Press release

Fintech Lending Market: Post COVID Growth Opportunity Analysis, Key Players | ZESTFINANCE, AVANT, BRAVIANT HOLDINGS and BOND STREET

According to the report, The global Fintech Lending market size was valued at $310.73 Billion in 2020 and is expected to reach $1927.45 Billion by 2028 growing at the CAGR of 25.08% from 2021 to 2028. One of the main factors driving the growth of the fintech lending market is the increased demand for convenient access to funds by consumers. The fintech lending market has also been witnessing the increasing adoption of Fintech lending solutions by banks, with increased profits and efficiency further contributing towards the growth of the market. Further, the introduction of new technologies is expected to aid the growth of the fintech lending market in the coming years. The fintech lending market is also witnessing the rise in the adoption of various technologies for reducing operational costs, thereby benefiting the market.Request Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005797

Our most recent research on the Global Fintech Lending Market , published by our partner Evolve Business Intelligence, examines the industry in the context of major market aspects including market size & forecasts, key players, SWOT analysis (strengths, weaknesses, opportunities and threats. There are currently several key trends that hold immense potential for driving profits through the industry, but there are also some obstacles that can hinder how successful your business venture will be overall. Market share values are discussed within these sections as well as assumptions regarding current projections for where this particular industry is headed over the upcoming few years.

Research shows that the market is being influenced by a number of different indicators. Specifically, we have identified 4 major indications in our analysis: Drivers, Restraints, Key Trends, and Challenges. The total sum of these sections will help you understand what strategies will be best to adopt in order to prosper through this industry over a few short years. The sum of all these elements will help you understand what strategies to adopt in order to succeed. The quantitative research study that we published as a supplement to it includes our findings out of this research study as well as the actual findings supplemented with further advice for those who want to grasp new opportunities or those who want to plan against threats that might hinder the development of the market.

Impact of COVID-19

The on-going Covid-19 pandemic has had a devastating effect on the market. The industry report on Fintech Lending Market includes financial impacts and market disturbance that have been felt over a long period of time. Our research has interviewed numerous delegates from this industry and got involved in the primary and secondary research to collect information from different delegates from this market across many geographical markets in order to gather data and strategies that will be helpful for addressing potential challenges people might face with COVID-19 pandemic plus its impact on the industry going forward.

The New Normal

During the COVID-19 pandemic, businesses were forced to shift focus on numerous occasions, having to react to crisis after crisis. As businesses recover from the COVID-19 pandemic, they have a lot of new priorities to deal with due to all of the shifting situations throughout this crisis. Throughout this pandemic, they were always trying to cope with changing circumstances and most often fell short of their ultimate goals. Now that the pandemic is subsiding, they will need to recuperate from this by setting forth new objectives for themselves in order to succeed in the future.

In terms of COVID 19 impact, the Fintech Lending Market report also includes the following data points:

• Impact of COVID-19

• Government Aids and Policies for Industry Revival

• Companies Recent Developments to Tackle Negative Impact

• Opportunity Window & Post COVID Trend

For Any Query or Customization, Ask Our Industry Experts@ https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005797

Key Players

Some of the major Fintech Lending Market players holding highest market share include ZESTFINANCE, AVANT, BRAVIANT HOLDINGS and BOND STREET. These players use new product development as a key strategy to gain significant market share to compete with market leaders.

The key players profiled in the report are:

● ZESTFINANCE

● AVANT

● BRAVIANT HOLDINGS

● BOND STREET

● SALT LENDING

● ORCHARD

● EARNEST

● ONDECK

● FUNDERA

● LENDINGCLUB

Segmental Analysis

Market Segment By Type with focus on market share, consumption trend, and growth rate of Fintech Lending Market :

• Digital Payments

• Personal Finance

• Alternative Lending

• Alternative Financing

Market Segment By Application with focus on market share, consumption trend, and growth rate of Fintech Lending Market :

● Business Loans

● Personal Loan

For more information: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=005797

Global Fintech Lending Market Geographic Coverage:

• North America

o US

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Rest of Asia Pacific

• Latin America

o Mexico

o Brazil

o Argentina

o Rest of Latin America

• Middle East & Africa

o Saudi Arabia

o UAE

o Egypt

o South Africa

o Rest of MEA

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Contact: +1 773 644 5507 / +91 635 396 3987

