Press release

Europe Sales Tax Software Market 2021 Best Workable Strategy That Will Help to Boost your Revenue Till 2028 | APEX Analytix, Avalara, Inc.Ryan, LLC, The Sage Group Plc, Sovos Compliance LLC and Taxjar

Business market insights Latest update on “Europe Sales Tax Software Market” Analysis, Europe Sales Tax Software market growth analysis and Projection by – 2028. This report is highly predictive as it holds the overall market analysis of topmost companies into the Europe Sales Tax Software industry. With the classified Europe Sales Tax Software market research based on various growing regions this report provide leading players portfolio along with sales, growth, market share and so on.The Market research report on Europe Sales Tax Software has integrated the analysis of different factors that boost the Europe Sales Tax Software market’s growth. It establishes trends, restraints and drivers that transform the Europe Sales Tax Software market in either a positive or negative manner. The detailed information is based on current Europe Sales Tax Software market trends and historic achievements.

To Know How COVID-19 Pandemic Will Impact Europe Sales Tax Software Market | Get a Sample Copy of Report, Click Here: https://www.businessmarketinsights.com/new-sample/BMINEW01656

This section of the report cover identifies various key manufacturers of the Europe Sales Tax Software market. It helps the reader understand the strategies and associations that players are focusing on combat competition in the Europe Sales Tax Software market. The Analysis report on Europe Sales Tax Software Market provides a significant in-depth analysis of the market.

The market report incorporates the key market players –

• APEX Analytix

• Avalara, Inc.

• Ryan, LLC

• The Sage Group Plc

• Sovos Compliance LLC

• Taxjar

• Thomson Reuters Corporation

• Vertex, Inc.

• Wolters Kluwer (CCH Incorporated)

• Xero Limited

Our Research Specialist Analyses Research Methodology overview including Primary Research, Secondary Research, Company Share Analysis, Model ( including Demographic data, Macro-economic indicators, and Industry indicators: Expenditure, infrastructure, sector growth, and facilities ), Research Limitations and Revenue Based Modeling. Company share analysis is used to derive the size of the Europe Sales Tax Software market. As well as a study of revenues of companies for the last three to five years also provides the base for forecasting the market size (2021-2028) and its growth rate. Porter’s Five Forces Analysis, impact analysis of covid-19 and SWOT Analysis are also mentioned to understand the factors impacting consumer and supplier behavior.

Production Analysis:

SWOT analysis of major key players of Flexible Paper Packaging industry based on a Strengths, Weaknesses, company’s internal & external environments, Opportunities and Threats. It also includes Production, Revenue and average product price and market shares of key players. Those data are further drilled down with Manufacturing Base Distribution, Production Area and Product Type. Major points like Competitive Situation and Trends, Concentration Rate Mergers & Acquisitions, Expansion which are vital information to grow/establish a business is also provided.

Get PDF Sample Report Copy for Your Research: https://www.businessmarketinsights.com/new-sample/BMINEW01656

Europe Sales Tax Software Market 2021-2028: Key Highlights

• CAGR of the market during the forecast period 2021-2028.

• Detailed data on factors that will help Europe Sales Tax Software Market development during the following five years.

• Assessment of the Europe Sales Tax Software market size and its commitment to the parent market.

• Forecasts on forthcoming patterns and changes in purchaser conduct.

• The development of the Europe Sales Tax Software Market.

• Analysis of the market’s serious scene and definite data on vendors.

• Comprehensive details of components that will challenge the development of Europe Sales Tax Software market vendors.

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team (sales@businessmarketinsights.com), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on UK: +442081254005 to share your research requirements.

Contact US:

Business Market Insights

Phone: +442081254005

E-Mail ID: sales@businessmarketinsights.com

Web URL: https://www.businessmarketinsights.com/

LinkedIn URL: https://www.linkedin.com/company/business-market-insights/

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Sales Tax Software Market 2021 Best Workable Strategy That Will Help to Boost your Revenue Till 2028 | APEX Analytix, Avalara, Inc.Ryan, LLC, The Sage Group Plc, Sovos Compliance LLC and Taxjar here

News-ID: 2402356 • Views: …

More Releases from business market insights

Laser Hair Removal Market Accelerates as Innovation, Consumer Awareness, and Aes …

The laser hair removal market is undergoing a transformative phase as evolving beauty standards, rapid technological innovation, and increasing preference for non-invasive aesthetic treatments continue to reshape the global personal care and dermatology landscape. Once considered a premium cosmetic procedure, laser hair removal is now becoming an integral part of modern grooming routines across diverse age groups and demographics.

