Press release

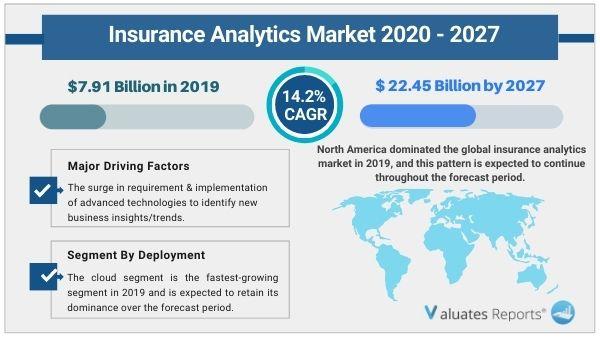

Insurance Analytics Market To Reach USD 22.45 Billion By 2027 Growing at a CAGR of 14.2% - Valuates Reports

The global Insurance Analytics Market size was valued at USD 7.91 billion in 2019 and is projected to reach USD 22.45 billion by 2027, growing at a CAGR of 14.2% from 2020 to 2027.The major factor driving the insurance analytics market are:

The surge in requirement & implementation of advanced technologies to identify new business insights/trends to unlock new value-added services to customers and reduce operational cost.

Insurance analytics optimizes customer relationship processes and uses predictive analytics in insurance models to create reliable reports across several product lines.

Risk assessment features of analytics are helping the insurers in predicting the cost of insurance associated with the coverage and reduce uncertainty in the business

View Full Report: https://reports.valuates.com/market-reports/ALLI-Manu-4N44/insurance-analytics

TRENDS INFLUENCING THE INSURANCE ANALYTICS MARKET SIZE

Companies are being encouraged to update their current business model, streamline operations, and improve processes as the market becomes more competitive. This rise in competition in the insurance landscape is expected to increase the growth of the insurance analytics market. Insurance analytics is a collection of resources and software that can be used to process and analyze data in order to create information that can be used to make better decisions.

Companies are focused on optimizing customer service and providing solutions based on a deep understanding of customer behavior and needs. Thus the demand for providing an improved customer experience by providing value-added service is expected to drive the insurance analytics market. The insurers can revise and redevelop new strategies and products based on consumer behavioral data, potentially increasing market sales performance.

Analytics can also enable insurers to provide tools & solutions to distributors or agents to help them find new market opportunities and serve existing customers. These solutions also allow businesses to reduce total customer handling costs and time. This feature of analytics is expected to drive the growth of the insurance analytics market size.

Insurers all over the world are concerned about rising insurance costs. The analytics, on the other hand, aid insurers in risk management by estimating the cost of insurance associated with a given coverage. Furthermore, analytics help to reduce losses by identifying and preventing fraudulent activity.

The rising need for big data and predictive modeling capability during the COVID-19 pandemic drives the adoption of insurance analytics tools. The potential of predictive modeling in insurance software will aid in the more effective definition and delivery of rate increases and new products. Insurers can gain useful insights from predictive analytics and big data by predicting consumer behavior and supporting underwriting processes.

Inquire For Sample: https://reports.valuates.com/request/sample/ALLI-Manu-4N44/Insurance_Analytics_Market

Inquire For Regional Reports: https://reports.valuates.com/request/regional/ALLI-Manu-4N44/Insurance_Analytics_Market

KEY MARKET SEGMENTS

By Component

- Solution

- Service

-

By Deployment type

- On-premises

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Claims Management

- Risk Management

- Customer Management

- Sales & Marketing

- Others

By End User

- Insurance Companies

- Government Agencies

- Third-party Administrators, Brokers & - -

- Consultancies

By Region

- North America

- Europe

- Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players

- Applied Systems

- BM Corp.

- Microsoft

- Open Text Corporation

- Oracle

- Pegasystems Inc.

- salesforce.com inc.

- SAP SE

- SAS Institute Inc.

- Vertafore, Inc.

