Press release

How is ESR impacting Business Structure in UAE?

Let's look at what the rules specify and how you and your organization could be affected.Structure of Management- When determining if improvements must be made, the manner in which a UAE company is operated and owned is important. Essentially, companies that fall under these rules need either a managing director or a member of the senior management team who is physically based in the UAE and running the company. In addition to daily board meetings in the UAE, this is explicitly outlined in the law itself, with written minutes taken as evidence and signed by all directors.

Correct information of Income generation- Economic substance regulations make sure that the organizations have mentioned the exact income source. As it may affect their taxation as wrong income information can lead to paying a higher amount of tax to the government. Concerned companies need to make ensure that all of the earnings of the business are generated throughout the legal and right sources in UAE. This simply means that work carried out must be done by an organization that has a physical presence here, regardless of its customers.

Want to know How is ESR impacting Business Structure in UAE, read the blog here:-

https://nsktglobal.com/how-is-esr-impacting-business-structure-in-uae-

Office spaces and staffing- Companies operating in the business sectors need to show that they have a particular number of workers working in the UAE as part of the Economic Substance Laws. In addition, proof of a sufficient amount of office space is often needed to accommodate the employees. Another rule notes that companies in the UAE will need to have sufficient physical assets-implying that it could be dependent on the operation of the firm-and thus income. An office address is important when it comes to getting the right company set up. While many smaller companies that lie beyond the laws of the economic substance may simply rent a P.O. Box address to run a business in the UAE.

Reporting Liabilities- In order to comply with these new regulations, the concerned companies must declare details of the related activities set out by the government of the UAE to the authority that granted their original commercial license. Failure to do so will result in a fine of up to AED 50,000 and repeat violations would encourage more serious financial penalties, leading to the suspension or revocation of the commercial license of non-compliant firms.

You can get your free consultancy here

https://www.nsktglobal.com/contact-us.php

Transparent information of Taxes- ESR would require companies to use legitimate and correct business practices for operating in the UAE. They should also provide the correct financial reports otherwise will have to pay extra taxes.

Liquidation and de registration of Businesses- If the company does not comply with the ESR, if it consistently fails to provide development details or to meet any of the conditions set out in the legislation, then the license of the organization will not be extended or, in certain situations, the entity will have to liquidate the company. It will have a major effect on the country's economy. This also helps in keeping the company's management on its toes so that no mistakes are made or errors are made, which will hamper the functioning of the company.

Competitors for Company- The introduction of the ESR would eliminate businesses that commit malpractice and unethical business practices and thereby pave the way for businesses that are better and do work in the right manner, creating healthy competition between rivals.

Become one of our subscribers and read these blogs as soon as they are live

https://nsktglobal.com/subscriber_form.php

NSKT Global (USA Office)

1564 Market Place Blvd Suite 400 PMB 328

Ocean Isle Beach, NC 28469

Email:- usoffice@nsktglobal.com

Phn:- 888 701 675

888 701 NSKT

https://www.nsktglobal.com/usa

NSKT Global (UAE Office)

Level 14, Boulevard Plaza Tower 1,

Downtown, Dubai, UAE PO 334155

Phn +971 44 394 263

Whatsapp +971 55 171 2487

Email:- uae@nsktglobal.com

https://nsktglobal.com/uae

At NSKT Global we provides the complete range of advisory services to the SMEs as well as to the established businesses. Dealing in the industry for over 10 years. In countries across globe Namely UAE, USA and India.

contact us

https://www.nsktglobal.com/contact-us.php

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How is ESR impacting Business Structure in UAE? here

News-ID: 2226120 • Views: …

More Releases from NSKT Global

Top Business Tax Deductions in 2022

Small businesses usually function on a very tight budget, and saving on business tax services is one of the topmost priorities of small businesses worldwide, irrespective of their industry. Learning about all the possible deductions and income tax savings made available by the IRS to support the growth of small businesses is crucial. The eligibility criteria for these deductions depend on the business category. The business can fall into categories…

Is there a first-time homebuyer tax credit available for 2022?

The Internal Revenue System has made several attempts to help taxpayers enhance their spending capacity by providing credits and deductions for specific transactions. The first-time homebuyer credit is one such bill, which was proposed in April 2018. This bill is yet to be passed. However, this bill changes the IRS's current tax code and entitles taxpayers about to buy a home for the first time with a $15,000 federal tax…

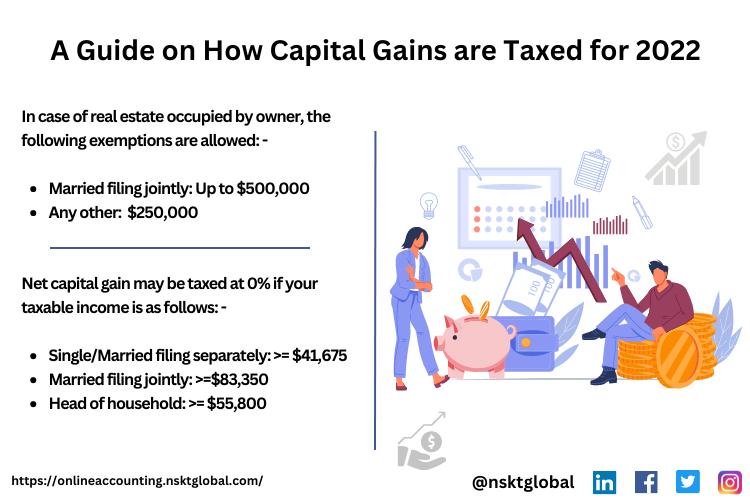

A Guide on How Capital Gains are Taxed for 2022

What is capital gain tax?

If you have sold a property that you were previously the owner of, or if you've cashed out on an investment made by you and have made a profit from the transfer of capital, you are required to pay capital gain tax. Capital gain tax refers to the levy on the profit made by an investor upon the sale of an asset, including shares, bonds, businesses,…

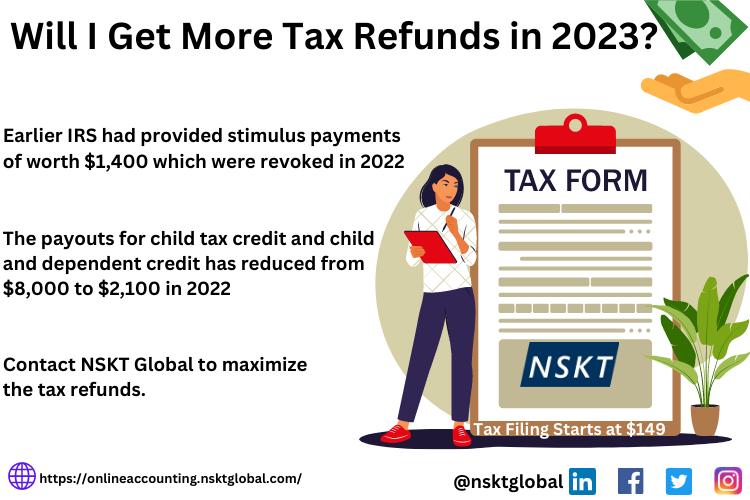

Will I Get More Tax Refunds in 2023?

Taxpayers are wondering if they are entitled to similar tax refunds as in previous years, as the tax refunds for 2021 and 2022 were considerably higher than usual. Steps were taken by the IRS and the government to help tax preparer near me deal with the economic impact of the Covid-19 outbreak. The total amount of tax return was increased substantially for the taxes of FY 2021, owing to factors…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…