Press release

UK Tax Software Market 2020 COVID-19 Impact, Key Players, Trends, Sales, Supply, Analysis and Forecast 2027 By Top Vendors BTCSoftware Limití, GoSimpleTax Ltd., Capium, FreeAgent, Nomisma

Tax software can be incorporated with various other software components, such as customer relationship management (CRM), enterprise resource planning (ERP), and reporting applications; also, the software performs calculations and generates reports. These software solutions offer real-time business visibility through their reports. Wide-ranging tax reporting and analysis across several businesses are increasing swiftly. To manage all the tax-related reports, organizations are embracing tax software. Due to the growing demand for cloud-based technologies in various industries, there is wide adoption of cloud-based tax software in these industries as is a cost-effective type with lowered processing time.The UK tax software market was valued at US$ 611.3 million in 2019 and is projected to reach US$ 1,331.3 million by 2027; it is expected to grow at a CAGR of 10.5% from 2020 to 2027.

Browse Full Report With TOC @ https://www.businessmarketinsights.com/reports/uk-tax-software-market

The Business Market Insights provides you regional research analysis on “UK Tax Software Market” and forecast to 2027. The research report provides deep insights into the regional market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the UK Tax Software market during the forecast period, i.e., 2020–2027.

The report profiles the key players in the industry, along with a detailed analysis of their individual positions against the regional landscape. The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the UK Tax Software market. The researcher provides an extensive analysis of the UK Tax Software market size, share, trends, overall earnings, gross revenue, and profit margin to accurately draw a forecast and provide expert insights to investors to keep them updated with the trends in the market.

Get Sample Copy of this UK Tax Software Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00017335

Major key players covered in this report:

• Acorah Software Products Limited (TaxCalc)

• Andica Limited

• BTCSoftware Limití

• GoSimpleTax Ltd.

• IRIS Software Group Ltd

• Sage Group plc.

• Taxfiler Limited

• Capium

• FreeAgent

• Nomisma

• Thomson Reuters Corporation

• Wolters Kluwer

• Xero Limited

The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the UK Tax Software market. Further, the report conducts an intricate examination of drivers and restraints operating in the market. The report also evaluates the trends observed in the parent market, along with the macro-economic indicators, prevailing factors, and market appeal with regard to different segments. The report predicts the influence of different industry aspects on the UK Tax Software market segments and regions.

Order a Copy of this UK Tax Software Market research report at – https://www.businessmarketinsights.com/buy/single/TIPRE00017335

The research on the UK Tax Software market focuses on mining out valuable data on investment pockets, growth opportunities, and major market vendors to help clients understand their competitor’s methodologies. The research also segments the UK Tax Software market on the basis of end user, product type, application, and demography for the forecast period 2020–2027. Comprehensive analysis of critical aspects such as impacting factors and competitive landscape are showcased with the help of vital resources, such as charts, tables, and infographics.

This report strategically examines the micro-markets and sheds light on the impact of technology upgrades on the performance of the UK Tax Software market.

Contact US:

Business Market Insights

Phone: +442081254005

E-Mail ID: sales@businessmarketinsights.com

Web URL: https://www.businessmarketinsights.com/

About Us:

Based in New York, Business Market Insights is a one-stop destination for in-depth market research reports from various industries including Technology, Media & Telecommunications, Semiconductor & Electronics, Aerospace & Defense, Automotive & Transportation, Biotechnology, Healthcare IT, Manufacturing & Construction, Medical Device, and Chemicals & Materials. The clients include corporate and academic professionals, consulting, research firms, PEVC firms, and professional services firms.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK Tax Software Market 2020 COVID-19 Impact, Key Players, Trends, Sales, Supply, Analysis and Forecast 2027 By Top Vendors BTCSoftware Limití, GoSimpleTax Ltd., Capium, FreeAgent, Nomisma here

News-ID: 2271806 • Views: …

More Releases from Business Market Insights

Laser Hair Removal Market Accelerates as Innovation, Consumer Awareness, and Aes …

The laser hair removal market is undergoing a transformative phase as evolving beauty standards, rapid technological innovation, and increasing preference for non-invasive aesthetic treatments continue to reshape the global personal care and dermatology landscape. Once considered a premium cosmetic procedure, laser hair removal is now becoming an integral part of modern grooming routines across diverse age groups and demographics.

