Press release

Digital Lending Platform Market Trends and Analysis (2021-2028): Growth Opportunities and Business Development Strategies | FIS Global, Fiserv, Finastra, Black Knight, Ellie MAE, Nucleus Software, Temenos, and Wipro

Allied Market Research published a new report, titled, "Digital Lending Platform Market By Component (Software and Service), Deployment Model (On-Premise and Cloud), Type (Decision Automation, Collections & Recovery, Loan Processing, Risk & Compliance Management, and Others), and Industry Vertical (Banks, Insurance Companies, Credit Unions, Savings & Loan Associations, Peer-to-Peer Lending, and Others): Global Opportunity Analysis and Industry Forecast, 2020-2027".The report provides a detailed study of the global digital lending platform market covering a number of important aspects such as current market scenario, estimates, top investment pockets, recent trends, changing dynamics, and vibrant forces of the industry from 2019 to 2027 to identify the underlying opportunities. The report gives much focus on the prospects that may transpire in the near future and provide a significant boost to the overall market growth.

Download Sample Report (Get Full Insights in PDF - 249 Pages) @ https://www.alliedmarketresearch.com/request-sample/5404

The report also covers the drivers that are playing a substantial role in fueling the market growth. At the same time, restraining factors that are expected to obstruct or hold the growth of the industry are also presented by our expert analysts in order to provide the key market players with a detailed scenario of the future threats in advance.

The report offers exhaustive and thorough insights into each of the prominent end user domains along with annual forecasts till the year 2027. In-depth study of the market size and its detailed segmentation help determine the prevalent digital lending platform market opportunities. The major countries in each region are mapped according to their revenue waves in the market. The leading market players in the industry are profiled, and their adopted slants & strategies are analyzed meticulously, which predict the competitive outlook of the digital lending platform market.

Access Full Summary @ https://www.alliedmarketresearch.com/digital-lending-platform-market

Regions that are covered in the market report include North America (United States, Canada and Mexico), South America (Brazil, Argentina, and Colombia), Europe (Germany, France, UK, Russia and Italy), Asia-Pacific (China, Japan, Korea, India and Southeast Asia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa). The report presents a detailed scenario of the market in each province.

Some ruling enterprises in the global digital lending platform market are examined in the report along with the citation of innovative product launches by them, their collaborative undertakings & endeavors, several merges & acquisitions, and many more. The frontrunners operating in the global digital lending platform industry include Black Knight, Ellie MAE, Finastra, FIS Global, Fiserv, Intellect Design Arena, Nucleus Software, Tavant Technologies, Temenos, and Wipro.

Moreover, Porter’s five forces analytical pattern exhibits the assertiveness of the market by assessing several parameters including threats of alternatives, strength of the suppliers, and choice of the buyers operating in the industry.

Get Detailed Analysis of COVID-19 Impact on Digital Lending Platform Market @ https://www.alliedmarketresearch.com/purchase-enquiry/5404

Key Benefits:

1. The market report offers an all-inclusive analysis of the value chain, changing market trends, major segments, Porter’s Five Forces study, business performance of the leading market players, and competitive landscape in a number of regions across the globe.

2. Porter’s Five Forces analysis focuses on the detailed breakdown of the report highlighting the growing segments that help industrialists come up with useful tactics & approaches to capitalize on the profitable sections.

3. Key investment pockets and current market setups are underlined in the research.

4. The digital lending platform market report covers the major states in each province and highlights their revenue contribution as well.

