Press release

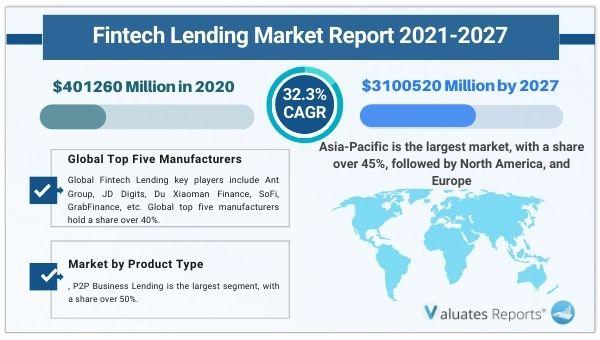

Fintech Lending Market to Reach $3100520 Million by 2027, Growing at 32.3% CAGR

The global Fintech Lending market size is projected to reach US$ 3100520 million by 2027, from US$ 401260 million in 2020, at a CAGR of 32.3% during 2021-2027. Fintech lenders employ the latest financial technologies to streamline the traditionally out-of-date and non-transparent lending process. Not only has fintech given lenders the power to speed up their payment processing times and de-mystify their policies, but it has also given lenders the ability to offer personalized experiences based on each loan and mortgage seeker’s needs.View Full Report: https://reports.valuates.com/market-reports/QYRE-Auto-4B5980/global-fintech-lending

Global Fintech Lending key players include Ant Group, JD Digits, Du Xiaoman Finance, SoFi, GrabFinance, etc. Global top five manufacturers hold a share over 40%.

Asia-Pacific is the largest market, with a share over 45%, followed by North America, and Europe, both have a share about 45 percent. In terms of product, P2P Business Lending is the largest segment, with a share over 50%. And in terms of application, the largest application is Private Lending, followed by Company Lending, etc.

With industry-standard accuracy in analysis and high data integrity, the report makes a brilliant attempt to unveil key opportunities available in the global Fintech Lending market to help players in achieving a strong market position. Buyers of the report can access verified and reliable market forecasts, including those for the overall size of the global Fintech Lending market in terms of revenue.

Inquire for Sample Report: https://reports.valuates.com/request/sample/QYRE-Auto-4B5980/Global_Fintech_Lending_Market

On the whole, the report proves to be an effective tool that players can use to gain a competitive edge over their competitors and ensure lasting success in the global Fintech Lending market. All of the findings, data, and information provided in the report are validated and revalidated with the help of trustworthy sources. The analysts who have authored the report took a unique and industry-best research and analysis approach for an in-depth study of the global Fintech Lending market.

Fintech Lending Market by Type

o P2P Business Lending

o P2P Consumer Lending

o Others

Fintech Lending Market by Application

o Private Lending

o Company Lending

o Others

Major Players in the Fintech Lending Market

o Ant Group

o JD Digits

o GrabFinance

o Du Xiaoman Finance

o SoFi

o Atom Bank

o Lending Club

o Prosper

o Upstart

o Enova

o Avant

o Funding Circle

o OnDeck

o Zopa

o October

o RateSetter (Metro Bank)

o Auxmoney

o GreeSky

o Borro

o Affirm

o Tala

o Best Egg

o Earnest

o Kabbage

o CreditEase

o Lufax

o Renrendai

Similar Reports :

Trade Finance Market: https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Insurtech Market: https://reports.valuates.com/market-reports/QYRE-Auto-35M2175/global-insurtech

Payment Processing Solutions Market: https://reports.valuates.com/market-reports/QYRE-Auto-25J944/global-payment-processing-solutions

Digital Lending Platform Market: https://reports.valuates.com/market-reports/ALLI-Manu-1F5/digital-lending-platform

AI in Fintech Market: https://reports.valuates.com/market-reports/QYRE-Auto-21V336/global-ai-in-fintech

Valuates Reports

sales@valuates.com

For U.S. Toll Free Call +1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp : +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Linkedin - https://in.linkedin.com/company/valuatesreports

Facebook - https://www.facebook.com/valuatesreports/

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Lending Market to Reach $3100520 Million by 2027, Growing at 32.3% CAGR here

News-ID: 2396816 • Views: …

More Releases from Valuates Reports

Global Wafer Bonder and Debonder Market Expands as Advanced Packaging and MEMS A …

Wafer Bonder and Debonder Market Size

The global market for Wafer Bonder and Debonder was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-9G8597/Global_Wafer_Bonder_and_Debonder_Market_Insights_Forecast_to_2028

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry, Bondtech, Aimechatec,…

Global Wafer Bonding and Debonding Equipment Market Expands with Rising Demand f …

Wafer Bonding and Debonding Equipment Market Size

The global market for Wafer Bonding and Debonding Equipment was valued at US$ 321 million in the year 2024 and is projected to reach a revised size of US$ 449 million by 2031, growing at a CAGR of 5.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-7D16601/Global_Wafer_Bonding_and_Debonding_Equipment_Market_Research_Report_2024

By Type

• Fully Automatic

• Semi Automatic

By Application

• MEMS

• Advanced Packaging

• CIS

Key Companies

EV Group, SUSS MicroTec, Tokyo Electron, Applied Microengineering, Nidec Machine Tool, Ayumi Industry,…

Global GaN HEMT Epitaxial Wafer Market Accelerates as RF and Power Device Innova …

GaN HEMT Epitaxial Wafer Market Size

The global GaN HEMT Epitaxial Wafer revenue was US$ 175.9 million in 2022 and is forecast to a readjusted size of US$ 608.6 million by 2029 with a CAGR of 19.5% during the forecast period (2023-2029).

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-26C15937/Global_and_India_GaN_HEMT_Epitaxial_Wafer_Market_Report_Forecast_2023_2029

By Type

• GaN-on-SiC

• GaN-on-Si

• GaN-on-Sapphire

• GaN on GaN Others

By Application

• GaN HEMT RF Devices

• GaN HEMT Power Devices

Key Companies

Wolfspeed, Inc, IQE, Soitec (EpiGaN), Transphorm Inc., Sumitomo Chemical (SCIOCS), NTT Advanced Technology (NTT-AT), DOWA…

Global 300 mm Wafer Shippers and Carriers Market Advances as Semiconductor Capac …

300 mm Wafer Shippers and Carriers Market Size

The global market for 300 mm Wafer Shippers and Carriers was valued at US$ 521 million in the year 2024 and is projected to reach a revised size of US$ 759 million by 2031, growing at a CAGR of 5.6% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-8C10284/Global_300mm_Wafer_Shippers_and_Carriers_Market_Insights_Forecast_to_2028

By Type

• FOUP

• FOSB

By Application

• Foundry

• IDM

Key Companies

Entegris, Shin-Etsu Polymer, Miraial, Chuang King Enterprise, Gudeng Precision, 3S Korea, Dainichi Shoji

Major Trends

The…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…