Press release

Europe Investor ESG Software Market Detailed Survey and Outlook Report Shows How Top Companies Is Able to Survive in Future by Accuvio, Dynamo Software, Inc, Enablon, FactSet Research Systems Inc

The investor ESG software market in Europe is expected to grow from US$ 204.19 million in 2021 to US$ 499.92 million by 2028; it is estimated to grow at a CAGR of 13.6% from 2021 to 2028.The Business Market Insights provides you regional research analysis on “Europe Investor ESG Software Market” and forecast to 2027. The research report provides deep insights into the regional market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the “Europe Investor ESG Software market during the forecast period, i.e., 2021–2028.

Browse Full Report URL:

https://www.businessmarketinsights.com/reports/europe-investor-esg-software-market

Boom in climate and social concern is impacting ESG investing; About 90% of climate scientists agree that climate change is occurring rapidly, and human activity is considered the major reason for the same. Many developing countries have been hampered in their efforts to combat climate change by several political and practical roadblocks. Besides, climate change provides an opportunity for ESG investors to benefit while still supporting a cause they believe in. Additionally, women in the US still earn just 78% of what men earn for doing the same work, according to some lawmakers and advocates, though others have questioned the methods used to arrive at this figure.

Major key players covered in this report:

• Accuvio

• Dynamo Software, Inc

• Enablon

• FactSet Research Systems Inc

• Fincite GmbH

• Greenstone+ Ltd

• Refinitiv

• WeSustain GmbH

Get Sample Copy of this “Europe Investor ESG Software Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00023472

The report profiles the key players in the industry, along with a detailed analysis of their individual positions against the regional landscape. The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the Europe Investor ESG Software market. The researcher provides an extensive analysis of the Europe Investor ESG Software market size, share, trends, overall earnings, gross revenue, and profit margin to accurately draw a forecast and provide expert insights to investors to keep them updated with the trends in the market.

The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the Europe Investor ESG Software market. Further, the report conducts an intricate examination of drivers and restraints operating in the market. The report also evaluates the trends observed in the parent market, along with the macro-economic indicators, prevailing factors, and market appeal with regard to different segments. The report predicts the influence of different industry aspects on the “Europe Investor ESG Software market segments and regions.

Order a Copy of this “Europe Investor ESG Software Market research report at – https://www.businessmarketinsights.com/buy/single/TIPRE00023472

The research on the Europe Investor ESG Software market focuses on mining out valuable data on investment pockets, growth opportunities, and major market vendors to help clients understand their competitor’s methodologies. The research also segments the “Europe Investor ESG Software market on the basis of end user, product type, application, and demography for the forecast period 2021–2028. Comprehensive analysis of critical aspects such as impacting factors and competitive landscape are showcased with the help of vital resources, such as charts, tables, and infographics.

This report strategically examines the micro-markets and sheds light on the impact of technology upgrades on the performance of the “Europe Investor ESG Software market.

Contact US:

Business Market Insights

Phone: +442081254005

E-Mail ID: sales@businessmarketinsights.com

Web URL: https://www.businessmarketinsights.com/

LinkedIn URL: https://www.linkedin.com/company/business-market-insights/

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Investor ESG Software Market Detailed Survey and Outlook Report Shows How Top Companies Is Able to Survive in Future by Accuvio, Dynamo Software, Inc, Enablon, FactSet Research Systems Inc here

News-ID: 2339238 • Views: …

More Releases from Business Market Insights

Wireless Infrastructure Market Set for Robust Growth Through 2033 Amid Rapid Con …

Global wireless connectivity demands, accelerated by 5G deployment, IoT adoption, and digital transformation, are reshaping the Wireless Infrastructure Market - driving expansion, innovation, and significant strategic investment globally.

Connectivity has become the backbone of modern society, powering everything from everyday personal communication to mission-critical industrial and public safety networks. As service providers and enterprises race to expand network capacity and improve performance, the Wireless Infrastructure Market continues to surge with strong…

3D Printed Drugs Market Outlook 2022-2033: Personalized Medicine Revolutionizes …

The 3D Printed Drugs Market is rapidly reshaping the way medications are developed, manufactured, and delivered, offering transformative solutions for personalized therapies, on-demand production, and advanced treatment models. As healthcare systems worldwide strive for patient-centric care, cost efficiencies, and rapid drug development, 3D printing technology stands at the forefront of pharma innovation.

With intensifying demand for customized drug dosages, decentralized manufacturing, and cutting-edge technologies like inkjet printing and AI-driven design, the…

Switchgear Market Outlook 2022-2033: Infrastructure Modernisation & Clean Energy …

The switchgear market continues to evolve as a cornerstone of modern electrical infrastructure, fueling the global transition toward smart energy systems and resilient power networks. With rising electrification across emerging economies, grid modernisation strategies, and heightened demand for reliable distribution systems, the switchgear market is poised for strong expansion through 2033.

Recent industry insights highlight how policy initiatives, digital transformation in power utilities, and trends in eco-efficient technology adoption are reshaping…

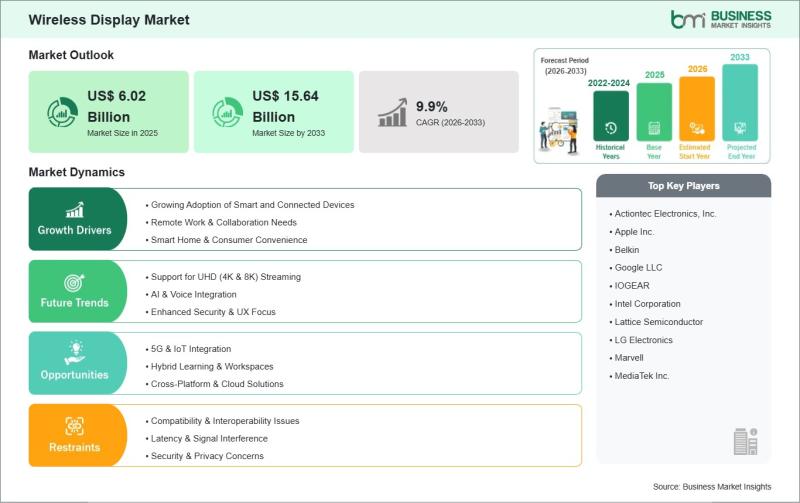

Wireless Display Market to Reach US$ 15.64 Billion by 2033, Registering 9.90% CA …

The Wireless Display Market is experiencing significant growth as consumers and enterprises increasingly shift toward seamless, cable-free content sharing solutions. Wireless display technology enables users to stream audio and video content from smartphones, tablets, laptops, and other smart devices directly to display screens without physical connections, improving convenience, flexibility, and collaboration. As digital transformation accelerates across industries and households, wireless display solutions are becoming a core component of modern connected…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…