Press release

How to use XERO accounting platform for businesses?

XERO is an online cloud-based accounting platform that allows businesses to automate most of their time-consuming book-keeping and accounting tasks. The Xero platform has a wide range of features that helps in reducing the amount of time spent on performing the accounting and book-keeping task which is usually repetitive in nature, as well as it also helps in minimizing the overall cost spent on the accounting service of your business.Given below are steps that will guide you to use XERO:

Watch the dashboard video of XERO- The first step is to learn about XERO and how it works. You can learn this by watching the XERO Dashboard video which can be found in the top left corner of your Xero dashboard.

Fill in the details of your organization- Go to the settings>organization settings to input your organization’s details such as Display name, Legal / Trading name, Email, Registration Number, Organisation Description, Physical address, Registered address, Organization type, Phone and fax numbers, Logo, and Website.

Setup financial details of your organization- Go to Settings>Advanced settings>Financial Settings to enter the financial details of your company such as Financial year-end which will help in preparing the right year-end report for your organization. Sales Tax and VAT details including VAT scheme (flat, cash, or accrual rate), VAT number, and VAT period.

Add branding of your company- Next step is to set up your invoices with terms of payment, contract, and logo. This can be done by going to Settings>Invoice Settings. Putting up terms of payment will help in improving the cash flow. Making your payment terms shorter will help in getting your payments earlier from your clients.

read all the steps of how to Setup XERO here..

https://nsktglobal.com/how-to-use-xero-accounting-platform-for-businesses-

Also subscribe to our blogs here

https://www.nsktglobal.com/subscribe-us.php

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to use XERO accounting platform for businesses? here

News-ID: 2278397 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

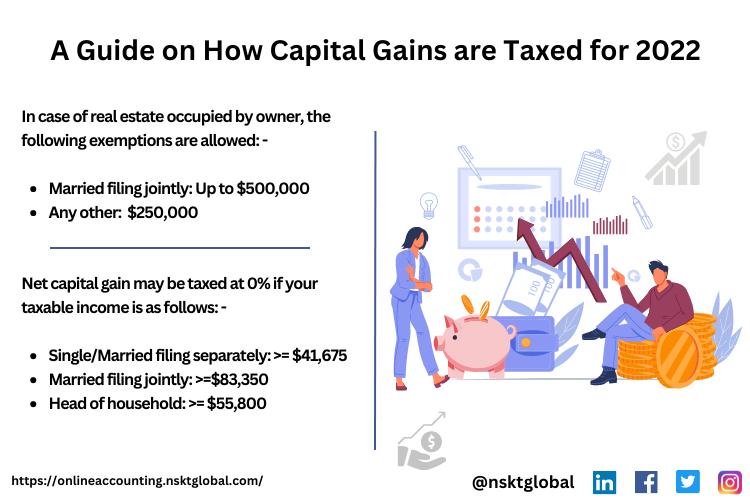

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

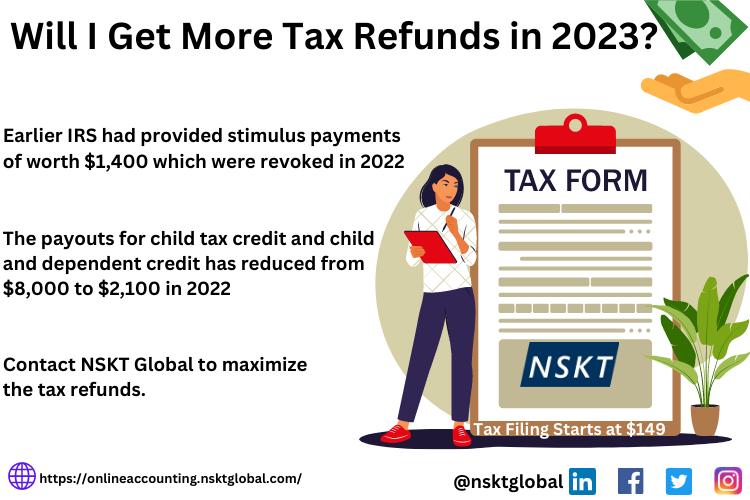

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for XERO

3 Best Xero Assignment Help Websites in Australia

Are you struggling to keep up with your Xero accounting assignments? You're not alone. Many students across Australia are juggling deadlines, part-time jobs, and complex coursework. If you're desperately searching for Xero assignment help online, you're in the right place.

[https://thestudenthelpline.io/au/]

With the increasing demand for Xero skills in accounting and finance careers, mastering this software is a must-but it doesn't have to be overwhelming. Whether you're falling behind or aiming for…

Is Xero Share Price Set to Break $200?

You Can Buy XERO Software In Full Here: https://xero5440.partnerlinks.io/xeroaccounting

Xero Ltd (ASX: XRO), an Australian cloud-based accounting software company, has recently experienced an exceptional surge in its stock price, sparking discussions about its future trajectory. Just last week, the company's share price hit a record high of $172.94 before settling at $172.61 at the end of the week. This represents a remarkable 72% increase compared to the same period last…

Square Market to Set Phenomena Growth | Xero, simPRO, Apple

A new 19 page research study released with title 'Square - Enterprise Tech Ecosystem Series' provides detailed qualitative and quantitaive research to better analyze latest market scenario and staged competition. The study not just covers geographic analysis that includes regions like North America, Europe, Australia or Asia Pacific but also player’s analysis with profile such as Xero, simPRO, Apple, Digital Main Street, Satispay, Oura, Transparent Financial Systems, Stitch Labs,…

Tyro Market - Competitor Profile Tyro, Xero, Vend, eWAY

A new research document is added in HTF MI database of 15 pages, titled as 'Tyro - Competitor Profile' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled players are Tyro, Xero, Vend,…

Xero training for practice graduates

Xero is one of the most famous names when it comes to the best accounting software. The development team of Xero works very precisely to fulfil the demands of the users. Due to the extraordinary features, Xero training should be an essential part of a resume.

To enhance this reputation further, Xero hosted the 2019 KPMG. There were some workshops, seminars, some demonstrations of products, etc. The main intention behind…

Ari Retail POS Software announces integration with Xero

Web Masters is an IT solutions provider with offices in UAE, Singapore, Bahrain, and India. It provides a multitude of products to help to make the business operations smoother and efficient. Its bag of products includes ERP, CRM, retail solutions, business intelligence, and cloud and productivity solutions. Ari is a full-fledged retail management offering of Web Masters for the retail businesses in various fields such as electronics, jewelry, supermarkets, accessories,…