Press release

Mobile Payment Methods show high Potential for global E-Commerce

The "Global Online Payment Methods 2012" report by yStats.com – Hamburg-based secondary market research specialist – analyzes recent developments in E-Commerce payment methods, first on a global scale and then separately for more than 50 regions and countries worldwide. Additionally, the report features the most important trends and the latest news for more than 40 payment companies in these markets.The average global online shopper uses only a small number of payment methods, with a preference for familiar systems. Not only the online payment segment but also mobile payment methods show a steady growth in 2012. The transaction volume for mobile payments is forecasted to increase by approximately 75% worldwide compared to 2011. In response to this trend, PayPal has launched its PayPal Mobile service. The company expects further growth for 2012 and plans to enter the markets of Russia, China, India and the Middle East.

Credit Card Payments still the preferred Form of Payment on the American Continent

In 2011, the market share for credit card payments in online shopping was approximately 40% in the USA. This figure is set to slightly increase until 2016 despite data safety concerns voiced by consumers. In March 2012, Western Union launched a digital payment platform called WU Pay, offering bank transfer and cash-based payment options for online shoppers. Despite the continued growth of B2C E-Commerce in Latin America, approximately half of all online shoppers still continued to use cash as the preferred payment method. In 2011, credit cards were online shoppers' preferred payment method in Brazil and Mexico. In 2012, credit cards replaced cash as the preferred online payment method in Argentina, where the transaction volume for the online payment systems DineroMail and MercadoPago experienced strong growth.

Cash Payment Alternatives on the Rise in Eastern Europe

In Europe, where credit cards are still the most popular E-Commerce payment option, new regulations and the SEPA (Single Euro Payments Area) initiative have been introduced to make online payments within Europe easier. In the UK, credit cards were the most frequently used online payment option in 2012, followed by debit cards. In France, credit and debit cards were generally preferred, while payment on invoice was the number one payment method in Germany. The company Visa plans to launch "V.me", its mobile payment service, in the fall of 2012 in the UK, France and Spain - where in 2011 Internet users' preferred payment option was credit cards as well - as the first European markets.

Even though in Eastern Europe payment via Cash-o-Delivery (COD) was previously widespread, other payment methods have also increased in popularity. In Russia, the number of E-wallets increased slightly, but their transaction volume very strongly between 2010 and 2011, while in Romania, credit cards were used in the first nine months of 2011 by nearly 15% more than in the same period the previous year. In this context, Yandex.Money, the leading E-wallet service in Russia, and Earthport announced their partnership in 2012. In Scandinavia, online payment method preferences vary. While online shoppers in Sweden and Finland preferred payment by invoice in 2011, in Denmark and Norway credit card payments dominated in E-Commerce transactions, clearly ahead of other payment options.

Credit Cards and Third-Party Payments predominate in Asia-Pacific Region

With the exception of China and Thailand, in 2012, credit cards were the most popular payment method in the Asia-Pacific region. In Japan, every resident had on average more than six credit cards in 2011. So-called third-party payments, where a third party acts as a middleman, are especially popular in China, where in the first quarter of 2012, more than 750 billion CNY in trade volume were generated with this method. Conversely, in 2011, credit cards were the most frequently used E-Commerce payment method in South Korea. Since July 2012, PayPal has also been active in Malaysia, where the company offered mobile payment options in cooperation with Malaysia Airlines for flight bookings. In Australia, PayPal was the most popular online payment method in 2011, ahead of credit card payments.

Mobile Payment Methods especially popular in Africa

The "Global Online Payment Methods 2012" report by yStats.com clearly shows that less traditional markets such as the Middle East and Africa also show potential for online payment methods. In July 2011, Visa and Mastercard payments were the most popular E-Commerce payment methods in the United Arab Emirates, while mobile payment options were preferred in Africa, where many consumers use mobile Internet due to lower costs. Mastercard started to cooperate with Oltio to offer Mastercard Mobile in South Africa.

When it comes to global payment trends in E-Commerce, credit cards appear to be the most popular method, replacing cash payments more and more, while mobile payment options also show high potential.

About yStats.com

yStats.com has been committed to research up-to-date, objective and demand-based data on markets and competitors for top managers from various industries since 2005. Headquartered in Hamburg, Germany, the firm has a strong international focus and is specialized in secondary market research. In addition to offering reports on markets and competitors, yStats.com also carries out client-specific research. Clients include leading global enterprises from various industries including B2C E-Commerce, electronic payment systems, mail order and direct marketing, logistics, as well as banking and consulting.

