Press release

Investor ESG Software Market is Anticipated to Surge with an Impressive CAGR of 15.8% During 2021- 2031

Investor ESG Software Market: IntroductionTransparency Market Research delivers key insights on the global investor ESG software market. In terms of revenue, the global investor ESG software market is estimated to expand at a CAGR of 15.8% during the forecast period, owing to numerous factors, regarding which TMR offers thorough insights and forecasts in its report on the global investor ESG software market.

Investor environment, social, and governance (ESG) software solutions are a Software-as-a-Service platform that enable energy companies to achieve greater value, optimize ESG programs, and understand their performance risks. With this tool, companies can prevent and mitigate business behavior risks related to their operations, assets, and investments.

The ESG investment has grown significantly in recent years as corporations, investors, governments, and a wide variety of stakeholders seek to address critical issues such as environmental damage, climate change, discrimination, and social inequality. Hence, the adoption of investor ESG software is expected to increase, which is likely to propel the investor ESG software market in the upcoming years.

Request a Sample –

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82082

Investor ESG Software Market: Dynamics

Organizations must measure and report on their environmental performance and compliance with corporate social responsibility (CSR) and environmental, social, and governance (ESG) principles in today’s world. Businesses must also follow EHS regulations in the jurisdictions where they operate. While most environmental regulations have been in place for over a half-century, the collection and reporting of sustainability, CSR, and ESG data is relatively new and is quickly becoming an integral part of annual business reports. This increases the demand for investor ESG software.

Organizations suffer when their domain experts and others rely on outdated, manual processes to meet growing reporting needs. Hence, the demand for investor ESG software is expected to increase in the near future.

The increasing adoption of investor ESG software in the industrial sector is expected to propel the market during the forecast period.

Investor ESG Software Market: Prominent Regions

North America is a hub for new technologies and innovations. In North America, most of the institutional investment community is expected to make ESG their number one priority during the forecast period. Moreover, the increasing adoption of cloud-based solutions is anticipated to boost the investor ESG software market. In Europe, several new entrants and start-ups have entered the investor ESG market due to the increasing demand for cost-effective ESG software among organizations. Europe offers significant opportunities in the ESG software market as per the current market scenario. Europe (EU) is anticipated to hold the largest share of the investor ESG software market. The software segment held a major share of the investor ESG software market in 2020. It is likely to maintain its dominant position during the forecast period. Increasing government and central bank support to industries and organizations is projected to propel the investor ESG software market in the region. For instance, in June 2019, the European Commission published new guidelines on reporting climate-related information.

Buy Our Premium Research Report@

https://www.transparencymarketresearch.com/checkout.php?rep_id=82082<ype=S

The investor ESG software market in Asia Pacific is projected to expand at a robust pace during the forecast period. The rapid adoption of cloud technology is observed in Asia Pacific in the past few years. In the region, large enterprises are expected to adopt investor ESG software solutions at a higher rate during the forecast period. South America and Middle East & Africa are expected to be high growth potential regions of the global investor ESG software market during the forecast period.

Investor ESG Software Market: Key Players

Key players operating in the global investor ESG software market are Emex Software Ltd, Dynamo Software, Inc., Locus Technologies, Envizi, Fincite Gmbh, Greenstone+ Ltd., Wolters Kluwer NV, Intelex Technologies, ULC, IsoMetrix Software, Ltd., Cority Software Inc., OpenInvest, EnHelix Software, Workiva Inc., Vervantis Inc., Sphera Solutions, Inc., Diligent Corporation, Novisto Inc., Prentiss Smith & Company, Inc., EKA Software Solutions, and Dynamo Software, Inc.

Contact

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com/

About Us

Transparency Market Research is a global market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investor ESG Software Market is Anticipated to Surge with an Impressive CAGR of 15.8% During 2021- 2031 here

