Press release

Fintech Block Chain Market Scope and Market Outlook and Deep Study of Top Key Players like Oracle, Digital Asset, Circle, Factom, AlphaPoint, Coinbase, Abra, Auxesis Group,

Fintech Block Chain Market report makes to focus on the more important aspects of the market like what the market recent trends are. The market research report also conducts study on production capacity, consumption, import and export for all major regions across the globe. Additionally, the report helps the manufacturer in finding out the effectiveness of the existing channels of distribution, advertising programmed or media, selling methods and the best way of distributing the goods to the eventual consumers. Furthermore, competitive analysis gives a clear idea about the strategies used by the major competitors in the Fintech Block Chain market that perks up their penetration in the market.Fintech block chain market is expected to grow at a CAGR of 43.51% in the forecast period of 2020 to 2027. Data Bridge Market Research report on fintech block chain market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market’s growth. An open record of all bitcoin exchanges that have ever been executed is known as block chain. A block is a part of block chain that records a part of the exchanges that are going on and once finished, it goes into the permanent database. Rise in the compatibility with financial services, increasing cryptocurrency market capitalization in equity market and new breed of programmable block chain platforms. Challenges related to security and lack of block chain applications..

Download FREE Sample Report (Get Full Insights in PDF) with Tables, Charts and Graphs @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-fintech-block-chain-market

Leading Players in the Fintech Block Chain Market:AWS, IBM, Microsoft, Ripple, Chain, Earthport, Bitfury, BTL Group, Oracle, Digital Asset, Circle, Factom, AlphaPoint, Coinbase, Abra, Auxesis Group, BitPay, BlockCypher, Applied Blockchain, RecordesKeeper, Symbiont, Guardtime, Cambridge Blockchain, Tradle and Blockchain Advisory Mauritius Foundation among others.

Competitive landscape

The global fintech block chain market is fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market in order to sustain in long run. The report includes market shares of Fintech block chain market for global, Europe, North America, Asia Pacific and South America.

The titled segments and sub-section of the market are illuminated below:

By Application (Smart contracts, Identity management and others),

Provider (Middleware providers and others),

Organization Size (Small and Medium-Sized Enterprises (SMEs) and Large enterprises),

Industry Vertical (Banking and Others),

Fintech Block Chain Market Country Level Analysis

Fintech block chain market is analysed and market size, volume information is provided by country, provider, organization size and industry vertical as referenced above.

The countries covered in the market report are the U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

More https://www.databridgemarketresearch.com/reports/global-fintech-block-chain-market

Points Covered in the Report:

The pivotal aspects considered in the Global Fintech Block Chain Market report consist of leading competitors functioning in the Global Fintech Block Chain market

The report encompasses company profiles prominently positioned in the global market.

The sales, corporate strategies, and technological capabilities of leading manufacturers are also mentioned in the report.

The driving factors for the growth of the Global Fintech Block Chain Market are explained exhaustively, along with an in-depth account of the endusers in the industry.

The report also explains critical application areas of the market to readers/users.

The report undertakes a SWOT analysis of the market. In the final section, the report features the opinions and views of industry experts and professionals. The experts also evaluate the export/import policies that might propel the growth of the Global Fintech Block Chain Market.

The report on the Global Fintech Block Chain Market delivers valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

Fundamentals of Table of Content:

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.5 Market by Application

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Fintech Block Chain Market Size

2.2 Fintech Block Chain Growth Trends by Regions

2.3 Industry Trends

3 Market Share by Key Players

3.1 Fintech Block Chain Market Size by Manufacturers

3.2 Fintech Block Chain Key Players Head office and Area Served

3.3 Key Players Fintech Block Chain Product/Solution/Service

3.4 Date of Enter into Fintech Block Chain Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Product

4.1 Global Fintech Block Chain Sales by Product

4.2 Global Fintech Block Chain Revenue by Product

4.3 Fintech Block Chain Price by Product

5 Breakdown Data by End User

5.1 Overview

5.2 Global Fintech Block Chain Breakdown Data by End User

Access full Report Description, For More Inquiry@ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-fintech-block-chain-market

Global Fintech Block Chain Market Scope and Market Size

Fintech block chain market is segmented on the basis of application, provider, organization size and industry vertical. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Based on application, the fintech block chain market is segmented into Payments, clearing, and settlement, exchanges and remittance, smart contracts, identity management, compliance management/know your customer (kyc) and others (cyber liability and content storage management).

Based on provider, the fintech block chain market is segmented into application and solution providers, middleware providers and infrastructure and protocols providers.

Based on organization size, the fintech block chain market is segmented into small and medium-sized enterprises (SMES) and large enterprises.

Based on industry vertical, the fintech block chain market is segmented into banking, and others.

Note – In order to provide more accurate market forecast, all our reports will be updated before delivery by considering the impact of COVID-19.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe, MEA or Asia Pacific.

Contact:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Block Chain Market Scope and Market Outlook and Deep Study of Top Key Players like Oracle, Digital Asset, Circle, Factom, AlphaPoint, Coinbase, Abra, Auxesis Group, here

News-ID: 2220135 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

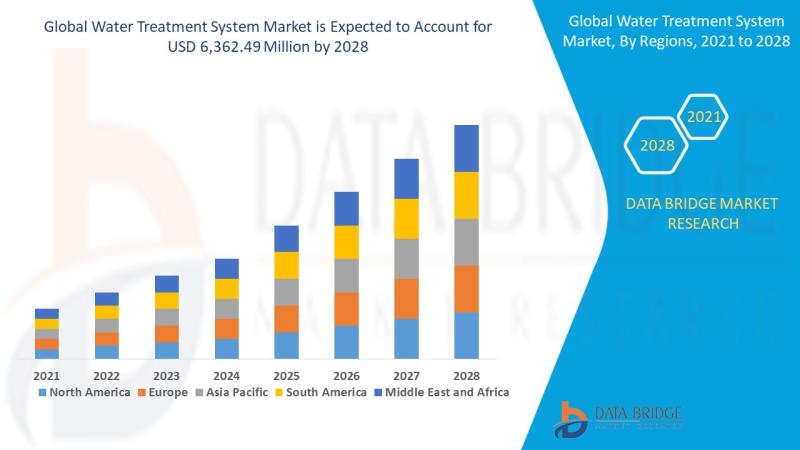

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…