Press release

Global Digitization in Lending Market 2020 Business Strategies – FirstCashInc., Speedy Cash, LendUp, Elevate, NetCredit

The market report titled “Digitization in Lending Market by Loan Type (Personal Loans, Auto Loans, and Business Loans); by Deployment (On Computer and On Smart Phone): Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2016– 2025” and published by Zion Market Research will put forth a systematizedevaluation of the vital facets of the global Digitization in Lending Market market. The report willfunction as a medium for the better assessment of the existing and future situations of the global market. It will be offering a 360-degree framework of the competitive landscape and dynamics of the market and related industries. Further, it entails the major competitors within the market as well as budding companies along with their comprehensive details such as market share on the basis of revenue, demand, high-quality product manufacturers, sales, and service providers. The report will also shed light on the numerous growth prospects dedicated to diverse industries, organizations, suppliers, and associations providing several services and products. The report will offer them buyers with detaileddirectionto the growth in market that would further provide them a competitive edge during the forecast period.Digitization in Lending Market Market research report which provides an in-depth examination of the market scenario regarding market size, share, demand, growth, trends, and forecast for 2020-2026. The report covers the impact analysis of the COVID-19 pandemic. The COVID-19 pandemic has affected export imports, demands, and industry trends and is expected to have an economic impact on the market. The report provides a comprehensive analysis of the impact of the pandemic on the entire industry and provides an overview of a post-COVID-19 market scenario.

The global Digitization in Lending Market Market report offers a complete overview of the Digitization in Lending Market Market globally. It presents real data and statistics on the inclinations and improvements in global Digitization in Lending Market Markets. It also highlights manufacturing, abilities & technologies, and unstable structure of the market. The global Digitization in Lending Market Market report elaborates the crucial data along with all important insights related to the current market status.

Request Free Sample Report of Digitization in Lending Market Market Report @ https://www.zionmarketresearch.com/sample/digitization-in-lending-market

Our Free Complimentary Sample Report Accommodate a Brief Introduction of the research report, TOC, List of Tables and Figures, Competitive Landscape and Geographic Segmentation, Innovation and Future Developments Based on Research Methodology

Global Digitization in Lending Market Market Report covers major market characteristics, size and growth, key segments, regional breakdowns, competitive landscape, market shares, trends and strategies for this market.

Major Market Players Included in this Report is:

FirstCashInc., Speedy Cash, LendUp, Elevate, NetCredit, AvantInc., Opportunity Financial, LLC., Prosper MarketplaceInc., The Business Backer LLC., Headway Capital Partners LLP, Blue Vine, Lendio, RapidAdvance, Amigo Loans Ltd, Lendico, Trigg, Lending Stream, 118118Money, Simplic, Wonga Group, Check'n Go Inc., OnDeck, KabbageInc., and Fundation Group LLC.

The global Digitization in Lending Market Market report offers a knowledge-based summary of the global Digitization in Lending Market Market. It demonstrates the new players entering the global Digitization in Lending Market Market. It emphasizes the basic summary of the global Digitization in Lending Market Market. The perfect demonstration of the most recent improvements and new industrial explanations offers our customer a free hand to build up avant-garde products and advanced techniques that will contribute in offering more efficient services.

The report analyzes the key elements such as demand, growth rate, cost, capacity utilization, import, margin, and production of the global market players. A number of the factors are considered to analyze the global Digitization in Lending Market Market. The global Digitization in Lending Market Market report demonstrates details of different sections and sub-sections of the global Digitization in Lending Market Market on the basis of topographical regions. The report provides a detailed analysis of the key elements such as developments, trends, projections, drivers, and market growth of the global Digitization in Lending Market Market. It also offers details of the factors directly impacting on the growth of the global Digitization in Lending Market Market. It covers the fundamental ideas related to the growth and the management of the global Digitization in Lending Market Market.

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/digitization-in-lending-market

Note – In order to provide more accurate market forecast, all our reports will be updated before delivery by considering the impact of COVID-19.

(*If you have any special requirements, please let us know and we will offer you the report as you want.)

The global Digitization in Lending Market Market research report highlights most of the data gathered in the form of tables, pictures, and graphs. This presentation helps the user to understand the details of the global Digitization in Lending Market Market in an easy way. The global Digitization in Lending Market Market report research study emphasizes the top contributors to the global Digitization in Lending Market Market. It also offers ideas to the market players assisting them to make strategic moves and develop and expand their businesses successfully.