Press Contact:

yStats.com GmbH & Co. KG

Behringstrasse 28a, D-22765 Hamburg

Phone: +49 (0)40 - 39 90 68 50

Fax: +49 (0)40 - 39 90 68 51

E-Mail: press@ystats.com

Internet: www.ystats.com

Twitter: www.twitter.com/ystats

Facebook: www.facebook.com/ystats

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Methods show high Potential for global E-Commerce here

News-ID: 232100 • Views: …

More Releases from ystats.com Gmbh & Co. KG

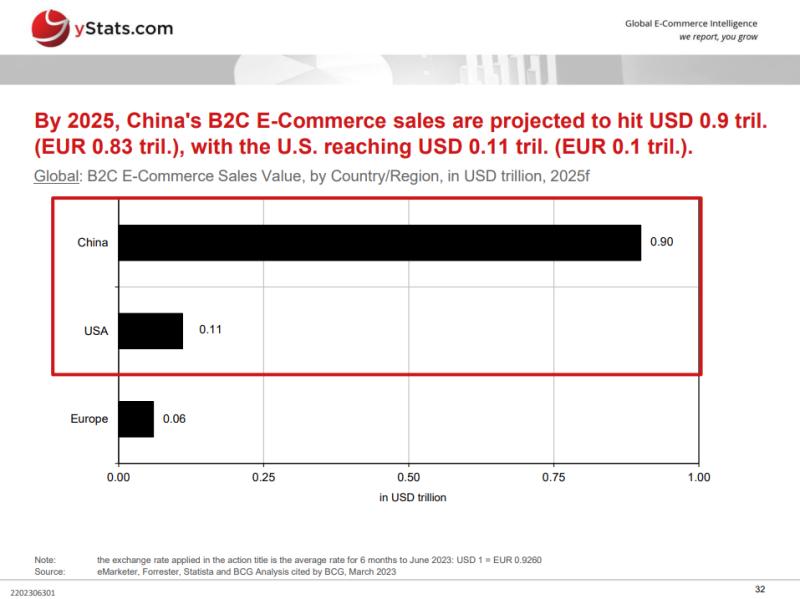

The global B2C E-Commerce market is expected to double from 2022 to 2025: New re …

[Hamburg, Germany - September 14, 2023] - The latest release from Hamburg-based market research company yStats.com, titled "Global B2C E-Commerce Market 2023," provides an overview of global trends in the B2C E-Commerce market and insights into the growth potential of various markets through key figures, forecasts, and trends.

B2C E-Commerce market initially experiences strong growth followed by a moderate growth outlook.

While the world witnessed a boom in online shopping during the…

B2C E-Commerce sales in Eastern Europe projected to rise in 2019, reports yStats …

yStats.com, Hamburg-based desk research firm specialized in E-Commerce & Online Payment market intelligence, has released a new publication: “Eastern Europe B2C E-Commerce Market 2019”. According to this report’s findings, online retail sales in the countries of Eastern Europe are expected to maintain double-digit growth in 2019.

More consumers in Eastern Europe shop online

Online shopper penetration is on the rise across Eastern Europe, but remains behind that of Western Europe. In the…

New report from yStats.com suggests continued expansion of online retail in Viet …

A recent publication from Hamburg-based business intelligence company yStats.com, “Vietnam B2C E-Commerce Market 2019,” projects continued strong growth of the online retail sector in the Southeast Asia nation through the middle of the next decade. Factors contributing to the growth include the entry of regional and global online merchants in Vietnam, plus the growing Internet connectivity through mobile phones.

Online retail sales year on year to increase at a double-digit…

Online retail sales in Thailand projected to continue strong growth: yStats.com …

The latest publication from Hamburg-based research firm yStats.com, “Thailand B2C E-Commerce Market 2019,” reveals the expectation of continued year-to-year online retail sales increases. Thailand’s mobile and social shopping trends make it one of the leaders in the region in total web-base sales.

Internet connection increase and social media shopping result in more online shoppers

Thailand’s constant rate of growth of internet connectivity and the growing comfort of connected individuals in making purchases…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…