Press release

What are the guidelines to comply with the banking business?

Explaining banking business activity in ESR.Economic Substance Regulation or more popularly known as ESR was introduced everywhere to achieve compliance with the major regulatory bodies from the US and Europe, in efforts to offer minimal tax liabilities to the businesses and organizations. This will ensure that such organizations have access to the economic substance in the jurisdiction. The main criteria for ESR applicability on such organizations are that they should be carrying out specific types of business activities.

What are the rules for identifying whether a business carries out relevant activity?

If any organization is caught in the dilemma of whether their activities fall in the list of the relevant activities, then they must refer to schedule 1 of the Ministerial Decision 100, for good.

Say, an organization that has been doing the following activities is liable to fall under the relevant activities criteria of the banking business:

Read the complete blog here

https://nsktglobal.com/what-are-the-guidelines-to-comply-with-the-banking-business-

Accepts deposits of withdrawable money, or repayable on the demand after notice or tenure which is fixed.

Use partial or entire deposits for making investments or giving advances/ loans/ overdrafts/ guarantees or similar facilities

What is an appropriate substance?

Businesses vary in size and their incomes apart from nature. So, following that, The Economic Substance Regulations clearly state that there is no “minimum” standard for the terms “adequate” or “appropriate”.

FTA goes with a realistic approach while assessing the Economic Substance Test, considering whether the relevant activities have fluctuated in the respective financial year.

Here are some important takeaways:

UAE Tax residency Certificate isn’t proof of meeting the Economic Substance Test for the carried relevant activity

Employees who carry out the CIG (Core Income Activity) have to be a resident in the UAE. In other cases, they have to carry out activity while being physically present in the UAE, under the Licensee directions and the licensee bearing the relevant costs of the individual.

An adequate number of board meetings need to be held in UAE by the Licensee, with signed and maintained meeting minutes and board of directors with necessary skills and expertise to carry out their duties; present in UAE. In the case of a holding company, the business is not required to be directed and managed in the UAE, except it is required by the relevant licensing authority.

Become one of our subscribers and read these blogs as soon as they are live

https://www.nsktglobal.com/subscribe-us.php

We have published a explanatory Guide on What ESR is? and how to file ESR in the UAE?. All Licensees and the exempted licensees have to file a Notification within the six months of the respective financial period, if they have carried out any relevant activity which has garnered them income, with notifications filed on the Ministry of Finance filing portal. If the businesses feel that they are still stuck, they can connect with the leaders in the Domain NSKT Global for assistance from their highly experienced experts. NSKT Global being one of the top firms in UAE dealing in ESR filling helps and assists in all areas related to ESR.

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What are the guidelines to comply with the banking business? here

News-ID: 2278406 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

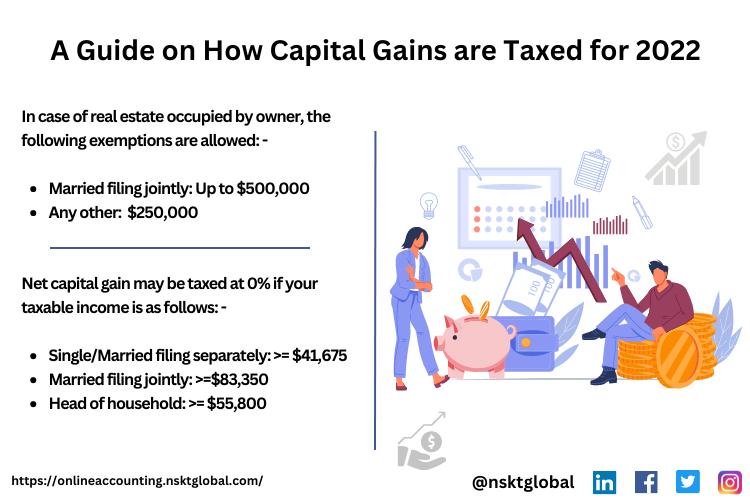

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

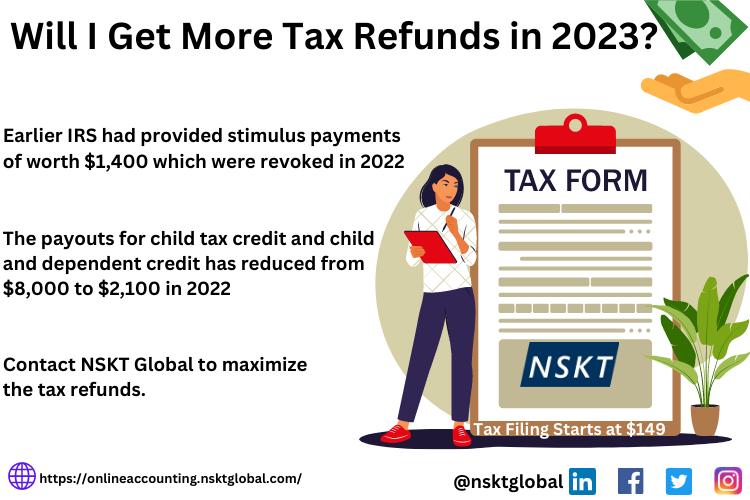

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…