Promising Regions & Countries Mentioned In The Digitization in Lending Market Market Report:

North America ( United States)

Europe ( Germany, France, UK)

Asia-Pacific ( China, Japan, India)

Latin America ( Brazil)

The Middle East & Africa

Inquire more about this report @ https://www.zionmarketresearch.com/inquiry/digitization-in-lending-market

Highlights of Global Market Research Report:

Show the market by type and application, with sales market share and growth rate by type, application

Digitization in Lending Market Market forecast, by regions, type and application, with sales and revenue, from 2019 to 2026

Define industry introduction, Digitization in Lending Market Market overview, market opportunities, product scope, market risk, market driving force;

Analyse the top manufacturers of Digitization in Lending Market Market Industry, with sales, revenue, and price

Display the competitive situation among the top manufacturers, with sales, revenue and market share

Request the coronavirus impact analysis across industries and market

Request impact analysis on this market @ https://www.zionmarketresearch.com/toc/digitization-in-lending-market

The report’s major objectives include:

To establish a comprehensive, factual, annually-updated and cost-effective information based on performance, capabilities, goals and strategies of the world’s leading companies.

To help current suppliers realistically assess their financial, marketing and technological capabilities vis-a-vis leading competitors.

To assist potential market entrants in evaluating prospective acquisitions and joint venture candidates.

To complement organizations’ internal competitor information gathering efforts by providing strategic analysis, data interpretation and insight.

To identify the least competitive market niches with significant growth potential.

Global Digitization in Lending Market Market Report Provides Comprehensive Analysis of:

Digitization in Lending Market Market industry diagram

Up and Downstream industry investigation

Economy effect features diagnosis

Channels and speculation plausibility

Market contest by Players

Improvement recommendations examination

Also, Research Report Examines:

Competitive companies and manufacturers in global market

By Product Type, Applications & Growth Factors

Industry Status and Outlook for Major Applications / End Users / Usage Area

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

244 Fifth Avenue, Suite N202

New York, 10001, United States

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digitization in Lending Market 2020 Business Strategies – FirstCashInc., Speedy Cash, LendUp, Elevate, NetCredit here

News-ID: 2192797 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

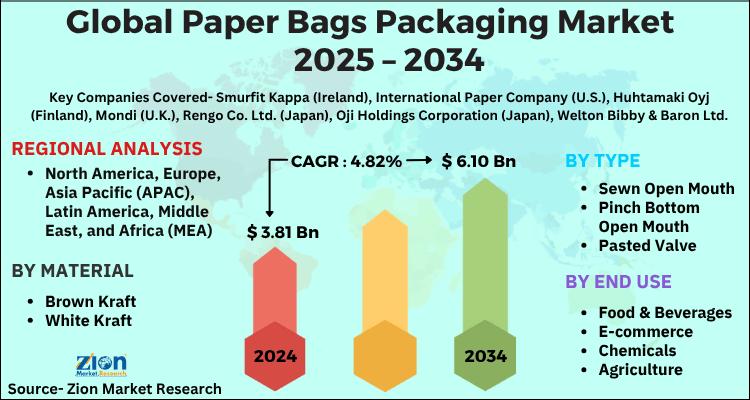

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

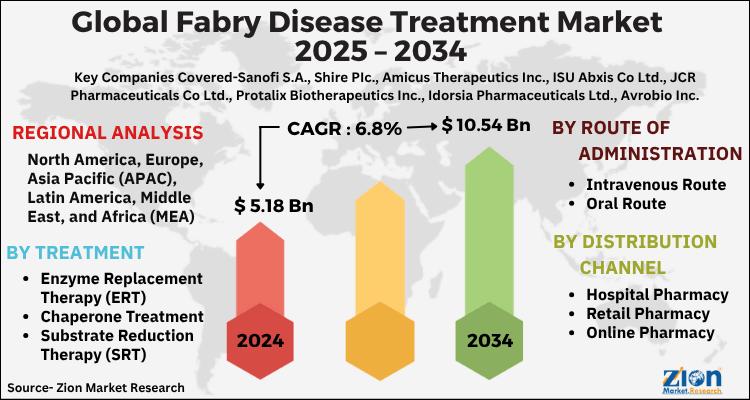

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…