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool – EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune’s global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Lending Market: Post COVID Growth Opportunity Analysis, Key Players | ZESTFINANCE, AVANT, BRAVIANT HOLDINGS and BOND STREET here

News-ID: 2481455 • Views: …

More Releases from Evolve Business Intelligence

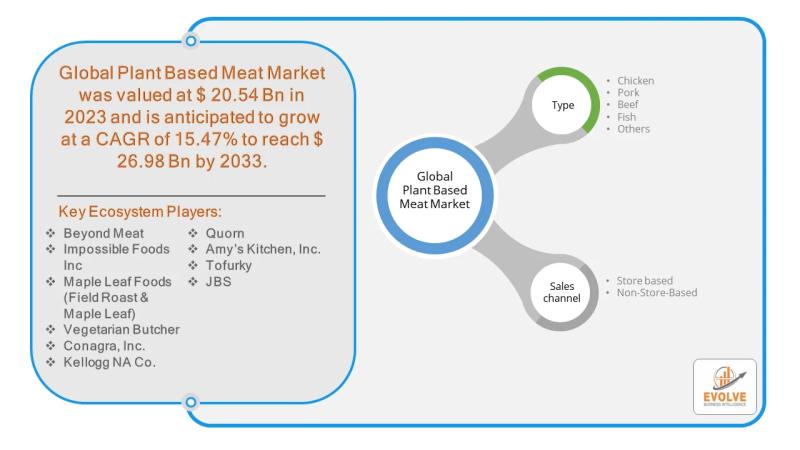

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

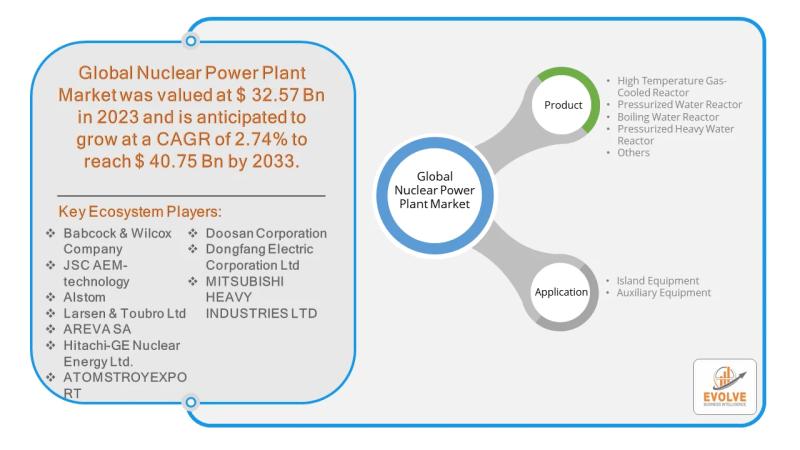

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

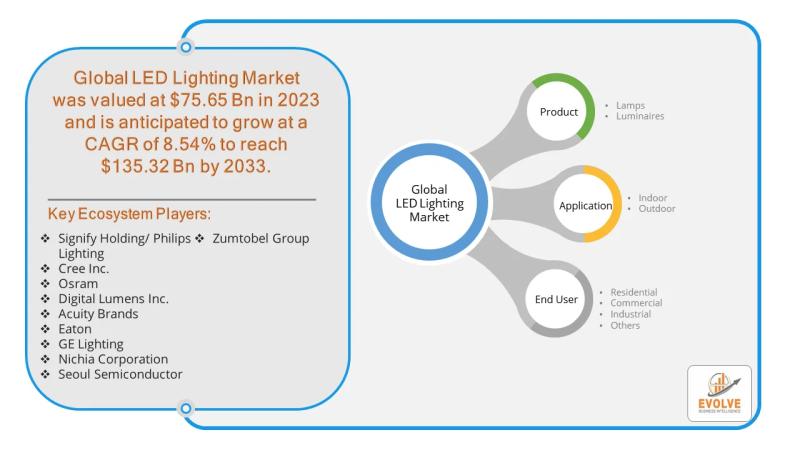

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…