SIMILAR REPORTS

Insurance Big Data Analytics Market -

https://reports.valuates.com/market-reports/QYRE-Auto-36L2669/global-insurance-big-data-analytics

IoT Insurance Market -

https://reports.valuates.com/market-reports/QYRE-Auto-11U2357/global-iot-insurance

Digital Innovation in Insurance Market -

https://reports.valuates.com/market-reports/QYRE-Auto-17J2376/global-digital-innovation-in-insurance

Insurance Analytics Software Market -

https://reports.valuates.com/market-reports/QYRE-Auto-12L2586/covid-19-impact-on-global-insurance-analytics-software

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call +1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp : +91 9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Linkedin - https://in.linkedin.com/company/valuatesreports

Facebook - https://www.facebook.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

Our team of market analysts can help you select the best report covering your industry. We understand your niche region-specific requirements and that's why we offer customization of reports. With our customization in place, you can request for any particular information from a report that meets your market analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market To Reach USD 22.45 Billion By 2027 Growing at a CAGR of 14.2% - Valuates Reports here

News-ID: 2449982 • Views: …

More Releases from Valuates Reports

Epoxy Molding Compound in Semiconductor Packaging Market Grows as Advanced Packa …

Epoxy Molding Compound in Semiconductor Packaging Market Size

The global market for semiconductor was estimated at US$ 579 billion in the year 2022, is projected to US$ 790 billion by 2029, growing at a CAGR of 6% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-25C10139/Global_Epoxy_Molding_Compound_in_Semiconductor_Packaging_Market_Research_Report_2022

By Type

• Normal Epoxy Molding Compound

• Green Epoxy Molding Compound

By Application

• Advanced Packaging

• Traditional Packaging

Key Companies

Sumitomo Bakelite, Nitto Denko, Resonac, Shin-Etsu Chemical, KCC, NEPES, CHANG CHUN SB(CHANGSHU), Hysol Huawei Electronics, Jiangsu Huahai…

Advanced Packaging Inspection Systems Market Accelerates as Semiconductor Packag …

Advanced Packaging Inspection Systems Market Size

In 2024, the global market size of Advanced Packaging Inspection Systems was estimated to be worth US$ 456 million and is forecast to reach approximately US$ 853 million by 2031 with a CAGR of 9.5% during the forecast period 2025-2031.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10W9117/Global_Advanced_Packaging_Inspection_Systems_Market_Outlook_2022

By Application

• IDM

• OSAT

Key Companies

Camtek, Onto Innovation, KLA, Intekplus, Cohu, Semiconductor Technologies & Instruments (STI), Segment by Power, Optical Based Packaging Inspection Systems, Infrared Packaging…

Aseptic Packaging Market Expands Globally as Demand for Safe, Shelf-Stable Food …

Aseptic Packaging Market Size

The global Aseptic Packaging revenue was US$ 14560 million in 2022 and is forecast to a readjusted size of US$ 18490 million by 2029 with a CAGR of 3.0% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-27M15709/Global_and_India_Aseptic_Packaging_Market_Report_Forecast_2023_2029

By Type

• Brick Shape

• Pillow Shape

• Octagon Shape

By Application

• Dairy Products

• Beverage & Drinks

Key Companies

Tetra Pak, SIG, Elopak, Greatview, Xinjufeng Pack, Lamipack, SEMCORP, ipack, Bihai, Coesia IPI, Jielong Yongfa, Yingsheng

Major Trends

• Increasing adoption of aseptic formats for…

Quartz Ingot Market Expands as Semiconductor and Photovoltaic Industries Drive D …

Quartz Ingot Market

The global market for Quartz Ingot was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-1W9577/Global_Quartz_Ingot_Market_Research_Report_2022

By Type

• Square Quartz Ingot

• Round Quartz Ingot

By Application

• Semiconductor

• Photovoltaic

• Optical Materials

Key Companies

Heraeus, Feilihua, Tosoh Silica Corporation, Pacific Quartz, SUMCO, MicroChemicals, CNBM Quzhou Jinglan Quartz, Dongfang Quartz Glass, Lianyungang Taosheng Fused Quartz, East…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…