5. Last but not the least; the market report also doles out a demonstration of the active industry leaders.

Get Offer @ https://www.alliedmarketresearch.com/get-discount/5404

Highlights of the Report:

1. Detailed and exhaustive evaluation of the digital lending platform market.

2. Accrued revenues from each segment of the market from 2019 to 2027.

3. Drivers, restraints, and opportunities in the industry.

4. Approaches embraced by the key market players.

5. Provinces that would create multiple opportunities for the frontrunners in the industry.

6. Current scope and trends of the digital lending platform market.

Digital Lending Platform Market Key Segments:

By Component:

1. Software

2. Service

By Deployment Model:

1. On-Premise

2. Cloud

By Type:

1. Loan Origination

2. Decision Automation

3. Collections and Recovery

4. Risk and Compliance Management

5. Others

By Industry Vertical:

1. Banks

2. Insurance Companies

3. Credit Unions

4. Savings & Loan Associations

5. Peer-to-Peer Lending

6. Others

By Region:

1. North America

2. Europe

3. Asia-Pacific

4. LAMEA

CHAPTERS DISCUSSED IN THE REPORT: [Total 249 Pages]

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview

Chapter 4: Digital Lending Platform Market, By Component

Chapter 5: Digital Lending Platform Market, By Deployment Model

Chapter 6: Digital Lending Platform Market, By Type

Chapter 7: Digital Lending Platform Market, By Industry Vertical

Chapter 8: Digital Lending Platform Market, By Region

Chapter 9: Competitive Landscape

Chapter 10: Company Profile

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/5404

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market Trends and Analysis (2021-2028): Growth Opportunities and Business Development Strategies | FIS Global, Fiserv, Finastra, Black Knight, Ellie MAE, Nucleus Software, Temenos, and Wipro here

News-ID: 2254715 • Views: …

More Releases from Allied Market Research

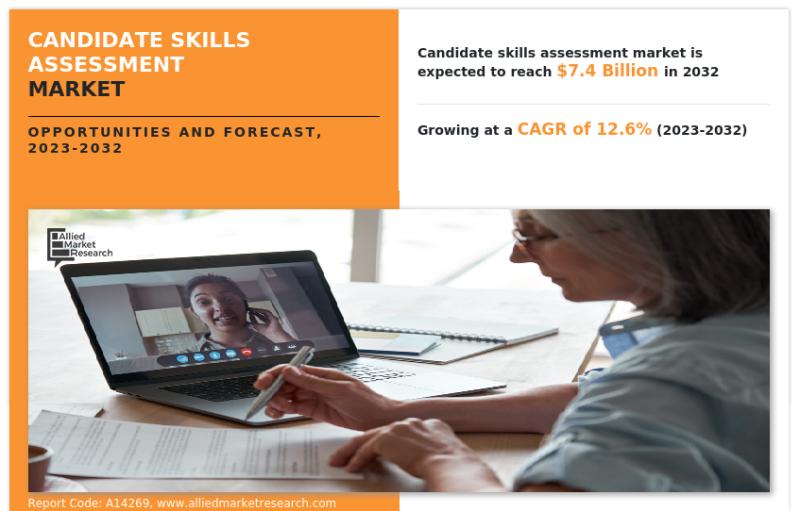

Candidate Skills Assessment Market Reach USD 7.4 Billion by 2032 Growing with 12 …

Allied Market Research published a new report, titled, "Candidate Skills Assessment Market Reach USD 7.4 Billion by 2032 Growing with 12.6% CAGR." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine…

Smart Building Market Reach USD 247.17 Billion by 2032 Growing with 12.3% CAGR

Allied Market Research published a new report, titled, "Smart Building Market Reach USD 247.17 Billion by 2032 Growing with 12.3% CAGR." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segments, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain a thorough understanding of the industry and determine steps…

Generative AI Market Reach USD 126.5 Billion by 2031 Driving with 32% CAGR

Allied Market Research published a new report, titled, "Generative AI Market Reach USD 126.5 Billion by 2031 Driving with 32% CAGR." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a helpful source of information for market players, investors, VPs, stakeholders, and new entrants to gain thorough understanding of the industry and determine steps…

Tourism Source Market to Grow at a CAGR of 6.6% and will Reach USD 1.1 Trillion …

The Tourism Source Market Size was valued at $599.40 billion in 2022, and is estimated to reach $1.1 Trillion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/6807

Traveling to other locations for pleasure, recreation, or business is referred to as tourism. It entails travelling to and taking in a variety of locations, points of interest, and cultural…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…