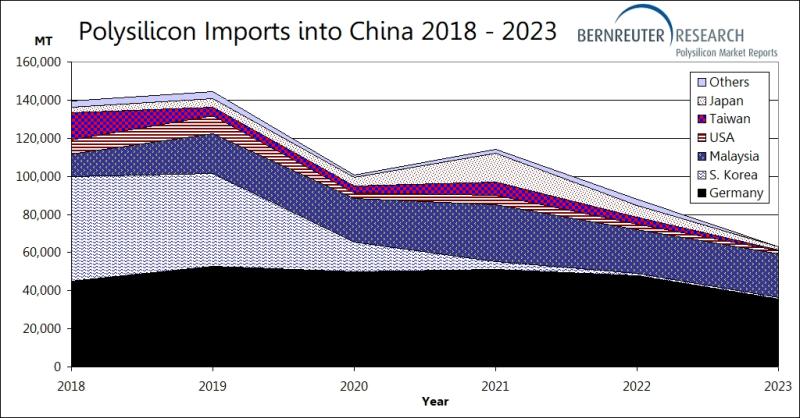

Polysilicon Imports into China Drop to Level of 2011

Bernreuter Research: Non-Chinese producers shift shipments to wafer plants in Vietnam

Würzburg (Germany), February 28, 2024 - Polysilicon imports into China have fallen to the lowest level since 2011. According to Chinese customs statistics, imports of the feedstock for solar cells and semiconductors slumped by 28.5% from 88,093 metric tons (MT) in 2022 to 62,965 MT in 2023. This volume is even slightly less than the 64,614 MT reached in 2011.

"The…

More Releases for Silicon

Silicon Carbide Ceramics and Silicon Nitride Ceramics

Overview of Silicon Carbide Ceramics [https://www.rbsic-sisic.com/wear-resistant-silicon-carbide-ceramic-tiles-3.html]

Silicon carbide ceramics are a new type of ceramic material made mainly from silicon carbide powder through high-temperature sintering. Silicon carbide ceramics have high hardness, wear resistance, corrosion resistance, and excellent high temperature resistance, with excellent mechanical, thermal, and electrical properties. Silicon carbide ceramics can be divided into compacted sintered silicon carbide ceramics and reaction sintered silicon carbide ceramics due to different firing processes.

Overview of…

High Purity Silicon Metal Market Growth Forecast: Latest Research Unveils Opport …

Global High Purity Silicon Metal Market Overview:

Global High Purity Silicon Metal Market Report 2022 comes with the extensive industry analysis by Introspective Market Research with development components, patterns, flows and sizes. The report also calculates present and past market values to forecast potential market management through the forecast period between 2022-2028.

This research study of High Purity Silicon Metal involved the extensive usage of both primary and secondary data sources. This…

Future Prospects of Silicon Rings and Silicon Electrodes for Etching Market by …

The Silicon Rings and Silicon Electrodes for Etching Market research report provides all the information related to the industry. It gives the outlook of the market by giving authentic data to its client which helps to make essential decisions. It gives an overview of the market which includes its definition, applications and developments and manufacturing technology. This Silicon Rings and Silicon Electrodes for Etching market research report tracks all the…

Silicon Metal Market Global Outlook 2021-2026: Ferroglobe, Mississippi Silicon, …

The Global Silicon Metal Market Research Report 2021-2026 is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand, and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Market study provides comprehensive data which enhances the understanding, scope, and application of this report.

The market…

Global Solar Grade Multi-Crystal Silicon Market Leading Major Players – GCL-Po …

Researchmoz added Most up-to-date research on "Global (United States, European Union and China) Solar Grade Multi-Crystal Silicon Market Research Report 2019-2025" to its huge collection of research reports.

The Solar Grade Multi-Crystal Silicon market report [6 Year Forecast 2019-2025] focuses on Major Leading Industry Players, providing info like company profiles, product type, application and regions, production capacity, ex-factory price, gross margin, revenue, market share and speak to info. Upstream raw materials…

Silicon Metal Market 2018: Top Key Players H.C. Starck, Elkem, Zhejiang Kaihua Y …

Silicon Metal Market Status and Forecast 2025

This Write up presents in detail analysis of Silicon Metal Market especially market drivers, challenges, vital trends, standardization, deployment models, opportunities, future roadmap, manufacturer’s case studies, value chain, organization profiles, Sales Price and Sales Revenue, Sales Market Comparison and strategies.

The Silicon Metal market Report provides a detailed analysis of the Silicon Metal industry. It provides an analysis of the past 5 years and a future forecast till the year…