News-ID: 2405006 • Views: …

More Releases from Transparency Market Research

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

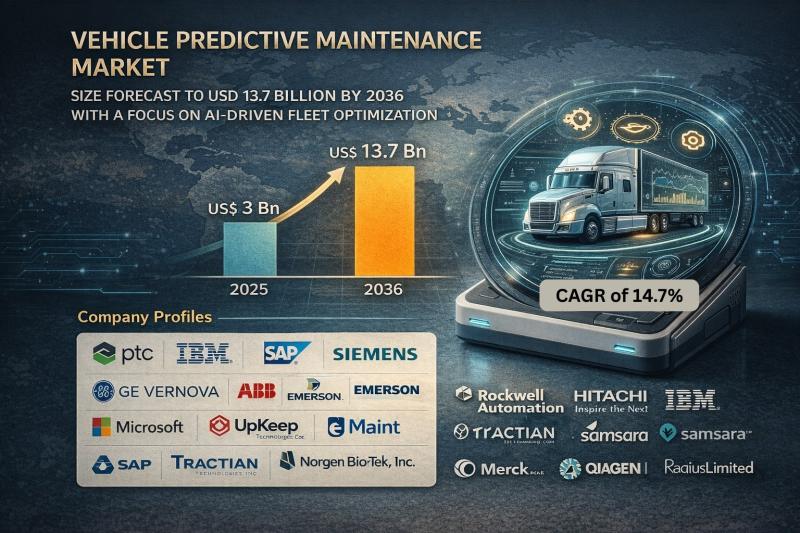

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

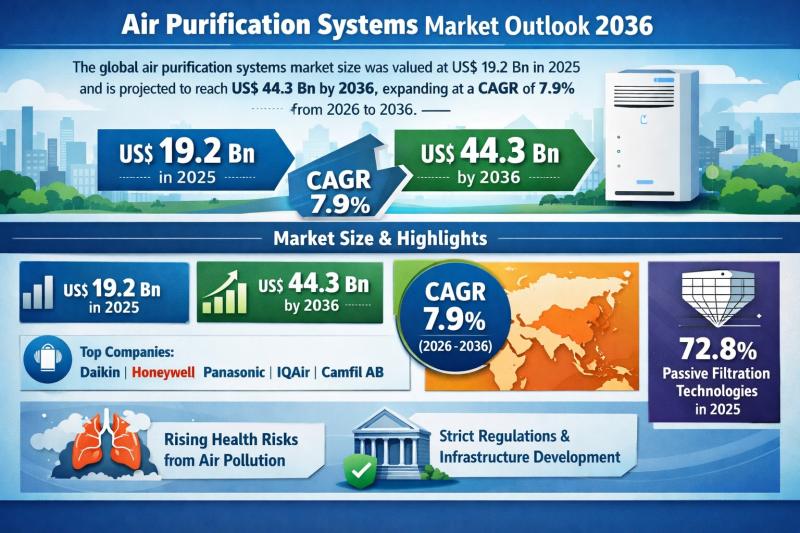

Global Air Purification Systems Market to Reach USD 44.3 Billion by 2036 at 7.9% …

The global Air Purification Systems Market was valued at US$ 19.2 Bn in 2025 and is projected to expand to US$ 44.3 Bn by 2036, registering a compound annual growth rate (CAGR) of 7.9% from 2026 to 2036. The market's upward trajectory reflects the structural shift in indoor air quality (IAQ) management, moving from discretionary consumer spending to mission-critical infrastructure investment.

With historical data available from 2021 to 2024, the industry…

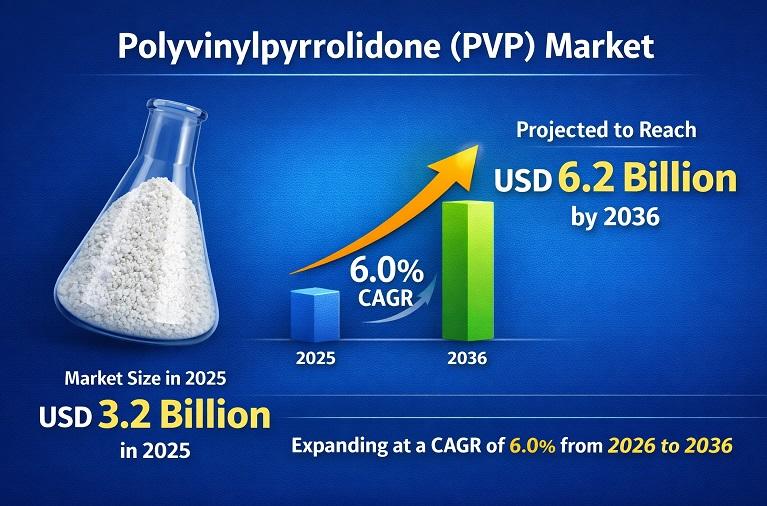

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…