Press release

eClear: Personnel reinforcement in November and renewed SAP® Certification for Value Added Tax solution

eClear AG is expanding its management team with Brigitte Holzer as CFO/COO and Andreas Weidner as Vice President Customs Compliance. In addition, the Value Added Tax (VAT) solution ClearVAT Services 1.2 again received SAP-certification as built on SAP Cloud Platform.Brigitte Holzer is the new Chief Financial Officer and HR/Organization Officer of eClear AG. With her comprehensive expertise in these areas as well as in corporate development, she complements the management team with Roman Maria Koidl (Chairman and CEO), Anne-Katrin Gewohn (CRO) and Oliver Port (CTO) since November first. "eClear will benefit from Brigitte Holzer's profound knowledge in building structures and processes in high-growth companies. With her experience in investor relations, she will provide strategic support for our company expansion," said Koidl. Most recently, Brigitte Holzer worked for Audatex and PPRO Group.

Also in November, Andreas Weidner started as Vice President Customs Compliance of eClear AG. Andreas Weidner has many years of experience in the management of global transport and in organizations for customs and trade regulations. As Global Director Customs & Trade Compliance at the Marquardt Group, he was able to contribute significantly to the growth and internationalization of the company. At eClear, he will establish the Customs Compliance department.

Since the beginning of the year, eClear has been growing continuously and now employs around 60 people in Berlin, Constance, Munich and Cologne. By the end of 2021, the team is expected to grow to 180 employees.

Successful SAP-certification

The core solution ClearVAT Services 1.2 also received SAP®-certification for the second time. ClearVAT frees traders from liability risks , administrative expenses and inefficient processes when selling their goods within the EU. In addition to dynamically updating applicable tax rates for all EU-27 countries and providing them to the retailer's store or ERP. ClearVAT automatically reports and pays the VAT to the tax authorities of the respective country of destination.

The SAP Integration and Certification Center (SAP ICC) has now certified ClearVAT Services 1.2 as built on SAP Cloud Platform. Applications built on SAP Cloud Platform are optimized to work with SAP cloud solutions and run on the SAP Cloud Platform.

"We are very proud of the renewed certification of ClearVAT Services 1.2,” says CTO Oliver Port. "Our goal is to develop innovative, secure applications that add value for our customers. SAP products are an integral part of this. For us, the renewed certification of our services by SAP is not only proof of a technically streamlined integration solution but also confirms the high quality of our development and implementation processes. The certification is very important for our customers because it supports their own compliance requirements.”

eClear AG, Chausseestraße 116, 10115 Berlin

VP Communications: Nadine Städtner

T: +49 30 235907111

E-Mail: comms@eclear.com

Any statements in this release that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. All forward-looking statements are subject to various risks and uncertainties described in SAP’s filings with the U.S. Securities and Exchange Commission (“SEC), including its most recent annual report on Form 20-F, that could cause actual results to differ materially from expectations. SAP cautions readers not to place undue reliance on these forward-looking statements which SAP has no obligation to update and which speak only as of their dates.

SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE in Germany and other countries. Please see https://www.sap.com/copyright for additional trademark information and notices. All other product and service names mentioned are the trademarks of their respective companies.

eClear AG (formerly ClearVAT AG) is Europe's only tax compliance provider that enables online businesses to automatically distribute goods within the European Union to the country of destination – while taking into account the applicable value added tax. The company offers two solutions: ClearRULES, an up-to-date, comprehensive database of all EU VAT rates and customs rates that is dynamically integrated into the merchant's systems. ClearVAT, Full Service Clearing House: install the software, sign the contract and deliver immediately and without liability to all EU countries.

www.eclear.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release eClear: Personnel reinforcement in November and renewed SAP® Certification for Value Added Tax solution here

News-ID: 2185731 • Views: …

More Releases from eClear AG

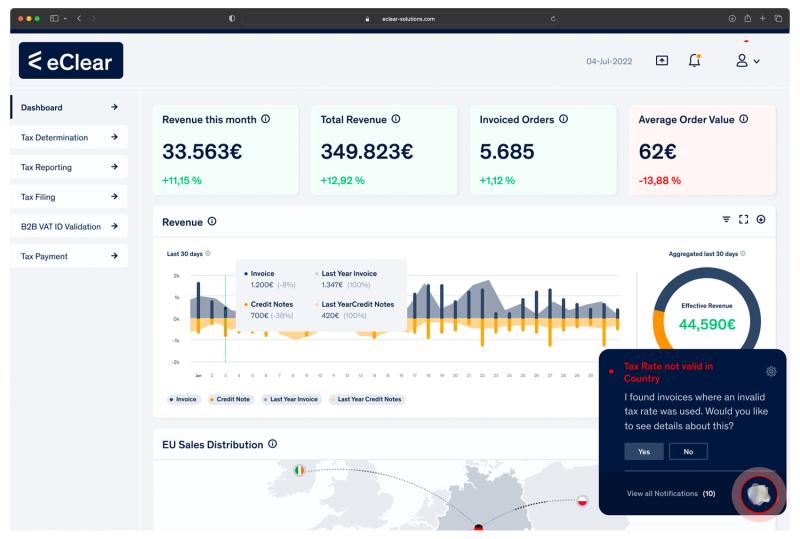

SPOT: The Revolutionary Tool That Alerts You to Incorrect Tax Rates in Real-Time

eClear, a leading VAT and customs compliance solutions provider, is proud to announce the release of its latest innovation - SPOT. SPOT is the first tool that uses real-time invoice data to identify incorrect tax rates, giving businesses the power to prevent costly errors and stay compliant.