Driven by continuous improvements in laser technology, treatment comfort, and customization capabilities,…

Veterinary Imaging Market Poised for Sustainable Growth Amid Rising Pet Humaniza …

The Global Veterinary Imaging Market continues its trajectory of steady, innovation-led expansion, fueled by rising adoption of advanced diagnostic solutions, deepening pet humanization trends, and escalating veterinary healthcare awareness worldwide. With significant developments reported in both technology adoption and service delivery, the veterinary imaging landscape is advancing to meet growing demand for higher diagnostic precision, faster clinical decision-making, and improved animal patient outcomes.

Veterinary imaging solutions - spanning X-ray, ultrasound,…

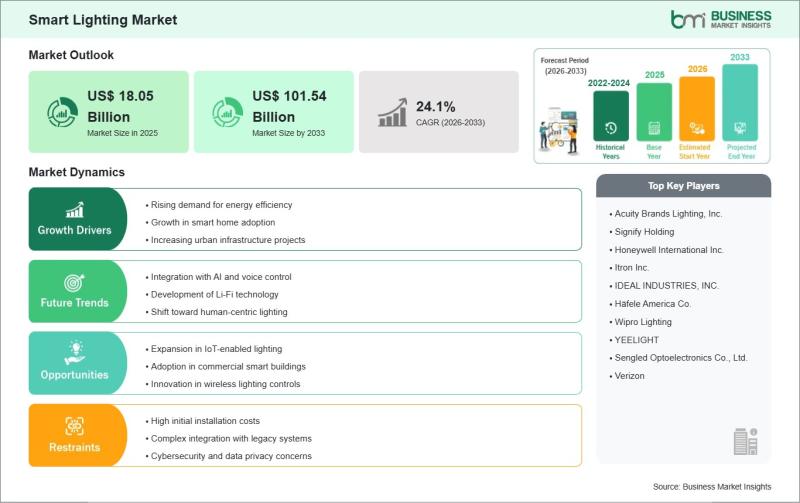

Smart Lighting Market to Skyrocket to US$101.54 Billion by 2033 from US$18.05 Bi …

The Smart Lighting Market is transforming everyday spaces into energy-efficient havens, powered by IoT, AI, and wireless controls that adapt to user needs and environments. Homeowners and businesses alike are discovering how connected bulbs and fixtures enhance ambiance while slashing energy use. The Smart Lighting Market size is expected to reach US$ 101.54 billion by 2033 from US$ 18.05 billion in 2025. The market is estimated to record a CAGR…

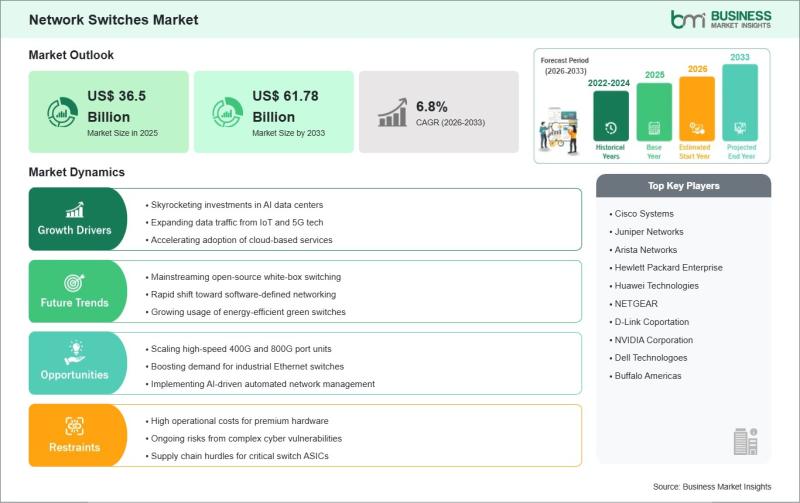

Network Switches Market Analysis: US$ 61.78 Billion Projection by 2033 at 6.8% G …

The Network Switches Market stands at the heart of digital transformation, powering seamless connectivity for enterprises embracing cloud computing, 5G, and IoT ecosystems. As businesses worldwide prioritize agile, secure networks, innovations in software-defined networking and high-speed Ethernet drive the evolution of this vital infrastructure.

Check valuable insights in the Network Switches Market report. You can easily get a sample PDF of the report - https://www.businessmarketinsights.com/sample/BMIPUB00032458?utm_source=OpenPr&utm_medium=10457

Executive Summary and Global Market Analysis:

Network…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…