Press release

Rise and Impact of COVID-19 on Payment Processing Solutions Market

Payment processing is defined as a moderator between the bank and the merchant involved in the transaction. This service provider authorizes and validates the payment, by checking if the buyer has abundant funds in their account, if the card is still valid, or if there are no limits on the account, and then transfers the amount to the seller. This can be either for in-person payments or online payments.Payment processing is one of the most vital tasks for everyday business. Today, online transaction has become one of the most convenient ways of payment for organizations. The payment processing solutions act as a passage while purchasing products & services using credit or debit card, relaying the information and handling the transaction to the bank.

Download FREE Sample Report of the Payment Processing Solutions Market @ https://www.researchdive.com/download-sample/416

Key Developments in the Global Market

The key industry players are implementing various business tactics & growth strategies such as mergers & acquisitions, partnerships, and geographical business expansion to maintain a robust position in the overall market, which is subsequently helping the payment processing solutions market to grow at a robust pace.

For instance, in September 2018, PhonePe and PayU Group entered into a partnership to increase its online merchant database in India. This strategic collaboration intends to offer a better payment experience for the growing digital-savvy merchants and consumers in the country. Also,

Global Payments Inc. entered into a partnership with Ingenico Group in September 2018 to provide advanced payment terminal services. The aim of the company behind this strategic partnership is to enhance the consumer payment experience.

Check out How COVID-19 impact on the Payment Processing Solutions Market. Click here to Connect with Analyst @ https://www.researchdive.com/connect-to-analyst/416

In March 2019, Square, Inc. expanded its omnichannel offerings and announced the availability of the revamped Square for Retail and Square Online Store. These new Square products or offerings are the first to be fully integrated with Weebly, which is a powerful platform for building online store or a website.

In May 2019, ACI Worldwide completed the acquisition of Speedpay, Western Union’s United States bill pay business for around US$750 million. The company, with this acquisition expanded its reach into complementary and existing segments such as insurance, higher education, consumer finance, healthcare, government, utilities, and mortgage.

Impact of COVID-19 Pandemic on the Industry

The COVID-19 pandemic has progressively impacted the global payment processing solutions market as people around the world are adopting digital payment services to reduce the fallout of coronavirus. Besides, e-commerce platforms such as websites that deliver groceries have seen an upsurge in the orders for essential goods. Moreover, retail stores have started taking online payments.

Forecast Analysis of Payment Processing Solutions Market

Global payment processing solutions market is anticipated to observe a progressive growth over the forecast period due to the growing usage of mobile devices. In addition, advancements in digital technology & internet facility are expected to create massive opportunities for the growth of the global market by 2027. However, the rising cases of cybercrime around the world is likely to restrict the market growth in the near future.

The growing adoption of payment processing application in smart phones and a surge in the e-commerce business across the globe are the major factors estimated to propel the growth of the global payment processing solutions market by 2027. Research Dive in its latest published report predicts that the payment processing solutions market will generate $176,749.5 million during the forecast period by 2027. The Asia Pacific market for payment processing solutions is anticipated to witness a significant growth throughout the forecast, owing to the rising government initiatives related to the use of digital payment in the region. The key players functioning in the global industry include Fiserv, Inc., PayPal, Global Payments, Inc., Mastercard, FIS, VISA, Inc., PaySafe, ACI Worldwide, Inc., Wirecard, and Dwolla, Inc.

Contact us:

Mr. Abhishek Paliwal

Research Dive

30 Wall St. 8th Floor, New York

NY 10005 (P)

+ 91 (788) 802-9103 (India)

+1 (917) 444-1262 (US)

Toll Free: +1-888-961-4454

E-mail: support@researchdive.com

LinkedIn: https://www.linkedin.com/company/research-dive/

Twitter: https://twitter.com/ResearchDive

Facebook: https://www.facebook.com/Research-Dive-1385542314927521

Blog: https://www.researchdive.com/blog

About Us:

Research Dive is a market research firm based in Pune, India. Maintaining the integrity and authenticity of the services, the firm provides the services that are solely based on its exclusive data model, compelled by the 360-degree research methodology, which guarantees comprehensive and accurate analysis. With unprecedented access to several paid data resources, team of expert researchers, and strict work ethic, the firm offers insights that are extremely precise and reliable. Scrutinizing relevant news releases, government publications, decades of trade data, and technical & white papers, Research dive deliver the required services to its clients well within the required timeframe. Its expertise is focused on examining niche markets, targeting its major driving factors, and spotting threatening hindrances. Complementarily, it also has a seamless collaboration with the major industry aficionado that further offers its research an edge.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rise and Impact of COVID-19 on Payment Processing Solutions Market here

News-ID: 2269897 • Views: …

More Releases from Research Dive

Electronic Data Management Market Expected to Rise Progressively by 2031 Due to …

The global electronic data management market is expected to witness significant growth by 2031, owing to the rising applications of electronic data management in the industrial sector. The North America region was the most dominant in 2021.

As per the report published by Research Dive, the global electronic data management market is projected to garner a revenue of $19,289.5 million and rise at a stunning CAGR of 12.2 % during…

Gastric Cancer Market Predicted to Make a Strong Comeback after the Pandemic Deb …

The global gastric cancer market is predicted to observe significant growth by 2031, owing to the increasing pervasiveness of gastric cancer among people worldwide. The Asia-Pacific region generated the highest market share in 2021.

As per the report published by Research Dive, the global gastric cancer market is envisioned to garner a revenue of $10,737.00 million and grow at a fascinating CAGR of 17.9% over the estimated timeframe from…

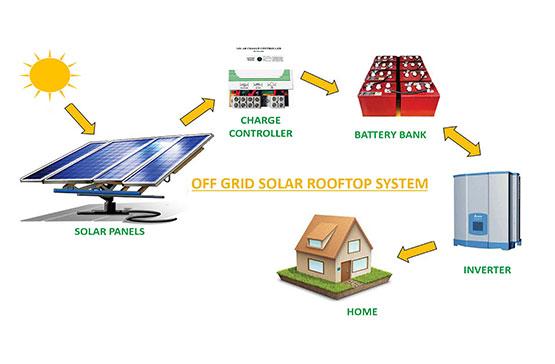

Off Grid Solar Market to Exhibit 12.3% CAGR and Generate $5,825.80 Million by 20 …

As per the report published by Research Dive, the global off grid solar market is predicted to generate a revenue of $5,825.80 million and grow at a stunning CAGR of 12.3% during the analysis timeframe from 2022 to 2031.

The global off grid solar market is predicted to witness prominent growth by 2031, owing to the increasing demand for electricity independence across the globe. The Asia-Pacific region garnered…

Roofing Materials Market to Garner a Revenue of $186.7 Billion and Exhibit a 4.3 …

As per the report published by Research Dive, the global roofing materials market is expected to register a revenue of $186.7 billion by 2031, at a CAGR of 4.3% during the forecast period 2022-2031.

The global roofing materials market is expected to grow primarily due to the growing need for waterproofing roofing materials. Re-roofing sub-segment is expected to flourish immensely. The Asia-Pacific region is predicted to grow at a high…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…