Driven by continuous improvements in laser technology, treatment comfort, and customization capabilities,…

Veterinary Imaging Market Poised for Sustainable Growth Amid Rising Pet Humaniza …

The Global Veterinary Imaging Market continues its trajectory of steady, innovation-led expansion, fueled by rising adoption of advanced diagnostic solutions, deepening pet humanization trends, and escalating veterinary healthcare awareness worldwide. With significant developments reported in both technology adoption and service delivery, the veterinary imaging landscape is advancing to meet growing demand for higher diagnostic precision, faster clinical decision-making, and improved animal patient outcomes.

Veterinary imaging solutions - spanning X-ray, ultrasound,…

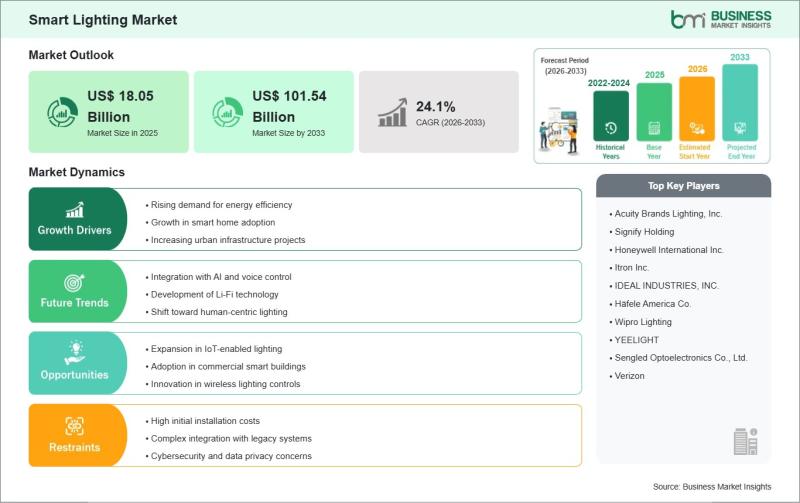

Smart Lighting Market to Skyrocket to US$101.54 Billion by 2033 from US$18.05 Bi …

The Smart Lighting Market is transforming everyday spaces into energy-efficient havens, powered by IoT, AI, and wireless controls that adapt to user needs and environments. Homeowners and businesses alike are discovering how connected bulbs and fixtures enhance ambiance while slashing energy use. The Smart Lighting Market size is expected to reach US$ 101.54 billion by 2033 from US$ 18.05 billion in 2025. The market is estimated to record a CAGR…

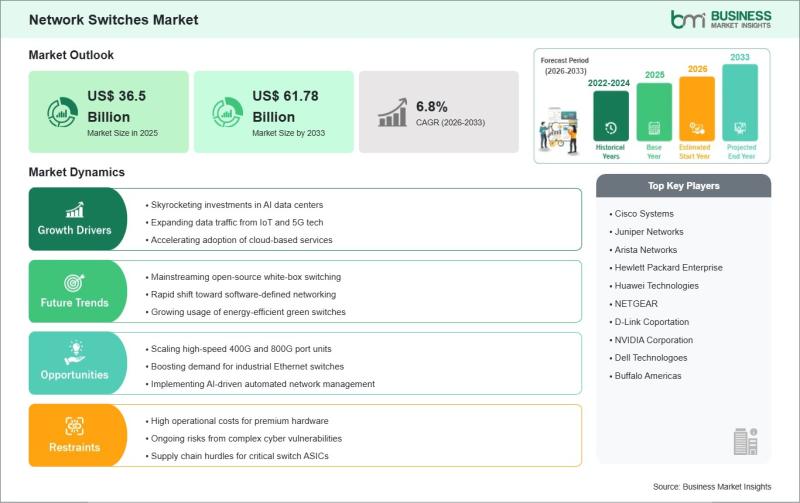

Network Switches Market Analysis: US$ 61.78 Billion Projection by 2033 at 6.8% G …

The Network Switches Market stands at the heart of digital transformation, powering seamless connectivity for enterprises embracing cloud computing, 5G, and IoT ecosystems. As businesses worldwide prioritize agile, secure networks, innovations in software-defined networking and high-speed Ethernet drive the evolution of this vital infrastructure.

Check valuable insights in the Network Switches Market report. You can easily get a sample PDF of the report - https://www.businessmarketinsights.com/sample/BMIPUB00032458?utm_source=OpenPr&utm_medium=10457

Executive Summary and Global Market Analysis:

Network…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…