SPOT is designed to streamline financial operations, reduce compliance risks, and increase accuracy. With its Automated VAT Audit and Reporting assistant (AVATAR), it can…

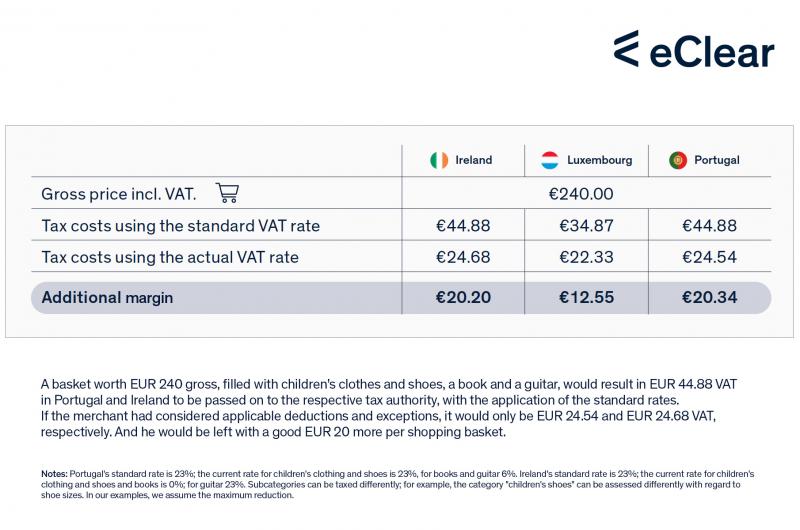

E-Commerce merchants could pay up to EUR 3.8 billion too much VAT in 2022

• Merchants underestimate losses due to VAT exceptions

• Online tool "VAT Optimiser" warns of possible VAT overpayment

Berlin, 16 February 2022 - VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions. It is up to each…

EU Commission publishes incorrect VAT rates

• So-called "EU VAT Rates Database" incorrect and incomplete

• E-commerce merchants and customers affected throughout Europe as of 1 July

• eClear database VATRules has over 800,000 tax codes

Berlin, 24 June 2021 – The database of VAT rates for the EU-27 published by the EU Commission (Tax-UD department) is partly incomplete and incorrect. This is pointed out by the Berlin-based tax technology specialist eClear AG. “The database has obvious gaps.…

eClear becomes a payment institution

BaFin has granted the Berlin-based start-up eClear permission to act as a payment service for cross-border e-commerce trade throughout the EU for its VAT payment solution "ClearVAT", which is unique in Europe.

Berlin, 3 May 2021 - Berlin-based tax technology specialist eClear AG has been granted a licence to provide payment services by the German Federal Financial Supervisory Authority (BaFin). The licence is valid for the whole of Europe in the…

More Releases for SAP

SAP Extended Warehouse Management (SAP EWM) - Epic Guide for U.S. Enterprises

What Is SAP Extended Warehouse Management?

SAP Extended Warehouse Management (SAP EWM) is a powerful, flexible warehouse management system developed by SAP SE. It allows organizations to efficiently manage and optimize their warehouse operations, from inbound and outbound logistics to inventory tracking and resource management.

Related terms: SAP EWM software, warehouse automation with SAP, extended warehouse logistics.

In the U.S. market, where logistics, fulfillment speed, and cost efficiency are crucial due to high…

atkrypto.io Enterprise Blockchain Platform for SAP joins SAP PartnerEdge Open Ec …

atkrypto.io, the Enteprise Blockchain Platform leader, announced today that it has signed an SAP® PartnerEdge® program agreement. The program provides access to resources, services and benefits that will help atkrypto.io build and maintain a successful partnership with SAP.

By partnering with the SAP PartnerEdge Program, atkrypto.io intends to help SAP Customers with enabling their Web3 and Blockchain visions to come to life.

atkrypto is an Enterprise Private Blockchain Platform taking blockchain to…

SAP Application Services Market Services for SAP Applications 2024 to 2030 | SAP …

The Report on "SAP Application Services Market" provides Key Benefits, Market Overview, Regional Analysis, Market Segmentation, Future Trends Upto 2030 by Infinitybusinessinsights.com. The report will assist reader with better understanding and decision making.

Market Overview of SAP Application Services Market: The SAP Application Services market is witnessing substantial growth due to the widespread adoption of SAP (Systems, Applications, and Products) solutions by businesses for enterprise resource planning (ERP) and business process…

Unlocking the Full Potential of SAP ERP: Understanding SAP AMS

Every organization invests significantly in enterprise software solutions like SAP ERP. However, reaping the full benefits and realizing the true value of this software requires effective maintenance and management, which is where SAP AMS comes into play.

So, what exactly is SAP AMS? It's a crucial service that steps in after the implementation phase. It assists the IT department in handling complexities by maintaining the existing SAP technology. Essentially, SAP AMS…

Investigation announced for Investors in shares of SAP SE (NYSE: SAP)

An investigation was announced over possible violations of securities laws by SAP SE in connection with certain financial statements.

Investors who purchased shares of SAP SE (NYSE: SAP), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on whether a series of statements by SAP SE regarding its business, its prospects and its operations were materially false…

SAP Business One Partner adopts TaskCentre for SAP Business One

Orbis Software today announced that Infinium Technologies has joined its TaskCentre for SAP Business One channel partner program. The partnership will enable Infinium Technologies to address complex SAP Business One Integration, Workflow and process automation requirements through the TaskCentre Business Process Management (BPM) Suite.

Manian Shankhar, Managing Director for Infinium Technologies highlighted the rationale for partnering with Orbis Software, “One of the primary drivers for joining the Orbis Software partner was…