Press release

Polysilicon Market on the Brink of Dynamic Growth

The Polysilicon Market Outlook 2024 provides in-depth analysis and forecasts through 2024 ? Image: Bernreuter Research

Würzburg (Germany), December 10, 2020 – After three years of nearly stagnant demand, the polysilicon industry is entering a new phase of dynamic growth. “As photovoltaic power plants have become the cheapest source of energy, global PV installations will increase in the coming years more rapidly than many think today. This will drive the demand for polysilicon,” says Johannes Bernreuter, head of Bernreuter Research and author of the Polysilicon Market Outlook 2024, the new report from the polysilicon market expert.

While supply constraints are almost certain in 2021, Bernreuter sees a risk of upcoming oversupply in 2022, which will intensify in 2023. “In order for the market to remain balanced, global PV installations would have to grow by 30% annually both in 2022 and 2023 to reach 270 GW in 2023. That is not impossible, but would require the PV market to speed up enormously,” says the analyst, who expects an installation volume of 127 GW in 2020.

The huge polysilicon volumes will come from the massive capacity expansion of the big Chinese polysilicon manufacturers – led by Tongwei, which has superseded German incumbent Wacker as the world’s largest producer in 2020. This expansion is fueled by the strongly rising demand for mono-grade polysilicon in general and the rapid growth of Longi and Zhonghuan Semiconductor, the two largest makers of monocrystalline solar wafers, in particular.

As a result, 14 small and medium-sized Chinese polysilicon companies, which mainly produced lower grade for multicrystalline wafers, were pushed out of the market between 2017 and 2019; in addition, all three South Korean polysilicon manufacturers have abandoned production of solar-grade material; U.S.-based REC Silicon has mothballed its plant and Hemlock Semiconductor has halved its production capacity. In total, the second shakeout wave in the polysilicon industry has eliminated a capacity of around 275,000 metric tons (MT), compared to 135,000 MT during the first wave between late 2010 and early 2013.

Consequently, China’s share in global polysilicon production – including electronic grade for semiconductors – has increased from little more than 50% in 2017 to nearly 75% in 2020.

Among the big Chinese players, GCL-Poly is boldly betting on fluidized bed reactor (FBR) technology to produce polysilicon granules in two new, large plants. “It still remains to be seen if GCL can smoothly ramp up its new capacities. But no matter which scenario ultimately comes true, all the new Chinese low-cost plants will drive the polysilicon spot price down to values below US$8 or even US$7 per kilogram in 2022,” predicts Bernreuter.

More details on the polysilicon, solar and semiconductor markets are provided in The Polysilicon Market Outlook 2024. The 76-page report contains sophisticated scenarios of supply and demand, detailed forecasts of polysilicon prices and cash production costs through 2024 as well as the latest developments of the dominant Siemens process, FBR technology and upgraded metallurgical-grade (UMG) silicon. For more information on the report, please go to:

https://www.bernreuter.com/polysilicon/industry-reports/polysilicon-market-outlook-2024/

Press Contact:

Bernreuter Research • Polysilicon Market Reports

Lessingstr. 6 • 97072 Würzburg, Germany

Your Contact Partner:

Johannes Bernreuter, Company Head

Telephone: +49/931/784 77 81

E-mail: info@bernreuter.com

About Bernreuter Research

Bernreuter Research was founded in 2008 by Johannes Bernreuter, one of the most reputable photovoltaic journalists in Germany, to publish global poly-silicon market reports. As early as 2001, Bernreuter authored his first analysis of an upcoming polysilicon bottleneck and new production processes. Since publishing its first report in 2010, Bernreuter Research has gained a reputation of providing the most comprehensive and accurate polysilicon reports on the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polysilicon Market on the Brink of Dynamic Growth here

News-ID: 2208077 • Views: …

More Releases from Bernreuter Research

Top Ten Polysilicon Makers Nearly All Chinese

Wacker will stay in the ranking as only western producer, says Bernreuter Research

Würzburg (Germany), November 25, 2025 - Nine of the world's top ten polysilicon manufacturers are based in China today. "The Chinese polysilicon industry reached a share of 93.5% in the global output of 2024. This dominance is also reflected in the ranking of the world's largest manufacturers," says Johannes Bernreuter, author of the Polysilicon Market Outlook 2029 and…

Polysilicon Industry Is Risking New Shortage

Bernreuter Research: Shutdown of overcapacity could create undersupply by 2028

Würzburg (Germany), June 25, 2025 - The Chinese polysilicon industry will face a difficult balancing act in the next three years. "If too much overcapacity is eliminated, the market could run into a new shortage by 2028," predicts Johannes Bernreuter, head of Bernreuter Research and author of the new Polysilicon Market Outlook 2029 report.

