Press release

Digital Lending Platform Market 2021-2026: Global Size, Growth, Trends, Share, Key Players, Outlook and Forecast

As per the latest report by IMARC Group, titled ”Digital Lending Platform Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2021-2026”, the global digital lending platform market exhibited strong growth during 2015-2020. Looking forward, IMARC Group expects the market to grow at a CAGR of around 13% during 2021-2026. A digital lending platform (DLP) is a loan agreement application that allows easy access to financial services and products. This platform primarily relies on mobile applications and web programs for debt management. DLP offers numerous benefits, such as enhanced efficiency, swift decision making, superior loan distribution, a simple application process, etc. At present times, various organizations are launching next-generation devices and end-to-end cloud-based loan granting platforms. Advanced payment patterns are leading financial institutions to adopt DLP to deliver quick services, improve revenue, and enhance productivity.We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

Request Free Sample Report: https://www.imarcgroup.com/digital-lending-platform-market/requestsample

Digital Lending Platform Market Trends:

The growing adoption of DLP in the banking, financial services, and insurance (BFSI) industry and the increasing demand for online banking services are driving the digital lending platform market. Moreover, due to the outbreak of COVID-19 pandemic, digital channels are being increasingly adopted by financial institutions to lend loans and resolve numerous challenges. Additionally, there is an escalating emphasis on digital automation and a rise in the utilization of various technologies, such as machine learning, data analytics, blockchain, artificial intelligence, etc., to avoid frauds. Besides this, DLP offers e-signing, easy accessibility, and minimum paperwork, which is catering to the growing internet penetration and elevating dependence on smartphones. This, in turn, is projected to catalyze the global market for digital lending platform in the coming years.

Explore Full Report with TOC & List of Figure: https://www.imarcgroup.com/digital-lending-platform-market

Key Market Segmentation:

Competitive Landscape:

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

• Black Knight Inc.

• Finastra

• FIS

• Fiserv Inc.

• Intellect Design Arena Ltd

• Intercontinental Exchange Inc.

• Nucleus Software Exports Ltd.

• Pegasystems Inc.

• Roostify Inc.

• Tavant Technologies and Wipro Limited

Breakup by Type:

• Loan Origination

• Decision Automation

• Collections and Recovery

• Risk and Compliance Management

• Others

Breakup by Component:

• Solutions

• Services

Breakup by Deployment Model:

• On-premises

• Cloud-based

Breakup by Industry Vertical:

• Banks

• Insurance Companies

• Credit Unions

• Savings and Loan Associations

• Peer-to-Peer Lending

• Others

Breakup by Region:

• Middle East and Africa

• North America

• Asia-Pacific

• Europe

• Latin America

Key highlights of the Report:

• Market Performance (2015-2020)

• Market Outlook (2021-2026)

• Porter’s Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Contact US:

IMARC Group

30 N Gould St Ste R

Sheridan, WY 82801 USA – Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market 2021-2026: Global Size, Growth, Trends, Share, Key Players, Outlook and Forecast here

News-ID: 2458065 • Views: …

More Releases from IMARC

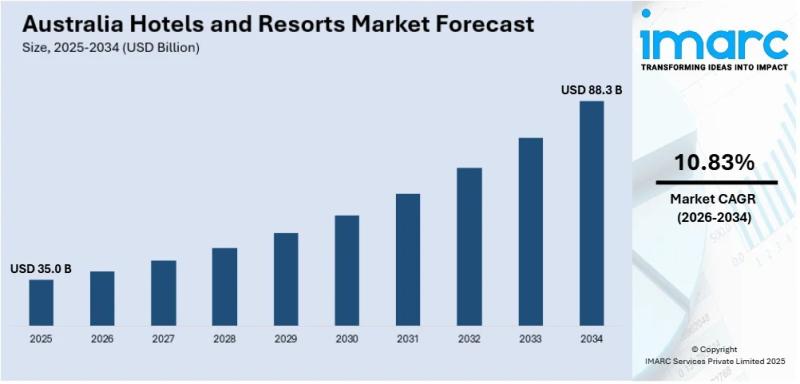

Australia Hotels and Resorts Market Projected to Reach USD 82.80 Billion by 2033

Market Overview

The Australia hotels and resorts market size reached USD 31.40 Billion in 2024 and is projected to expand at a CAGR of 11.40 % during 2025-2033, reaching approximately USD 82.80 Billion by 2033. Market growth is driven by rising domestic and international tourism, increasing disposable incomes, and greater investment in luxury, experiential, and eco-friendly accommodations. The surge in travel demand has led to heightened occupancy rates and average daily…

India Perfume Market Strategic Outlook Report: Growth Drivers, Value Pools & Com …

India Perfume Market 2025-2033

According to IMARC Group's report titled "India Perfume Market Report by Perfume Type (Premium, Mass), End User (Female, Male, Unisex), and Region 2025-2033", this report provides a structured assessment of the factors shaping the India perfume market through 2033. It outlines the sector's core growth drivers, emerging value pools, and the evolving competitive landscape. The analysis supports decision-makers in evaluating demand patterns, margin opportunities, and competitive positioning…

How to Start a Wine Tasting Events Business: Market Trends, Investment Requireme …

Overview

IMARC Group's "Wine Tasting Events Business Plan and Project Report 2025" provides a comprehensive framework for establishing and operating a successful wine tasting events business. This in-depth report analyzes key market trends, investment opportunities, operational models, revenue streams, and financial projections, offering actionable insights for entrepreneurs, hospitality brands, event organizers, wineries, and investors.

Whether launching a new experiential events venture or expanding an existing hospitality or lifestyle business, this report delivers…

India Luxury Fashion Industry Size, Share, Growth Trends, Top Brands & Market Ou …

According to the latest report by IMARC Group, titled "India Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033," the report presents a thorough review featuring the India luxury fashion market share, size, growth, trends, and research of the industry.

India Luxury Fashion Market Overview

The India luxury fashion market size reached USD 9.37 Billion in 2024. It is expected to grow…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…