Press release

2021 Open Banking Market Report: Business Outlook, CAGR Status, Upcoming Trends, Recent Changes, And Forecast

Open Banking Global Market Report 2021 – COVID-19 Implications And Growth by The Business Research Company is the most comprehensive report available on this market, with analysis of the market’s historic and forecast growth, drivers and restraints causing this, and highlights of the opportunities that companies in the industry can take on. The market research report helps gain a truly global perspective of the open banking industry as it covers 60 geographies. Regional and country breakdowns give an analysis of the market in each geography, with information on the size of the market by region and by country.The countries covered in the global open banking market are Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, Mexico, Netherlands, New Zealand, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Turkey, UAE, UK, USA, Venezuela, Vietnam.

The regions covered in the global open banking market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Know What You Need? Directly Purchase The Report Here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=5446

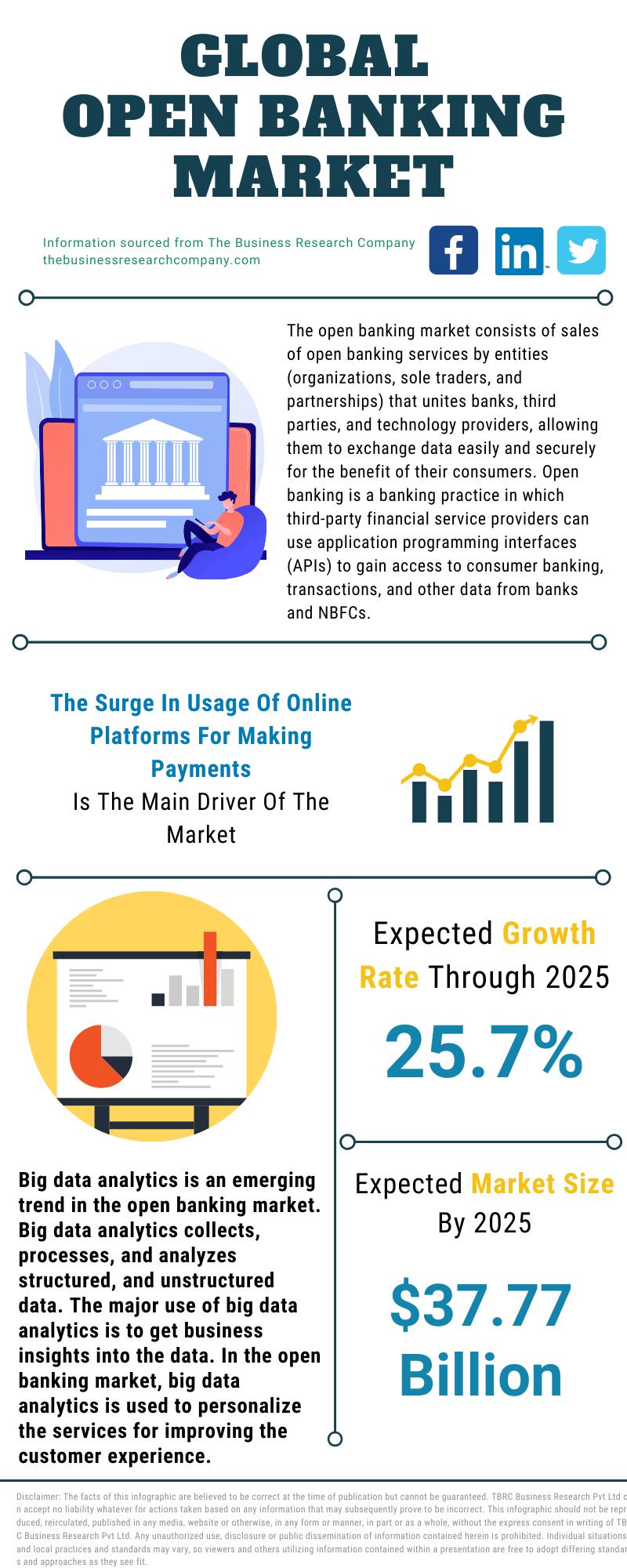

The open banking market consists of sales of open banking services by entities (organizations, sole traders, and partnerships) that unites banks, third parties, and technology providers, allowing them to exchange data easily and securely for the benefit of their consumers. Open banking is a banking practice in which third-party financial service providers can use application programming interfaces (APIs) to gain access to consumer banking, transactions, and other data from banks and NBFCs. These APIs deliver a secure way to share financial information between two parties and makes it easier for consumers to compare the details of current accounts and other banking services.

The global open banking market is expected to grow from $11.79 billion in 2020 to $15.13 billion in 2021 at a compound annual growth rate (CAGR) of 28.4%. The change in the growth trend of the open banking market is mainly due to the companies stabilizing their output after catering to the demand that grew exponentially during the COVID-19 pandemic in 2020. The open banking market is expected to reach $37.77 billion in 2025 at a CAGR of 25.7%.

Request For A Sample Of The Open Banking Market Report Here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=5446&type=smp

Global open banking market segmentation in TBRC’s report is:

1) By Service Type: Transactional Services, Communicative Services, Information Services

2) By Financial Services: Bank And Capital Markets, Payments, Digital Currencies, Value Added Services

3) By Deployment Type: Cloud, On-Premises, Hybrid

4) By Distribution Channel: Bank Channels, App Market, Distributors, Aggregators

Major players in the open banking market are Capital One, HSBC Bank plc, Banco Bilbao Vizcaya Argentaria S.A, NatWest Group plc, DBS Bank, Barclays, Lloyds Banking Group, Citigroup, Banco Santander S.A., Credit Agricole, NCR Corporation, DemystData, Figo GmbH, Finastra, Jack Henry & Associates Inc., and MineralTree Inc.

Need More? Read Further On The Open Banking Market Here:

https://www.thebusinessresearchcompany.com/report/open-banking-global-market-report

The Table of Contents includes:

1. Executive Summary

2. Open Banking Market Characteristics

3. Open Banking Market Trends And Strategies

4. Impact Of COVID-19 On Open Banking

5. Open Banking Market Size And Growth

.....

27. Open Banking Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Open Banking Market

29. Open Banking Market Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow us on LinkedIn: https://in.linkedin.com/company/the-business-research-company

Follow us on Twitter: https://twitter.com/tbrc_info

Check out our Blog: http://blog.tbrc.info/

Check out our Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Interested to know more about The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. Located globally, it has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services, chemicals, and technology.

Get a glimpse of our services here: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

The World’s Most Comprehensive Database

The Business Research Company’s flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2021 Open Banking Market Report: Business Outlook, CAGR Status, Upcoming Trends, Recent Changes, And Forecast here

News-ID: 2456441 • Views: …

More Releases from The Business research company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…