Press release

What is Work Opportunity Tax Credit (WOTC), Should you apply for WOTC?

WOTC which stands for work opportunity tax credit is a federal tax credit that is available to all the employers who retain and hire qualified veterans and other individuals from certain groups that have historically faced employment barriers. By creating economic opportunities, this program also helps lessen the burden on other government assistance programs.The WOTC (work opportunity tax credit) is jointly administered through the Internal Revenue Service (IRS) by the U.S. Treasury and the Department of Labor (DOL). The Internal Revenue Service (IRS) is responsible for claiming the credit by managing tax-related requirements while the Department of Labor (DOL) grants policy guidance and funding to state agencies that look after the certification process for work opportunity tax credit.

Read the complete blog on What is Work Opportunity Tax Credit (WOTC), Should you apply for WOTC? here:-

https://www.nsktglobal.com/what-is-work-opportunity-tax-credit-wotc-should-you-apply-for-wotc-

Types of employees eligible for Work Opportunity Tax Credit

An employer can only take the advantage of the Work Opportunity Tax Credit if they hire employees from certain targeted groups such as:

Individuals who receive temporary assistance for needy families (TANF) benefits under Part A, Title IV of the Social Security Act

Qualified veterans, including those receiving supplemental nutrition assistance program (SNAP) benefits, those who are unemployed, and those who are unemployed and entitled to compensation from a service-connected disability

Qualified ex-felons

Designated community residents who are at least 18 and under 40 and live in an empowerment zone, enterprise community, or renewal community

Individuals with physical or mental disabilities who have been referred for work after completing rehabilitative services

Summer youth employees

Supplemental nutrition assistance program (SNAP) recipients

Supplemental Security Income (SSI) recipients

Long-term family assistance recipients

Qualified long-term unemployment recipients

Read Work Opportunity Tax Credit Questionnaire

Here-

https://www.nsktglobal.com/what-is-work-opportunity-tax-credit-wotc-should-you-apply-for-wotc-

Which businesses are eligible for the Work Opportunity Tax Credit?

Any business, irrespective of the industry and size is eligible for the Work Opportunity Tax Credit under the program. And there is also no limit for the number of employees a business can hire for being eligible for the Work Opportunity Tax Credit program. And apart from all this, there is no cap set for the amount of credits that can be claimed by the business under the Work Opportunity Tax Credit program.

How can we calculate WOTC?

The amount of the WOTC is calculated as a percentage of qualified wages paid to an eligible worker during the eligible employee’s first year of employment. An employer may claim a credit equal to 40% of the eligible employee’s qualified wages if the eligible worker works at least 400 hours during the first year of employment. If the eligible employee works fewer than 400 hours but at least 120 hours, the employer may claim a credit equal to 25% of the eligible employee’s wages. If the eligible employee works fewer than 120 hours, an employer may not claim the WOTC.

Read How to claim the Work Opportunity Tax Credit for an Employee

Here

https://www.nsktglobal.com/what-is-work-opportunity-tax-credit-wotc-should-you-apply-for-wotc-

How can Nskt global help?

NSKT Global is one of the top consulting firms which provides services of Work Opportunity Tax Credit. We at NSKT Global help in clearing the screening for the WOTC and improving compliance rate and simply data collection. We help save time and reduce the stress of the client who wishes to apply for the WOTC. We also offer benchmarking and analytics tools that can help employers forecast their tax credits.

Get FREE 20 min Tax Consultation to better understand what WOTC is

here

https://www.nsktglobal.com/usa/contact-us.php

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What is Work Opportunity Tax Credit (WOTC), Should you apply for WOTC? here

