Press release

Sales Tax Software Market Classification By Suppliers, Consumption, Application and Overview

Wide-ranging market information of the Global Sales Tax Software Market report will surely grow business and improve return on investment (ROI). The report has been prepared by taking into account several aspects of marketing research and analysis which includes market size estimations, market dynamics, company & market best practices, entry level marketing strategies, positioning and segmentations, competitive landscaping, opportunity analysis, economic forecasting, industry-specific technology solutions, roadmap analysis, targeting key buying criteria, and in-depth benchmarking of vendor offerings. This Sales Tax Software Market research report gives CAGR values along with its fluctuations for the specific forecast period.Sales Tax Software Market research report encompasses a far-reaching research on the current conditions of the industry, potential of the market in the present and the future prospects. By taking into account strategic profiling of key players in the industry, comprehensively analysing their core competencies, and their strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions, the report helps businesses improve their strategies to sell goods and services. This wide-ranging market research report is sure to help grow your business in several ways. Hence, the Sales Tax Software Market report brings into the focus, the more important aspects of the market or industry.

Download Exclusive Sample (350 Pages PDF) Report: To Know the Impact of COVID-19 on this Industry @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sales-tax-software-market

Major Market Key Players: Sales Tax Software Market

Few of the major competitors currently working in the global sales tax software market are APEX Analytix; Avalara Inc.; CCH INCORPORATED.; Intuit Inc.; LegalRaasta.com; LumaTax, Inc.; Ryan, LLC; Sage Intacct, Inc.; Sales Tax DataLINK; Sovos Compliance, LLC; Thomson Reuters; Vertex, Inc.; Zoho Corporation Pvt. Ltd.; Xero Limited; The Federal Tax Authority, LLC d/b/a TaxCloud; Wolters Kluwer; CFS Tax Software Inc.; Service Objects, Inc.; TaxJar; Chetu Inc. and HRB Digital LLC among others.

Market Analysis: Sales Tax Software Market

Global sales tax software market is expected to rise to an estimated value of USD 9.29 billion by 2026, registering a healthy CAGR in the forecast period of 2019-2026. This rise in market value can be attributed to the growing usage of IoT based services amid increasing availability of services based on AI and machine learning.

This Free report sample includes:

A brief introduction to the Sales Tax Software Market research report.

Graphical introduction of the regional analysis.

Top players in the Sales Tax Software Market with their revenue analysis.

Selected illustrations of Sales Tax Software Market insights and trends.

Example pages from the Sales Tax Software Market

The Sales Tax Software Market report provides insights on the following pointers:

Market Penetration: Comprehensive information on the product portfolios of the top players in the Sales Tax Software Market.

Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

Market Development: Comprehensive information about emerging markets. This report analyses the market for various segments across geographies.

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Sales Tax Software Market.

Table of Contents: Sales Tax Software Market

Sales Tax Software Market Overview

Global Economic Impact on Industry

Global Market Competition by Manufacturers

Global Production, Revenue (Value) by Region

Global Supply (Production), Consumption, Export, Import by Regions

Global Production, Revenue (Value), Price Trend by Type

Global Market Analysis by Application

Manufacturing Cost Analysis

Industrial Chain, Sourcing Strategy and Downstream Buyers

Marketing Strategy Analysis, Distributors/Traders

Market Effect Factors Analysis

Global Sales Tax Software Market Forecast

Get Latest Free TOC of This Report @ https://www.databridgemarketresearch.com/toc/?dbmr=global-sales-tax-software-market

Some of the key questions answered in these Sales Tax Software Market reports:

What will the market growth rate, growth momentum or acceleration market carries during the forecast period?

Which are the key factors driving the Sales Tax Software Market?

What was the size of the emerging Sales Tax Software Market by value in 2020?

What will be the size of the emerging Sales Tax Software Market in 2027?

Which region is expected to hold the highest market share in the Sales Tax Software Market?

What trends, challenges and barriers will impact the development and sizing of the Global Sales Tax Software Market?

What is sales volume, revenue, and price analysis of top manufacturers of Sales Tax Software Market?

What are the Sales Tax Software Market opportunities and threats faced by the vendors in the global Sales Tax Software Market Industry?

With tables and figures helping analyse worldwide Global Sales Tax Software Market growth factors, this research provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

How will this Market Intelligence Report Benefit You?

The report offers statistical data in terms of value (US$) as well as Volume (units) till 2027.

Exclusive insight into the key trends affecting the Sales Tax Software Market industry, although key threats, opportunities and disruptive technologies that could shape the Global Sales Tax Software Market supply and demand.

The report tracks the leading market players that will shape and impact the Global Sales Tax Software Market

The data analysis present in the Sales Tax Software Market report is based on the combination of both primary and secondary resources.

The report helps you to understand the real effects of key market drivers or retainers on Sales Tax Software Market

Significant highlights covered in the Global Sales Tax Software Marketinclude:

In-depth market analysis, including information about current Sales Tax Software Market drivers and challenges

An exhaustive study on the expected trends, changing market dynamics, and market intelligence

Porter’s Five Forces analysis discussing the potentiality of buyers and sellers operating in the market, which is likely to help in developing efficient strategies

Detailed analysis of the changing competitive scenario and thorough vendor analysis

Some Notable Report Offerings:

We will provide you an analysis of the extent to which the global Sales Tax Software Market acquires commercial characteristics along with examples or instances of information that helps you to understand it better.

We will also help to identify customary/ standard terms and conditions, as like offers, worthiness, warranty, and others for the Sales Tax Software Market

Also, this report will help you to identify any trends to forecast Sales Tax Software Market growth rates.

The analysed report will forecast the general tendency for supply and demand in Sales Tax Software Market.

Any Question | Speak to Analyst @ https://www.databridgemarketresearch.com/speak-to-analyst/?dbmr=global-sales-tax-software-market

Thanks for reading this article you can also get individual chapter wise section or region wise report version like North America, Europe, MEA or Asia Pacific.

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sales Tax Software Market Classification By Suppliers, Consumption, Application and Overview here

News-ID: 2222582 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

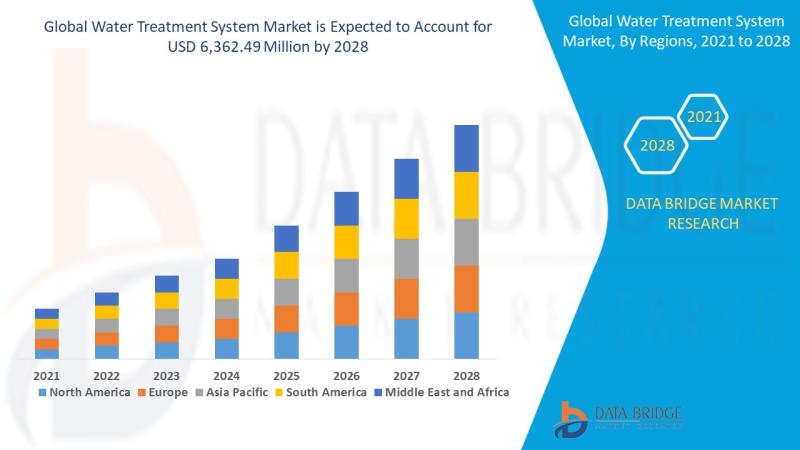

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…