Fueled by the shortage that culminated in a…

PV Installations Will Reach up to 660 GW in 2024

Bernreuter Research: Low module price will fuel demand in the second half of the year

Würzburg (Germany), June 18, 2024 - Global photovoltaic (PV) installations will land in a range of 600 to 660 gigawatts-direct current (GWdc) in 2024, according to the latest analysis from polysilicon market expert Bernreuter Research. "Once market participants come to the conclusion that the crash of the solar module price has reached its bottom, demand will…

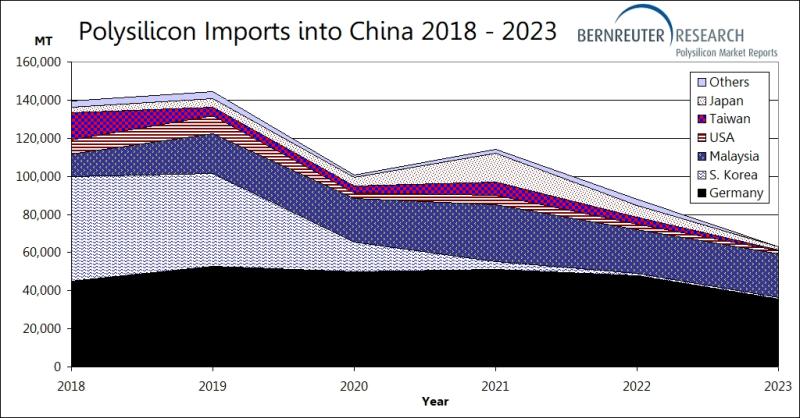

Polysilicon Imports into China Drop to Level of 2011

Bernreuter Research: Non-Chinese producers shift shipments to wafer plants in Vietnam

Würzburg (Germany), February 28, 2024 - Polysilicon imports into China have fallen to the lowest level since 2011. According to Chinese customs statistics, imports of the feedstock for solar cells and semiconductors slumped by 28.5% from 88,093 metric tons (MT) in 2022 to 62,965 MT in 2023. This volume is even slightly less than the 64,614 MT reached in 2011.

"The…

More Releases for Polysilicon

Increasing Adoption Solar Energy Drives The Polysilicon Market: Strategic Insigh …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Polysilicon Market Size By 2025?

In recent times, the polysilicon market has experienced an accelerated expansion. Its size is predicted to surge from $10.05 billion in 2024 to $11.84 billion in 2025, boasting a compound annual growth rate (CAGR) of 17.8%. Factors contributing to this…

Emerging Trends Influencing The Growth Of The Polysilicon Market: Strategic Part …

The Polysilicon Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Polysilicon Market Size Expected to Be by 2034?

The polysilicon market, valued at $10.05 billion in 2024, is expected to grow to $11.84 billion in 2025, reflecting a CAGR of 17.8%. This…

Emerging Trends Influencing The Growth Of The Polysilicon Market: Strategic Part …

The Polysilicon Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Polysilicon Market Size Expected to Be by 2034?

The polysilicon market, valued at $10.05 billion in 2024, is expected to grow to $11.84 billion in 2025, reflecting a CAGR of 17.8%. This…

Increasing Adoption Solar Energy Drives The Polysilicon Market Driver: Leading T …

How Are the key drivers contributing to the expansion of the polysilicon market?

The increasing adoption of solar energy is expected to boost the growth of the polysilicon market. Solar energy's growth is driven by rising environmental awareness and regulatory incentives. Polysilicon is the primary material used in photovoltaic cells that convert sunlight into electricity. The International Energy Agency (IEA) projected a significant increase in solar PV adoption, forecasting 100 million…

Top Factor Driving Polysilicon Market Growth in 2025: Increasing Adoption Solar …

How Big Is the Polysilicon Market Expected to Be, and What Will Its Growth Rate Be?

In recent times, there has been a substantial growth in the size of the polysilicon market. The market is projected to escalate from $10.05 billion in 2024 to $11.84 billion in 2025, with a compound annual growth rate (CAGR) of 17.8%. This growth observed in the historical period can be linked to factors such as…

Polysilicon Market Outlook & Forecast [2028]

According to the TechSci Research report, "𝐏𝐨𝐥𝐲𝐬𝐢𝐥𝐢𝐜𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 - Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028", the Global Polysilicon Market 𝐡𝐚𝐬 𝐛𝐞𝐞𝐧 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 𝐔𝐒𝐃 𝟐.𝟏𝟒 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟐 𝐚𝐧𝐝 𝐢𝐬 𝐚𝐧𝐭𝐢𝐜𝐢𝐩𝐚𝐭𝐞𝐝 𝐭𝐨 𝐩𝐫𝐨𝐣𝐞𝐜𝐭 𝐫𝐨𝐛𝐮𝐬𝐭 𝐠𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝 𝐰𝐢𝐭𝐡 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟑.𝟖𝟓% 𝐭𝐡𝐫𝐨𝐮𝐠𝐡 𝟐𝟎𝟐𝟖. The Global Polysilicon Market is witnessing a transformative wave of technological advancements, playing a pivotal role in the photovoltaic industry…