News-ID: 2448586 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

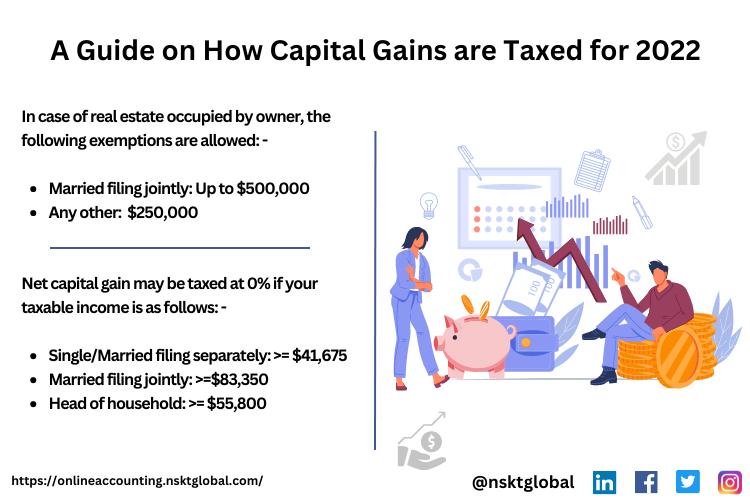

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

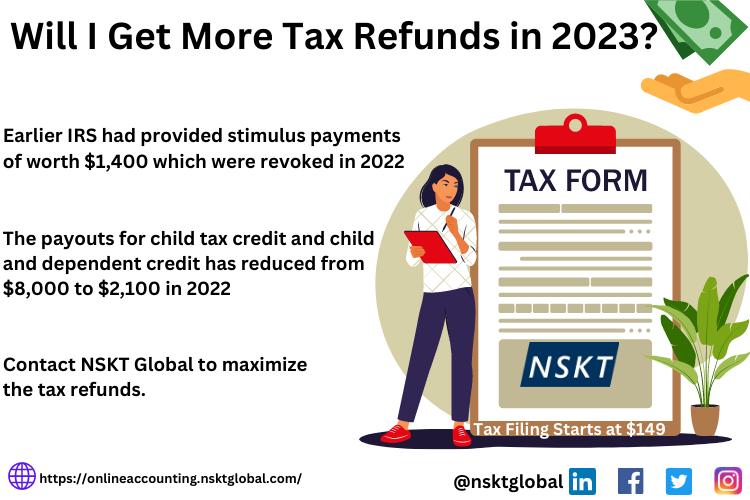

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for WOTC

Tax Credit Surge: Federal Incentives Give Employers a Fresh Edge with WOTC

A new wave of hiring incentives is making headlines: the federal Work Opportunity Tax Credit (WOTC) offers businesses a direct path to reduce their federal liability-up to $9,600 for every eligible person hired. Strict new IRS requirements have changed the game. Employers leaning into digital screening, automated forms, and precise tracking are leading the pack. With Congress debating the future of these credits, timing and compliance have never mattered more.

WOTC…

PocketFans Debuts Exclusive Signature Series Collector Box Showcasing Signed Pok …

Image: https://www.abnewswire.com/upload/2025/08/6bded02b5cfabe062e1fbac788d3326e.jpg

LOS ANGELES, CA - 13 August, 2025 - PocketFans, Inc. is proud to announce the soft launch of its highly anticipated Signature Series Collector Box - a new product created for Pokemon fans and collectors seeking verified, display-worthy autographs from the official English voice actors who brought beloved characters to life.

The limited-edition collector box will officially debut on September 12, offering fans a chance to own a piece of…

PocketFans Launches Signature Series Collector Box Featuring Signed Pokemon Card …

Image: https://www.abnewswire.com/upload/2025/08/267a39890d1b557a75fc587893c76679.jpg

LOS ANGELES, CA - 12 August, 2025 - PocketFans, Inc. is proud to announce the soft launch of its highly anticipated Signature Series Collector Box - a new product created for Pokemon fans and collectors seeking verified, display-worthy autographs from the official English voice actors who brought beloved characters to life.

The limited-edition collector box will officially debut on September 12, offering fans a chance to own a piece…

TaxIncentiveGenius.com Helps Business Owners Recover Hidden Cash with Proven Tax …

Discover hidden tax credits and incentives your CPA may have missed - all in under two minutes, with zero cost, zero risk, and no disruption.

In today's economic climate, cash flow challenges are one of the most common obstacles businesses face. While many business owners turn to loans or increased sales to stay afloat, a growing number are discovering a smarter, faster way to recover money they've already earned. TaxIncentiveGenius.com is…

Linda Jensen, Certified Exit Planning Advisor (CEPA), Launches New Website to Pr …

Image: https://authoritypresswire.com/wp-content/uploads/2024/10/2024_update_Linda_Jensen-removebg-preview.png

Increase Business Profits [https://increasebusinessprofits.com/] offers business owners tax strategies to maximize growth and drive success.

Business owners and entrepreneurs seeking to optimize profits and scale their enterprises have a new ally in renowned business expert Linda Jensen. Jensen has officially announced the launch of IncreaseBusinessProfits.com, a cutting-edge online platform designed to provide actionable tools, insights, and strategies to help businesses thrive in today's competitive market.

Linda Jensen, a recognized authority in…

Work Opportunity Tax Credit Services Market Global Industry Size, Growth Analysi …

The report includes an in-depth study of the global Work Opportunity Tax Credit Services market, where segments and sub-segments are analyzed in quite detail. This research will help players focus on high growth segments and modify their business strategy, if needed. The Work Opportunity Tax Credit Services market is segmented based on type, application and geography. The regional segmentation research presented in the report provides players with valuable insights and…